American Express is offering 350,000 Membership Rewards Points for New Amex Card Members who apply for the American Express Platinum Business Card by 25 June 2024 and spend $12,000 within the first 3 months from approval.

The card is aimed at business spenders who are looking for high points earn rates on spend, along with Amex Platinum service and a host of business and travel-related benefits.

It is worth knowing that Membership Rewards Ascent Premium points are transferable to 12 key frequent flyer programs, including Qantas Frequent Flyer, Velocity Frequent Flyer, KrisFlyer, Asia Miles, Etihad Guest and more.

Card Details

| Card | American Express Business Platinum Card |

| Loyalty Program | American Express Membership Rewards |

| Points earned from spend | Earn 2.25 points per $1 spent on all purchases, except those in the 1 point category Earn 1 point per $1 spent with government bodies |

| Travel Benefits | Global and domestic lounge access |

| Included Insurance | Travel Insurance, Card Purchase Cover, Buyer's Advantage Cover, Monthly Business Expenses Cover and Loss Damage Waiver Cover (PDS) |

| Overseas transaction fee | 3% of the converted amount |

| Mobile wallet | Apple Pay, Google Pay and Samsung Pay |

| Minimum income requirement | Annual business revenue of $75,000 or more |

| Annual Fee | $1,750 p.a. |

Effective Frequent Flyer Program Point Earn Rates

| Frequent Flyer Program | All spend except on government bodies |

|---|---|

| Qantas Points | 1.125 points / $ |

| Singapore Airlines KrisFlyer miles | 1.125 miles / $ |

| Cathay Pacific Asia Miles | 1.125 miles / $ |

Key eligibility requirements for the American Express Business Platinum Card

- Have a personal gross (pre-tax) annual income of $75,000 or more

- Operate a trading ABN or ACN

There are no requirements for the self-employed to have been trading for 18 months or 12 months if they hold another American Express card when considering the Platinum Business Card. Therefore, this card could be an alternative to the personal Platinum card.

Key differences to the personal Platinum Card

- Up to 55 days cash flow

- Flexible payment Option

- Up to 99 additional card members

- No $450 travel credit

- No complimentary guest privileges for Priority Pass lounges (guests are charged US$27 each)

For many people, the Platinum Card could be a more appropriate card. For those who have a lot of business-related spend then the Platinum Business Card could be useful and can provide additional cash flow to businesses.

Platinum Business is a charge card

This is a charge card, which means that the balance of the card must be paid for in full each month, as opposed to a credit card, where you can carry your balance over to the next month.

American Express offer some more detailed information regarding the differences between a charge and credit card here.

Benefits of the Business Platinum Card

The benefits of the Business Platinum Card include (take a deep breath):

- Earn Membership Rewards points, including the ability to transfer to Qantas Points

- 99 additional card members free of charge

- Up to 55 days cash flow

- Flexible Payment Option

- Global and domestic lounge access: American Express and Priority Pass

- Benefits when utilising travel booking services when using American Express Travel

- Travel Insurance (including points redemption bookings) and Card Purchase Cover, Buyer’s Advantage Cover, Loss Damage Waiver Cover (read full PDS here)

- Platinum’s By invitation only program, which gives access to events and experiences that are not open to the general public

Earning Points from Spend on the Platinum Business Card

With the American Express Platinum Business Card, you’ll be earning Membership Rewards Ascent Premium points.

In short, Membership Rewards partners with the major frequent flyer programs in the region as a flexible points program, which allows on-demand transfers of your points over to the frequent flyer program at your request.

On top of the standard benefits of Membership Rewards points, Platinum Business Card account holders are also able to transfer their points to Qantas Frequent Flyer, one of only a couple of cards in the market that can do this since it earns Membership Rewards Ascent Premium points (rather than earn directly into Qantas Points).

The Platinum Business Card earn rates are as follows:

- Earn 2.25 points per $1 spent on all purchases, except those in the 1 point category

- Earn 1 point per $1 spent with government bodies

The ability to earn 2.25 points per $1 on utility transactions including gas, water, electricity providers and insurances is a big plus for the card. You can also earn 1 point per $1 on all government spend such as at the Australian Taxation Office, Australia Post, federal/state and local government bodies.

Lounge Access

There are several lounge options you can take advantage of as a Platinum Business Card Member.

American Express also has a growing network of Amex-branded airline lounges globally, including The Centurion® Lounge at Sydney Airport’s International Terminal and another at the Melbourne Airport.

Generally, you can bring two guests to the American Express lounges, as well as children travelling with you, and with the Platinum Card, you may be able to access the The Centurion® Lounge in Sydney, Melbourne and other International American Express lounges globally on an unlimited basis.

You’ll receive a Priority Pass lounge membership for you and an additional card member, which now includes eateries at Sydney, Melbourne and Brisbane Airports. Guests are charged US$35 each.

(There is also a 10% discount on paid Priority Pass memberships here for Point Hacks readers.)

Another lounge network that Platinum Card Members gain access to is Plaza Premium, which operates a small number of about 50 high-quality lounges worldwide, including a great lounge in Brisbane’s International Terminal. You can read more in our Plaza Premium guide.

Additionally, when travelling with Delta, a Platinum Card Member can access Delta SkyClub lounges.

Access to travel booking benefits and services through American Express Travel

American Express Travel is available to all Amex Card Members, but Platinum Business Card Members receive additional value.

For Business Class fares, Amex Travel has competitive pricing and has access to a wide range of discounts that may not be publicly available.

This is primarily across their partner airlines: British Airways, Delta, Emirates, Etihad, Singapore Airlines and South African Airways.

Beyond airfare, there are also a number of partner independent hotel chains which offer some exclusive benefits when booking through American Express Travel.

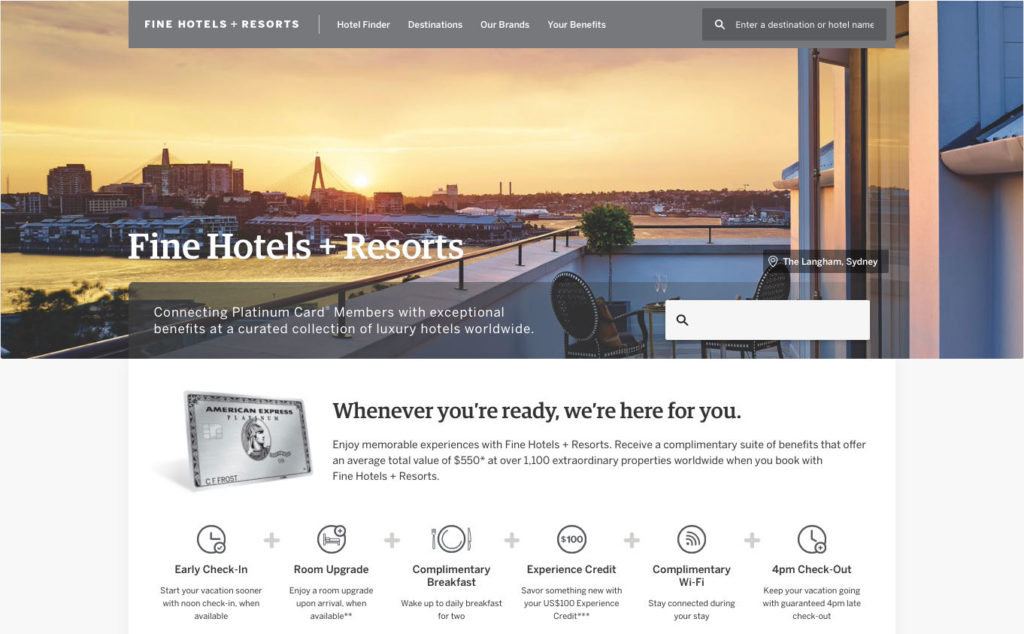

There’s then the major hotel program benefit – American Express Fine Hotels + Resorts.

American Express Fine Hotels + Resorts is only for Platinum Card Members

American Express Fine Hotels + Resorts is a unique benefit for Card Members, which offers more hotel benefits when booked through American Express.

With many Fine Hotels + Resorts bookings you’ll also continue to receive points and status with the parent hotel loyalty program too.

The benefits may include:

- An on property benefit, often $100 USD in credit per stay

- 12pm check in

- Room upgrade if available

- Free breakfast

- Guaranteed 4pm late checkout

- Free wifi

Business Platinum Card Members also have access to The Hotel Collection, which is a smaller set of high-end (as opposed to ultra high-end) properties, where they can get a free room upgrade and US$100 hotel credit. In addition, you may also use Pay with Points when booking a stay at properties under The Hotel Collection. This essentially allows you to use your Membership Rewards points to pre-pay your hotel stay.

Complimentary Hotel Status

The Platinum Business Card comes with a range of hotel and other elite status benefits. We’ve covered off exactly what you’ll receive in a dedicated guide, but the key benefits are Marriott Bonvoy Gold Elite, Hilton Honors Gold, and Radisson Rewards Premium status.

Complimentary Accor Plus membership

Also included with the Platinum Card is a complimentary membership to Accor Plus, which has an annual fee of $399 if bought separately.

This membership offers benefits such as a free night at a hotel in the Asia-Pacific each year you hold the card and the potential for large discounts at restaurants within hotels, even when you are not staying at one.

Flexible Payment Option

Business owners can free up their cash flow with an instant line of credit on their Charge Card. Instead of paying off the balance in full each statement period, it can be paid off over time.

How it works:

- The Card Member will receive a statement at the end of each statement period summarising their spend

- They can choose to pay the Closing Balance, the minimum amount due, or any amount in between (up to their Flexible Payment Option Limit).

- They can carry over any unpaid amount to their next month’s balance. Any amount not paid in full will incur interest at a rate of 23.99% p.a. until repaid.

Travel and Other Insurance

It is difficult to provide too much commentary on the card’s insurance coverage given that each person’s insurance needs are different, so check out the full Platinum Business Card Insurance PDS and assess whether it will cover your needs.

Depending upon the type of cover, the insurance is activated by either just being a Platinum Business Card Member, or by making a purchase of an eligible item.

The insurances included are:

- Buyer’s Advantage Cover

- Travel Insurance, including for points redemption bookings from using points earned by your Platinum Business Card

- Card Purchase Cover

- Roadside Assistance

- Up to $125,000 of Loss Damage Waiver Cover

This guide references some of the benefits of insurance policies provided with this card. You should read the PDS and obtain independent professional advice before obtaining this product.

Access to the Amex Experiences App

The Amex Experiences App makes it easier for you to access the Premium Concierge service, and check out the latest information on Platinum benefits, travel offers, events and recommended merchants.

The App is available for download on Google Play or the App Store. This is not a replacement for the Amex App but can be used alongside it.

Unparalleled mobile wallet integration

American Express cards support Apple Pay, Google Pay and Samsung Pay, meaning you can use this card on your smartphone for easier payments.

Read the Point Hacks guide to using Apple Pay or for using Google Pay and Samsung Pay, including instructions on how to add your American Express card to those services.

With this feature set up, it means you could still use your NFC-enabled phone to make purchases with your American Express account, even if your physical card is lost or stolen and pending replacement.

Eligibility criteria for bonus points for existing American Express Card Members

American Express are quite specific about whether existing Card Members will be eligible for bonus points if they apply for a card, are approved, and meet the minimum spend criteria.

Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the preceding 18 month period are ineligible for this offer.

American Express don’t allow existing Card Members, even for different types of American Express cards (e.g. Charge, Credit or Business) to be eligible for bonus points offers for cards in a different family.

Summing up: American Express Platinum Business Card

The expectation of most people is that this card should tick all the boxes since it combines plenty of Business-related features along with some very useful travel benefits.

If you have a lot of business spend to put into the card and are likely to utilise the softer benefits such as adding up to 99 Employee Card Members free of charge, up to 55 days cash flow or insurance protections, then this card may be for you.

Can you direct me to a guide or write a guide for credit cards that are offered with only having an ACN not an ABN?

Looking forward to hearing from you.

We haven’t heard anything regarding this so unfortunately, we are not able to update you on this at the moment.

Yes, business card eligibility is still based on an individual applicant’s details, with the difference to a personal application being an ABN and GST registration is required to apply for these cards. Contrast this with corporate cards, where is the corporate’s financial capacity that is assessed.

Given that the PP program has the settle “no free guest” with the Business Platinum card, can you or any holder of the Business Platinum please confirm if you have access to Delta/Plaza please?

The two conflicting sites are:

https://www.americanexpress.com/au/credit-cards/the-platinum-card/?inav=au_menu_cards_pc_plat_rcp

https://www.americanexpress.com/au/credit-cards/membership-benefits/the-business-platinum-card/

Hope that helps!

Is this article outdated or is it still relevant today? I’ve been trying to look for biz class tickets on Qantas points from Sydney to Dubai, you have an estimate on your site of 112 thousand points but when I check the Qantas site it says 570 thousand points. That’s a huge difference, am I doing something wrong? Or, (the more likely outcome) I read something wrong?