Whether it’s your yearly income tax or quarterly business statements, you might be wondering ‘how do I earn the most points with payments to the Australian Tax Office?’

There isn’t a set answer – cards and offers keep changing. Many banks now offer zero points on Australian Tax Office (ATO) transactions, and this is a trend that’s becoming increasingly common.

There are a few cards on the market that do still offer the ability to earn points for ATO transactions – mainly American Express plus some select high-end Mastercard and Visa cards.

In this guide, we reveal the current list of cards that earn points with the ATO, as well as some points-earning alternative payment options.

1. Paying the ATO with a credit card directly

The most direct way to make a payment by credit card is to head to the ATO EasyPay Portal and input the reference number given to you by your accountant or the ATO for your payment.

ATO credit card payment fees

When paying the ATO directly using a credit card, you’ll incur a surcharge on the transaction. There is no way to avoid this without sacrificing the ability to earn rewards points.

| Payment method | Surcharge (as of Jan 2022) |

|---|---|

| BPAY/bank transfer | None |

| Mastercard Debit | 0.20% |

| Visa Debit | 0.40% |

| Visa Credit | 0.72% |

| Mastercard Credit | 0.77% |

| American Express | 1.45% |

| Visa/Mastercard international payments | 1.99% |

The surcharge amount is often a tax-deductible expense for a business, but double-check with your accountant or tax advisor for your own circumstances.

Your personal choices might dictate that payment via bank transfer or BPAY makes more sense than incurring a surcharge, so bear that in mind.

Which rewards cards earn points at the Australian Tax Office (ATO)?

Unfortunately, not many cards in Australia award points for direct payments to the ATO anymore. These are the ones that do:

| Credit Card | Points earned per $ spent | Points cap | Notes |

|---|---|---|---|

| Most American Express-issued Membership Rewards cards, including: | 1 Membership Rewards points | Varies by card. Some none; some capped | Check the individual guides for each card in our cards table |

| Most American Express direct-earn cards, including: | 0.5 Qantas or Velocity points | Varies by card. Some none; some capped | Check the individual guides for each card in our cards table |

| 1 CommBank Awards point | 300,000 CommBank Awards points per year | CommBank Awards terms explicitly permit points earned at the ATO and for Business Transactions up to the points cap. See Section 1.1 of the PDS → | |

| 0.66 Qantas Points | 33,000 Qantas points per month | NAB states that payments you make to the Australian Taxation Office will earn you Qantas Points at the same rate as regular everyday business purchases. See the NAB website → |

Cards and banks that do not allow points earn for ATO transactions include (but are not limited to):

- ANZ Rewards & Frequent Flyer, Bank of Melbourne, BankSA, Citi (and Citi-managed cards, including Virgin Money, CUA and Diners), CommBank (personal cards), HSBC, Jetstar Mastercard, Macquarie Platinum/Hilton, NAB (personal cards), Qudos Bank, St.George and Woolworths Money and most others.

Caveats and disclaimers

- Do your own research by reading the credit card and rewards program PDS documents, asking the relevant bank and comparing your research with other online sources.

- We have tried to make this list as complete and as accurate as possible. If we do miss a card, have an error in our calculations or have made a mistake in the research, please let us know in the comments. There is no ranking or endorsement of a specific credit card implied in the above table.

- There are legitimate reasons for having to pay the ATO as either a personal entity or as a business entity. Many banks prohibit unreasonable amounts of business transactions on personal cards. We have tried to note the relevant terms and conditions of different bank rewards programs below.

- We recommend considering a specific business credit card that explicitly permits points earn at the ATO if you have a high volume of business-related transactions.

- Any advice in this guide is general advice only and does not consider any of your personal circumstances and existing banking relationships/products.

- Things can change – check the date at the top of this guide to see when it was last updated.

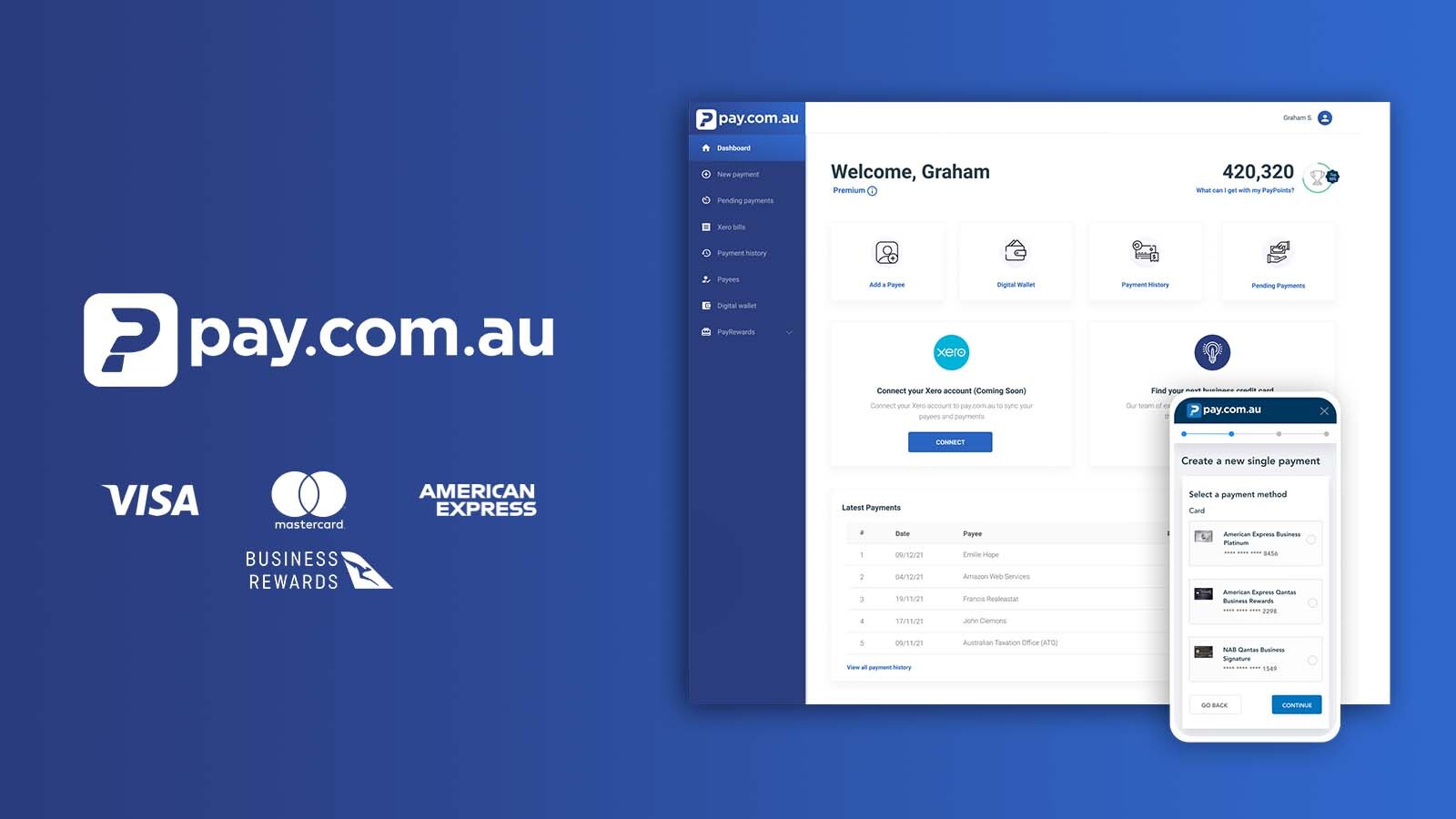

2. Using payment processors like Pay.com.au to earn points with the ATO

The list of banks offering points by directly paying the ATO is quite small now. But luckily, there is a way to earn full points on just about any card when paying the ATO and other businesses. The secret is third-party processors such as Pay.com.au, RewardPay, B2BPay, YakPay, and Sniip.

Rather than making a credit card payment directly to the ATO, you can earn the full rate of credit card points by paying a surcharge to those services and having them make the payment to the ATO on your behalf. You might also earn bonus reward points from the processor on top of the transaction points.

Fees for payment processors

Payment fees vary for each provider, depending on a range of factors including transaction size. Expect to pay around 1-2% in processing fees, on average. Fees for American Express payments tend to be the highest – including Sniip, where the rate for ATO payments is now pegged at the business rate of 1.99% + GST, even for personal tax payments.

Pay.com.au fees go as low as 0.80% for Mastercard credit cards, depending on your membership package. Given the ATO charges 0.77% but isn’t eligible for points from most banks, it certainly makes sense to pay a bit more through a payment processor and earn full points on all reward credit cards.

Be sure to run the sums to ensure the points you’re earning are worth more than the surcharge.

Note: Point Hacks is affiliated with Pay.com.au.

3. Working out if the surcharge is worth paying

The credit card surcharge is the key part of figuring out whether to use a points-earning credit card for ATO payments. In short, you want the value of the points earned to be worth more than the surcharge.

The first thing to consider is the value you place on your points. You can check out our list of rewards points values, which might help you. But points might be ‘worth’ more to you if you’re saving up for a big redemption, for example.

Once you have an idea of how much you value a point, you can then place a value on the total number of points earned by paying the ATO with a credit card surcharge. Here is a simplified example.

Example 1: It makes sense to pay the ATO surcharge

Example 1: It makes sense to pay the ATO surcharge

Say your NAB Qantas Business Visa card earns one point per AU$1.50 spent, and you value Qantas Points at 1.9 cents each. If your tax bill is $6,000, then you’ll earn 4,000 points, which have a value to you of $114.

With the ATO’s surcharge of 0.72% on Visa credit card payments, you are paying $43.20 to earn the 4,000 Qantas Points. In this case, you might consider paying using this credit card.

Example 2: It doesn’t make sense to pay the ATO surcharge

Example 2: It doesn’t make sense to pay the ATO surcharge

As an alternative example, let’s consider an American Express card that earns a capped 0.5 points per dollar. You’d earn 3,000 Qantas Points on the ATO bill, valued at $57 to you.

The surcharge of 1.45% means that you are paying $87 to earn the 1,000 points – more than what you valued it at. In this case, you might not consider paying using American Express. But fear not, because there are alternatives to earning full points with American Express, which we cover in Example 4.

Example 3: It makes sense to use Pay.com.au with Mastercard

Example 3: It makes sense to use Pay.com.au with Mastercard

This time, you want to use your Qantas Premier Platinum card which earns one point per AU$1 spent. The Qantas Premier Platinum card usually earns no points with the ATO. But if you go via Pay.com.au, for example, you would incur a payment fee of $48 to $60 + GST (equivalent to 1.0 to 1.2% + GST), depending on your plan. The $60 + GST fee is applicable to the free monthly plan.

If your tax bill is $6,000, then you’ll earn up to 6,060 points, which have a value to you of $115. The points earned would outweigh the payment charge, especially if you can claim the processing fee and GST on your tax (see a professional for further advice).

In comparison, Sniip charges a flat 1.5% fee for Mastercard, which comes to a $90 fee for earning the same number of points. You’re paying up to $37 more in fees for no extra benefit.

Example 4: It could make sense to use Sniip with American Express

Example 4: It could make sense to use Sniip with American Express

As an alternative example, let’s consider the American Express Qantas Ultimate that earns a healthy 1.25 points per dollar for general purchases. If you paid the ATO directly, you’d only get 0.5 points per dollar instead. But by going through a payment processor like Sniip, your rewards will multiply.

On a $6,000 bill, the surcharge of 1.99% (2.189% GST inc) means that you are paying $131.34 (GST inc) to earn 7,612 Qantas Points worth around $144 to you. That’s an okay deal, particularly if you put those points toward Business Class and get even more ‘value’.

What to consider when paying a surcharge

So three things you need to consider before you decide whether a surcharge is worth paying:

- The value you place on points you earn with your credit card.

- How many points the credit card you are planning to use will earn per dollar spent at the ATO.

- The surcharge incurred for using your chosen payment method by the ATO.

However, this analysis does not take into account:

- Any tax deductibility of the ATO payment fee and GST, if applicable.

- The cost of ownership of the credit card, such as its annual fee.

- The cost of any interest incurred for balances you are carrying on the card. The assumption in this guide is that no interest will be paid for your ATO payment. If you are planning on carrying the ATO balance on a card and incurring interest on this balance, then the interest incurred will likely be far higher in cost than the value of the points earned.

Summing up

While we can’t recommend specific cards for your circumstances, this guide will help you by outlining your main options. Paying the ATO directly isn’t the best way to earn points anymore, due to the limited range of banks and cards that offer points on ATO payments.

Instead, consider using a third-party payment processor like Pay.com.au or Sniip to make the most of your rewards card. You’ll most likely pay a slightly higher fee, but you’ll earn full credit card points.

Given most of us will probably have to pay significant amounts to the ATO anyway, maximising a rewards-earning credit card is a great way to get rewarded sooner. Just be sure to always check the fees and crunch the numbers first.

Frequently Asked Questions

There are numerous ways to pay an ATO bill. BPAY is recommended for those who don’t want to pay any extra transaction fees, but reward points are not normally earned in this case.

Credit cards will incur a set fee depending on the card type. You could also process payments through a third party mentioned in this article, which would help earn rewards points.

No, not usually. Most banks and rewards credit cards do not consider BPAY transactions as eligible to earn rewards points.

According to the ATO website, card payment fees are not subject to goods and services tax (GST). However, it may be a deductible expense depending on your circumstances.

Yes, you can use an American Express card to pay the ATO. However, this normally incurs a higher payment fee compared to using an Australian-issued Visa or Mastercard.

Originally published by Matt Moffitt. Note that Point Hacks is affiliated with Pay.com.au.

Just getting my head around this!

Has anyone figured out the best value Business Card + Payment Processor COMBO?!

Care to share..?! 🙂

I am considering using Sniip to pay off a HECS debt. How was your experience?

4,000 points at 1.9cpp would be $76.

Earn rate of 1 QF/$1 would result in $114 worth of points on a $6k spend.

Wondering if there is a cheaper way to pay for personal bills via EFT using BSB & Account number apart from RewardPay who charge 2.15% for transactions <$20k.

Cheers,

Steffano

– No extra charges apply from ATO

– No advance fees or other fees are triggered by Suncorp

– Rewards points were debited as per normal

I have Amex Explorer business card – so I’d earn 1 points per $ spent on ATO?

So 6000 points for $6000 tax bill valued at $114

Surcharge of 1.45% means I’m paying $87

Noticed only very recently, only in the last quarter (Jan-Mar 2021) that Qantas points earned has totally crashed per dollar value of purchases made on the St George Amplify card.

From simple analysis it could only be that ATO and State Government eligibility for reward point earnings has recently been axed.

So unless i want to jump ship it’s back to BPay for government transactions. Not paying those commission fees without earning points. No doubt other options are out there, but the extra handling costs incurred probably aren’t worth it.

https://www.australianfrequentflyer.com.au/st-george-axe-points-tax-payments/

I would like (and expect to see) that level of detail from them in the T&Cs document.

The T&Cs for that card state (under section 4.5): Amplify Points are not earned in respect of the following amounts that may be charged to your Card Account: government charges (other than GST payable in connection with the purchase of goods or services on which you earn Amplify Points).

If you are earning full points on the transaction, then that’s great! However, in our guides, we do have to report on what is written in the T&Cs.

I should also point out that other government payments such as council rates do not earn points but somehow, ATO payments do.

Just thought I would post in case others already have the same card and want to test it out for themselves.

I am aware of the T&Cs so I check after each ATO payment in case they stop crediting the points but it has continued to work for me for over 3 years now.

I wont be using my Visa card. Thanks again.

As we have chosen to have low income/ high assets in retirement, I doubt if we could get a credit card to pay ato and get ffpoints. But if we went with Qantas Cash we could get a quarter of our bill back in points? Ie if our bill was $100,000 (it isn’t), we’d get 25,000 points?

Better than nothing!

What do you think?

You still may be able to get a credit card that earns points with the ATO though!

We have to pay a HUGE tax bill this year from Capital Gains. I just want a card that will give us the best value in 50 Curedale St Beaconsfield points!

I’m also holding off on booking this year,s round the world trip in case it could be advantageous to pay by a new card.

It’s our sixth RTW but we’ve never bothered to care about points before!

Very grateful for your thoughts! Sxx

Thanks for the article. its an excellent summary of all the cards.

I justed wanted to ask 2 Qs:

1. What is the card payment fees for Qantas cash ? is it like a once- off fees?

– lat34 & Samantha- ur help will be appreciated – as u guys hv done it.

2. Is there a similar fees for Velocity Global Wallet card as well ?

Hope 2 c replies soon.

Cheers.

Hassan.

I’ll have a look and see if it answers my questions.

Cheers.

Hassan.

Qantas Cash is a “prepaid Mastercard” so per the current table, ATO MasterCard surcharge is 0.40% (ie you need to have cashed loaded to cover both the tax payment PLUS the surcharge amount).

Hope this helps.

🙂

I am still experimenting with various ways to pay the ato and get points. I successfully used OnlyVisa gift card but this week ato have stopped accepting them. ( stuck with $500 of Cards!)

I joined Qantas Cash and succeeded in paying $95 to ato today. But now I see I will (eventually) only get one point per every $4. So cheap points but not many! ( And this will all change soon anyway.)

I guess B2Bpay is the best deal, with Amex Explorer. 2 points per $1 but fee of nearly 3%.

Still don’t know if I should pay the two-ish grand to get 120,000 ish points.

My husband says I never use gift vouchers I’ve been given!

And the using of points for upgrades seems like another whole nightmare of learning curve!

Any thoughts?

Savannah x

Very interesting to see their latest offers to convert ANZ Rewards points to Virgin (with bonus). I think their is more value redeeming ANZ Reward points directly for flights as opposed to redeeming for Virgin points and then booking same flights. Any comments on this?

So, take that as either confirmation that you will get the points (albeit with some legwork) until the PDS is updated, or avoid at all costs……

If i have an amex explorer, do i have to use the amex payment platform you describe? Or can i just pay my ato bill directly and still earn points?

Thanks

So I rang them to dispute this and was given the line about it being government spend, on the basis that it says REWARDPAY*ATO in the transaction details. I highlighted that my partner’s AMEX Explorer account has always earned the full 2 points on these transactions before, but so far they haven’t budged.

Wonder if it’s worth raising it with RewardPay at all, since their website does sort of imply that you’ll get the full amount of points with their service?

Samantha, can you please advise how you used your Qantas Cash to pay tax? Mine is only allowing to convert currency to currency, card to another Qantas card, or transferring Qantas cash to another of my own bank account. Not any options allowing for tax payments?! Thanks!

Please let me know if you have any other tricks, thanks.

the card payment fee).

FYI. I just got off the phone with AMEX

Can confirm David Jones AMEX and AMEX Platinum Edge do earn points for ATO payments (1 and 0.5 respectively).

Thanks for the article Keith 🙂

I have just tried to pay my tax using my Qantas Cash card but it rejected because it isn’t a credit card. How do I go about paying using Qantas Cash?

Curious as to what qualifies as a business transaction… My wife has AMEX Explorer and ANZ Black cards and is contracted/self-employed. We will need to pay her tax (she is the sole employee and has an ABN) and I’d like to use a card to do so. Does her paying tax for her own business count as a business transaction? Or is it simply just a tax payment by an individual?

My take would be that if you are paying a personal tax bill, it’s personal, but a business tax bill e.g. for your BAS or IAS, would be a business transaction. That said, the ATO bills through the same portal in either case, so the bank would probably decide more generally whether they thought you were using the card for business or personal purposes. It’s all very grey!

Great article.

Considering ANZ’s recent announcement to withdraw all AMEX cards from the bank from August 2017 (others will follow soon), do you think it is wise to convert ANZ points (approaching $1m points) to one of their affiliated programs; ie Velocity?

As a business owner with a trust structure, most of my points are earned paying personal tax debts for myself and other beneficiaries through the ATO EasyPay system. Of course, 4 of these transactions per year relate to business GST (BAS).

I am beginning to get worried ANZ will catch on and relinquish points earned, perhaps only the BAS component.

It would be brilliant to see an article related to how to best convert your points (or just redeem) considering these recent changes.

Thanks in advance.

I want to offer another perspective. I have a couple of cards that won’t earn anything for ATO spend. My Amex-issued cards will, and my ATO payments for my quarterly BAS are processed with no quibble.

Whether I use a card that earns points or not, I still have to make that quarterly payment. So for me, I immediately consider can I get something more for it? Let’s face it, the ability to earn a couple of, or even many, thousand lazy points every three months is nothing to be sneezed at.

I could apply for another card, generally at a membership cost of a couple of hundred dollars, in order to save a couple of hundred dollars. But I need to factor in the cost of owning that card for just ATO spend, unless it also provides a very good general points return. And, the effect on my credit rating if I’m applying for yet another premium credit card.

These are all qualitative rather than quantitative concerns, and don’t detract from the very valid points you raise about the cost of earning these points. For me, I find it’s a justifiable expense to spend a little more and get the bonus points, and “save” some time and dollars getting another card that is otherwise not really needed, and leaving my credit rating strong for any particularly compelling deals I see (such as when Amex Velocity Platinum offered a 100,000 point sign-up bonus).

Do you know anyone who tested that one?

One time it can be worth using a high cost-per-point card to pay the ATO is to meet bonus point minimum spends on a new card.

Thanks for the comprehensive article. Do you know if the Qudos bank CC still gives points for ATO payments?