NAB Rewards is a flexible credit card points program offering card members a choice on how they use their rewards points. Cards linked to this program include:

The program was launched in 2017, and includes a number of airline and loyalty partners. These include:

- Velocity Frequent Flyer

- Flybuys

- Singapore Airlines KrisFlyer

- Cathay Asia Miles

- Air New Zealand Airpoints

This guide digs into the details of the NAB Rewards program, and how best to maximise the value from the program.

Why should I choose NAB Rewards?

NAB Rewards provides relevant cardholders with the ability to earn points on each dollar of spending. They can then redeem these points for a selection of different rewards options. The higher value redemptions are usually flight rewards. Therefore, transferring your points to an airline partner is the best option for maximising points value.

The added benefit of a flexible points program is that you can choose when to redeem your points. If you don’t have any near-term travel plans, just leave your points in your NAB Rewards account. You can then trasnfer them when you finalise your travel plans.

Which partners can I transfer my points to?

The transfer rates and effective earn rates for each of the program’s airline and loyalty partners are shown below.

| Frequent Flyer Program | Transfer Rate | NAB Rewards Signature Effective Earn Rate | NAB Rewards Platinum Effective Earn Rate | NAB Rewards Business Signature Effective Earn Rate |

|---|---|---|---|---|

| Velocity Frequent Flyer | 3,000 NAB Rewards points to 1,500 Velocity Points | 0.625 Velocity Points per $1 - everyday purchases 1.25 Velocity Points per $1 - major department and hardware stores 1.875 Velocity Points per $1 - overseas purchases | 0.5 Velocity Points per $1 - everyday purchases 1 Velocity Point per $1 - major department and hardware stores 1.5 Velocity Points per $1 - overseas purchases | 0.625 Velocity Points per $1 - everyday purchases 1.25 Velocity Points per $1 - major department and hardware stores 1.875 Velocity Points per $1 - overseas purchases |

| Flybuys | 3,000 NAB Rewards points to 3,000 Flybuys Points | 1.25 Flybuys Points per $1 - everyday purchases 2.5 Flybuys Points per $1 - major department and hardware stores 3.75 Flybuys Points per $1 - overseas purchases | 1 Flybuys Point per $1 - everyday purchases 2 Flybuys Points per $1 - major department and hardware stores 3 Flybuys Points per $1 - overseas purchases | 1.25 Flybuys Points per $1 - everyday purchases 2.5 Flybuys Points per $1 - major department and hardware stores 3.75 Flybuys Points per $1 - overseas purchases |

| Singapore Airlines KrisFlyer | 3,000 NAB Rewards points to 1,000 KrisFlyer miles | 0.416 KrisFlyer miles per $1 - everyday purchases 0.833 KrisFlyer miles per $1 - major department and hardware stores 1.25 KrisFlyer miles per $1 - overseas purchases | 0.333 KrisFlyer miles per $1 - everyday purchases 0.667 KrisFlyer miles per $1 - major department and hardware stores 1 KrisFlyer mile per $1 - overseas purchases | 0.416 KrisFlyer miles per $1 - everyday purchases 0.833 KrisFlyer miles per $1 - major department and hardware stores 1.25 KrisFlyer miles per $1 - overseas purchases |

| Cathay Asia Miles | 3,000 NAB Rewards points to 1,000 Asia Miles | 0.416 Asia Miles per $1 - everyday purchases 0.833 Asia Miles per $1 - major department and hardware stores 1.25 Asia Miles per $1 - overseas purchases | 0.333 Asia Miles per $1 - everyday purchases 0.667 Asia Miles per $1 - major department and hardware stores 1 Asia Mile per $1 - overseas purchases | 0.416 Asia Miles per $1 - everyday purchases 0.833 Asia Miles per $1 - major department and hardware stores 1.25 Asia Miles per $1 - overseas purchases |

| Air New Zealand Airpoints | 3,000 NAB Rewards points to 15 Airpoints Dollar | 0.00625 Airpoints per $1 - everyday purchases 0.0125 Airpoints per $1 - major department and hardware stores 0.01875 Airpoints per $1 - overseas purchases | 0.005 Airpoints per $1 - everyday purchases 0.01 Airpoints per $1 - major department and hardware stores 0.015 Airpoints per $1 - overseas purchases | 0.00625 Airpoints per $1 - everyday purchases 0.0125 Airpoints per $1 - major department and hardware stores 0.01875 Airpoints per $1 - overseas purchases |

Since rewards points are not earned, and do not transfer to airline partner programs at a 1:1 rate, we have calculated a net effective earn rate for you. Transfers to Velocity Frequent Flyer will maximise the points you earn for all three cards above. Don’t forget that you can also transfer your Flybuys Points to Velocity Points at a rate of 2:1. Transferring via Flybuys to get Velocity Points will yield the same number of Velocity Points as transferring the Velocity directly. However, there are occasional Flybuys Velocity bonus transfer offers where it would make sense to transfer via Flybuys to earn Velocity Points.

Planning a big flight redemption post-COVID? Brush up your knowledge on the best uses of 80,000 Velocity Points, 100,000 Asia Miles or 100,000 KrisFlyer miles.

What other rewards can I get with NAB cards?

Outside of NAB Rewards’ frequent flyer program partners, the program also offers other redemptions. These include gift cards, a range of products, charity donations, a 10% discount on AFL travel and a range of exclusive AFL redemptions. The latter is thanks to NAB’s commercial relationship with the AFL.

Webjet

NAB Rewards has partnered with Webjet to offer immediate redemption of your reward points for any travel booking offered from Webjet. Once you’ve logged in to the NAB Rewards, you click out to Webjet, and you’ll be shown how many points you can redeem and the value of those points in Webjet credit.

In this example, we have 83,639 NAB Rewards on offer, equating to $418.19 in Webjet credit. This offers a redemption value of 0.5c per NAB Rewards point.

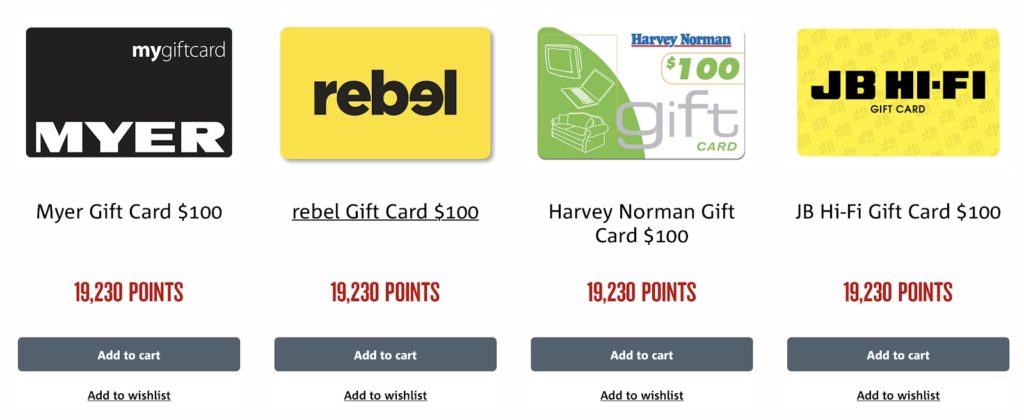

Gift cards

Gift cards are available for Myer, JB Hi-Fi, Myer, BP, Coles, Coles Express, Bunnings and many more. The current redemption rate for a $100 gift card is 19,230 points, offering a value of 0.52c per NAB Rewards point.

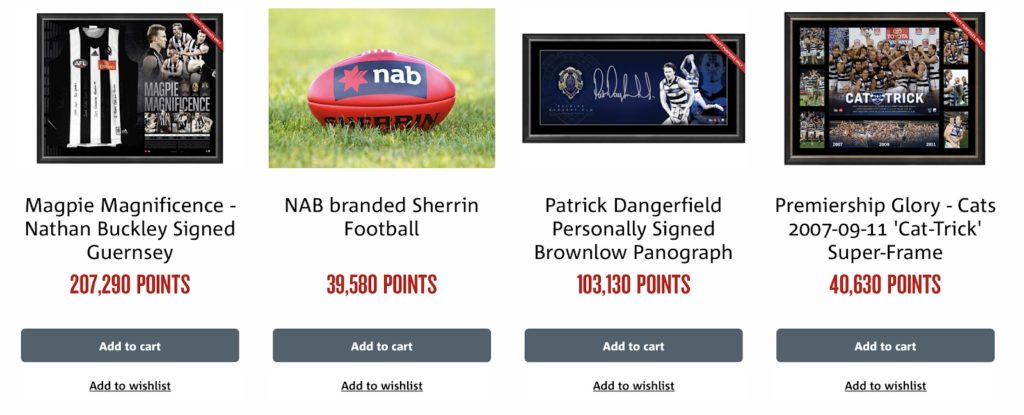

AFL

AFL redemption options through NAB Rewards include signed jerseys, lithographs and other merchandise, for the die-hard fans.

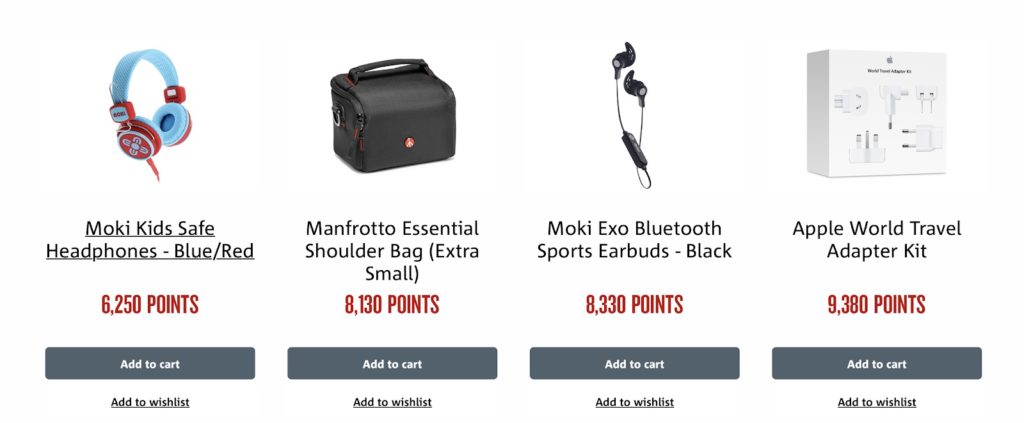

Products

A range of technology, lifestyle, and other product category redemption options are available through the NAB Rewards website. Given that the prices of these products change frequently, we won’t run a comparison of the value on offer here, but these are usually not the best value use of your points.

The NAB Rewards card range

NAB Rewards offers four cards:

- NAB Rewards Card: an entry-level, low-fee card (No longer available to new customers) ;

- NAB Rewards Platinum Card: a higher fee, higher points-earning card

- NAB Rewards Signature Card: the highest points-earning card in the line-up and

- NAB Rewards Business Signature Card: a business-focused card

We’ve got the details of the three consumer cards below, along with the latest sign-up offers and a link to our dedicated card guide.

Card Details

| Card | NAB Rewards Signature Card |

| Loyalty Program | NAB Rewards |

| Points earned from spend | 1.25 Rewards Points per $1 on everyday spend 2.50 Rewards Points per $1 in major department stores and hardware stores 3.75 Rewards Points per $1 on overseas spend |

| Points cap | uncapped |

| Earns points at ATO | No |

| Overseas transaction fee | 3% of the converted amount |

| Mobile wallet | Apple Pay, Google Pay |

| Annual fee | $295 p.a. ongoing |

Card Details

| Card | NAB Rewards Platinum Visa |

| Loyalty program | NAB Rewards |

| Points earned from spend | 1 Rewards Point per $1 on everyday spend 1.5 Rewards Points per $1 at eligible Grocery Stores 2 Rewards Points with purchases made online with Webjet via NAB Rewards Store or on Webjet.com.au |

| Points Cap | No points cap |

| Overseas transaction fee | 3% of the converted amount |

| Mobile wallet | Apple Pay, Google Pay, Samsung Pay |

| Regular Annual fee | $195 p.a. ongoing |

| Card | NAB Rewards Classic |

| Loyalty program | NAB Rewards |

| Points earned from spend | 0.75 NAB Rewards point per $1 on everyday spend 1.5 NAB Rewards points per $1 spend in major department and hardware stores 2.25 NAB Rewards points per $1 spend overseas |

| Points Cap | No points cap |

| Included insurances | Complimentary Purchase Protection Insurance (PDS) |

| Overseas transaction fees | 3% of the converted amount |

| Mobile wallet | Apple Pay, Google Pay |

| Annual fee | $95 |

What are the other features of NAB Rewards?

Points Booster

NAB Rewards boasts a handy Points Booster program, which permanently boosts the points you can earn at selected retailers.

- Double points: On purchases made at Kmart, David Jones, Big W, Target, Myer, Bunnings and Mitre 10

- Triple points: All purchases made at webjet.com.au and on overseas purchases, including in-store or online where the processing bank is outside of Australia

Summing up: is NAB Rewards for you?

If you are looking for a choice in how you redeem your rewards points, then NAB Rewards may be a program for you. With several airline partners to transfer to, you can redeem your points for travel at a time that is most opportune for you.

The program also has some great features, like point boosters, to help you maximise the points earned. Also, the range of redemption options is quite extensive.

However, one program’s weakness is the earn rate for standard purchases. The effective earning rates for these purchases are on the low side compared to similar cards in the market.

Overall, though, it is definitely a program to consider.