Velocity Frequent Flyer is the second largest frequent flyer program in Australia, making it very easy to earn Velocity Points through rewards credit cards.

This guide will cover many of the essentials you could consider when pondering the best Velocity-earning credit card for your own needs.

Best Virgin Australia Velocity Frequent Flyer credit card sign-up bonus point offers this month

| Credit Card | Velocity Bonus Points | Earn Rate | Annual Fee | Card Guide |

|---|---|---|---|---|

American Express Velocity Business ↓ | 200,000 Points | 1 point on general spend, 2 points on spend with Virgin Australia | $249 p.a. ongoing | Apply NowRead the guide |

America Express Platinum Business ↓ | 175,000 Points* | 1.125 points on all eligible spend. 0.5 points on spent at Gov. Spend | $1,750 p.a. ongoing | Apply NowRead the guide |

Westpac Altitude Velocity Black ↓ | Up to 150,000 Points | 0.8 points on everyday spend, 1.2 points overseas. 0.5 point on all other eligible spend | $370 p.a. ongoing | Apply NowRead the guide |

American Express Velocity Platinum ↓ | 100,000 Points | 1.25 points on general spend, 2.25 with Virgin, 0.5 point on Gov. spend, uncapped | $440 p.a. | Apply NowRead the guide |

American Express Platinum Card ↓ | 100,000 Points* | 1.125 points on eligible spend, 0.5 point on Gov. spend, uncapped | $1,450 p.a. | Apply NowRead the guide |

St.George Amplify Rewards Signature ↓ | Up to 100,000 Points* | 0.75 points per $1 on general spend, uncapped | $199 for the first year, $295 p.a. ongoing | Apply NowRead the guide |

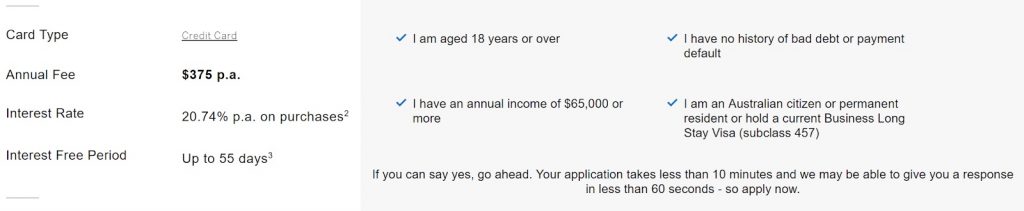

ANZ Rewards Black ↓ | Up to 90,000 Points* | 1 point per $1 on general spend ($5,000 per statement period), 0.5 point thereafter | $375 p.a. ongoing | Apply NowRead the guide |

NAB Rewards Signature Card with Velocity↓ | Up to 80,000 Points* | 1.5 points on everyday spend up to $15,000 per statement period, then 0.5 points per $1, uncapped | $35 monthly fee | Read the guide |

NAB Rewards Platinum Card with Velocity ↓ | Up to 80,000 Points* | 0.5 points on general spend. 0.75 points at eligible grocery stores, uncapped | $195 p.a. ongoing | Apply NowRead the guide |

ANZ Rewards Velocity Platinum ↓ | Up to 80,000 Points* | 0.75 points on general spend ($2,000 per statement period), 0.5 points afterwards | $149 p.a. | Apply NowRead the guide |

American Express Explorer ↓ | 37,500 Points* | 1.125 points on eligible spend, uncapped | $395 p.a. | Apply NowRead the guide |

The offers displayed on this page are selected from a range of products across pointhacks.com.au as at the time of publishing this article. The use of terms “Best” and “Top” are derived from the highest bonus points offered.

What are the best credit cards for Velocity Frequent Flyer Points?

Find below a roundup of some Velocity Point earning cards with noteworthy bonus offers to know about this month.

American Express Velocity Business

American Express® Platinum Business Card

Westpac Altitude Velocity Black

American Express Velocity Platinum

American Express Platinum Card

St.George Amplify Rewards Signature

ANZ Rewards Black credit card

NAB Rewards Signature Card with Velocity

NAB Rewards Platinum Card with Velocity

ANZ Rewards Velocity Platinum

American Express Explorer Credit Card

What are the best ways to earn Velocity Points with a credit card?

- Direct earn: These are Velocity co-branded credit cards that provide a set number of Velocity Points per dollar. The total points earned are transferred monthly to a cardholder’s Velocity account.

These cards often provide additional benefits too, such as lounge passes and Virgin Australia gift vouchers. - Transfer from other rewards programs: These credit cards will accumulate their own rewards points, which can then be later transferred to Velocity Frequent Flyer or other airline partners.

The main benefit here is having flexibility in where those rewards points go. Convert them to Velocity only when required, rather than waiting for a monthly transfer. Sometimes, there are bonuses for transferring too.

Most major banks offer this option, including American Express, ANZ, CBA, NAB and St.George.

| Transfer Ratio | Velocity Points (per point from transfer partner) | Minimum transfer amount (points from origin program) |

|

|---|---|---|---|

| Frequent Flyer Program | |||

| KrisFlyer | 1.55:1 | 0.64 | 5,000 |

| Bank Rewards Programs | |||

| American Express Membership Rewards | 2:1 | 0.5 | 2,000 |

| ANZ Rewards | 2:1 | 0.5 | 2,000 |

| Westpac Altitude Rewards | 3:1 | 0.33 | 3,000 |

| Amplify Rewards | 2:1 | 0.5 | 3,000 |

| NAB Rewards | 2:1 | 0.5 | 3,000 |

| CommBank Awards | 2.5:1 | 0.4 | 3,600 |

| CommBank Awards (Smart Awards, Platinum, Diamond and Ultimate) | 2:1 | 0.5 | 3,600 |

| Hotel Rewards Programs | |||

| Marriott Bonvoy | 3:1 | 0.33 | 3,000 |

| Hilton Honors | 10:1.5 | 0.15 | 10,000 |

| IHG Rewards | 10:2 | 0.20 | 10,000 |

| Le Club Accorhotels | 1:1 | 1 | 4,000 |

| Choice Privileges | 20:3 | 0.15 | 20,000 |

| Shangri-La's Golden Circle Award | 1:1 | 1 | 2,500 |

| Supermarket Rewards | |||

| Flybuys | 2:1 | 0.5 | 1,000 |

What to look for when searching for the best Velocity frequent flyer credit cards

- Bonus points offer: Most rewards cards will have bonus points offers to lure new customers in. Often these are the easiest ways to score a huge boost of Velocity Points, making premium reward flights more accessible.

Still, be mindful of annual fees and the spending criteria of any given offer before applying. - Earn rates: Also consider how many Velocity Points can be earned on an ongoing basis? One of the highest earn rates is 1.25 Velocity points per dollar, uncapped, through American Express.

Most non-Amex cards will earn 0.5 to 1 point per dollar, depending on the card type. Some cards will have caps on the number of points earned per month, which could impact those who spend more than the threshold at which these restrictions kick in. - Bonus travel inclusions: Some higher-end Velocity credit cards will include extras to enhance your travel experience. These could include Virgin Australia lounge passes, free return domestic flights, and travel credits.

Consider if these will be of any use to you. For example, Velocity Gold and Platinum members already have access to Virgin Australia lounges, so bonus lounge passes may be of limited use, except when flying with additional guests.

- Included insurances: Platinum-grade Velocity Frequent Flyer credit cards may include some form of complimentary insurances. Most common is travel insurance, which could be activated when purchasing flights or accommodation with the card.

Be sure to read the Product Disclosure Statements (PDS) very carefully, as these free insurances often have lots of clauses that can catch you out.

Other cards might go above-and-beyond and include price-drop protection, extra extended warranties on products, or even smartphone screen damage cover.

What to be mindful of with Velocity Frequent Flyer credit cards

There can be other considerations when deciding which Velocity Frequent Flyer rewards card could be a good fit.

- Annual fee: The bigger the inclusions with a rewards credit card, the higher the annual fee generally will be. For instance, consider whether paying such a fee is worth it for a card that includes lounge access and a free domestic return flight.

Unless there’s a special ‘no annual fee’ promotion, expect most Velocity-earning credit cards to have some sort of annual fee to cover part of the costs of the benefits provided. - Interest rate: All rewards cards have high-interest rates – they’re not inherently designed for carrying a balance from month to month. For those who struggle with credit card debt, a Velocity rewards card may not be the best option, as the fees and interest incurred would likely outweigh the value of any Velocity Points earned.

- Interest-free days: Most credit cards allow between 44-55 days interest-free for your purchases. This can provide a little breathing space to pay off purchases.

- Income requirements: Platinum-level Velocity credit cards will usually require a higher minimum income level to qualify. Expect banks to request payslips or other supporting documents to substantiate any amounts presented during an application.

For those living with a partner, combined household income might be taken into account, depending oon the process of each card issuer. Check the terms and conditions carefully before applying.

What to know before applying for a Velocity credit card?

Here’s a quick checklist of what to be aware of before considering an application for a Velocity credit card:

- Are there exclusions on earning bonus points? Most cards exclude customers from receiving bonus points if they’ve held the same (or similar) credit card in the last 12-18 months. This will be in the terms and conditions.

- What are the rules for earning those bonus points? Most bonus point offers require a certain degree of card spend (typically $1,000+) per month, for a few months.

- Could credit score have an impact? In general, card issuers are more likely to accept applications from those with a higher credit score, versus those who have a lower score.

How to earn Velocity points after geting a credit card?

There are a few strategies that new cardholders could employ to continue earning Velocity Points on everyday transactions.

- Put everyday purchases on the card: from flights to groceries, fuel to concert tickets, putting everyday household expenses onto a points-earning credit card can really add up. Paying off the closing balance in full every month can help avoid interest charges.

- Keep an eye out for bonus partners: Velocity has teamed up with many companies which offer bonus points with purchases, such as through the Velocity e-store or by swiping your Flybuys card at Coles.

- Take advantage of transfer promos: For those with an indirect earn Velocity credit card, transferring points to Velocity when there’s a transfer bonus can be even more rewarding. This could provide you a huge chunk of extra points, just for transferring at the right time.

Frequently asked questions

The following answers are general advice and do not take into account your personal circumstances. Be sure to consider all aspects of a Velocity credit card before applying.

Which credit card gives the best flight points?

Generally, American Express credit cards offer some of the highest sign-up bonuses and daily Velocity points earn rates. However, be mindful that annual fees are often higher, and acceptance of American Express is not as widespread as Visa or Mastercard.

What is the best frequent flyer credit card?

The best frequent flyer card depends on the personal circumstances of each individual. As we don’t take these into account, we’re unable to suggest one ‘best’ frequent flyer credit card. Instead, this guide may help you understand many of the popular aspects of Velocity-branded credit cards, as you make your own decision.

Which credit cards can earn Velocity points?

Here are just some of credit card issuers that provide Velocity Points, in one way or another: American Express, Virgin Money, ANZ, Commonwealth Bank, NAB, St. George, Bank of Melbourne, BankSA, Suncorp and BOQ.

I am very keen to get the 200K bonus Virgin Points offer with the AMEX velocity business card…..any thoughts if or how to be eligible for the bonus given the AMEX personal credit card I have at the moment ??? Many thanks

However 7 months on I am still waiting for that redemption offer and ANZ advise me that because I didn’t tick auto redemption on the app I am ineligible.

I am taking my complaint further as this is absolutely ridiculous and wonder has anyone else has this experience???

the points can be transferred to Velocity Frequent Flyer, Krisflyer or Asia Miles at a 3:1 ratio.

This is now 1:6 for Velocity

I was hoping you might give a comparison of what non-Amex cards give the best VFF earn rate per dollar spent (after the start up bonus) and then which Amex cards give the best earn rate.

Cheers.

We don’t have a comparison table, but you can find out more information about Velocity earning credit cards from the following link https://www.pointhacks.com.au/credit-cards/.