As regular readers of this site will know, there are plenty of frequent offers on credit cards. Signing up for these points-earning cards usually comes with a very lucrative sign-up bonus.

Most offers come with a minimum spending requirement in order to earn bonus points. This is to help the provider recoup some costs associated with offering bonus points.

A good example is the current Westpac Altitude Qantas Platinum offer:

How much you normally spend will determine whether you can easily meet a minimum spending requirement. For many, this may not be enough to meet such a requirement. This is where this guide comes in.

We provide some tips on how to meet this requirement without overspending.

It is worth reiterating, do not go into needless debt just to earn points! Interest rates on rewards credit cards are usually very high! And you must pay the full statement balance to avoid paying any interest.

Most of our tips are about methods to timeshift your spending. This invariably means paying your expenses is brought forward. So, ensure you only consider offers and transactions that you know you can repay.

Put as many of your day-to-day transactions on your card as you can

The easiest way to meet a minimum spend is, no surprises here, to use the card. And often. In fact, on everything possible, until you have reached the requirement. So make sure to put the card at the front of your wallet or purse.

All your shopping, all your bills, every coffee, eating out, take away, etc. Most people would be able to make up the requirements of most cards within a couple of months.

The key here is to NOT go on an unnecessary shopping spree. The purchases on your card should be largely what you would normally be buying anyway.

Pay your bills, even before they arrive!

While a boring option, it is also one of the easiest and best. This is because bills can usually be for a large amount. I just paid my Council Rates the other day, which was well into the 4 figures!

Most (not all) household bills will let you overpay to credit future bills. And having an automatic payment set up does not preclude you from making a manual payment. If you are set up for online billing, it is easy to log on and make a payment.

Personally, in the past, I have done this for electricity and council water and rates bills. I have found it a good way to quickly hit a minimum spend target. And it’s a nice feeling seeing the words ‘no payment is required’ on your next bill that comes around!

Think about all the bills you pay!

Sizeable bills are not just council rates. They are also health insurance, car registration, school fees and many more. For these bills, consider pre-paying them in a lump sum, even for a year ahead. Just note though that government-related charges are sometimes excluded from earning points. But this is where a company like pay.com.au can come in handy.

If you’re smart and plan ahead, you can time your card application optimally. You do this by applying for a sign-up bonus just before you expect some large bills to arrive. This will then help to meet a minimum spend if you are approved.

For example, let’s say there is an offer that runs from 1 June to 31 July. And the offer requires a $5,000 spend in three months.

You know you have a $2,000 insurance bill at the start of September. You might choose to delay your sign-up until the end of July rather than applying at the start of June. This will allow you to pay your bill on the new card to help you hit your target.

Pay rent

The above tip will depend on whether your landlord or real estate agency accepts credit card payments. This may require paying through a third-party company. And a surcharge may apply.

Some businesses providing this service include:

Pay for others

We’ve all been there. You go to a restaurant as a group and you reach the time to split the bill. Why don’t you be the hero and volunteer your card for payment? You earn the points, and you can ask your friends to transfer you their share separately.

Obviously, this is a bit of work for you to calculate everyone’s share. And there is also the risk that some friends may ‘forget’ to pay. So proceed with caution on this tip if you’re not too close to your friends.

You could also ask trusted family and friends if you can pay their bills on behalf of them and then have them transfer the money. In my experience, most people (who are not earning points anyway) are happy for me to do this and see no real difference whilst you reap the rewards.

Big-ticket purchases

If you are thinking about a new fridge or lounge, or any other big-ticket item, you could consider bringing this purchase forward to help you hit your minimum spend (potentially in one fell swoop). Normal financial advice applies not to overextend yourself on credit obviously!

Buying Christmas or birthday presents for others at any time of the year is a good way to contribute to your minimum spend requirement. Make sure you are maximising your purchases by shopping through a points-earning online mall.

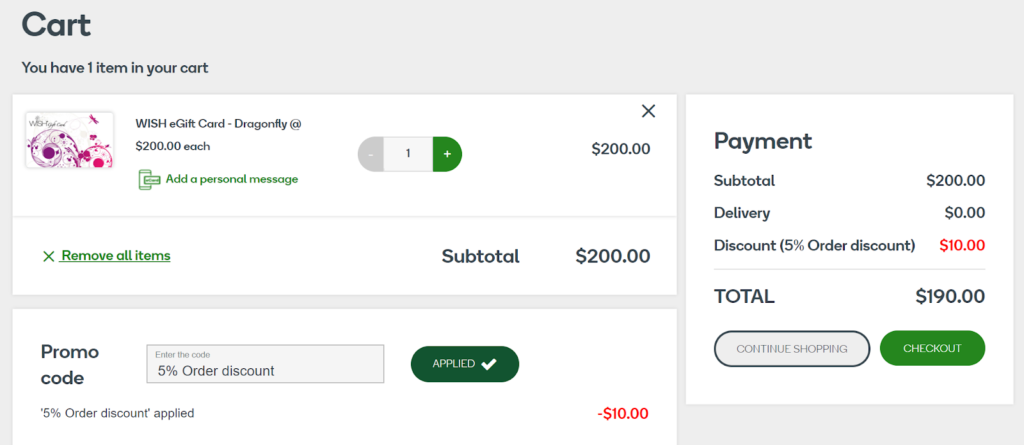

Gift cards for future purchases

We have covered ways that you can make gift cards work for you before. If you are a few hundred dollars short, you could buy a gift card now that you can then use after the time limit of your offer. For example, you can buy a supermarket gift card to hit your target, that you can then use over the next couple of months to buy your groceries.

As always with gift cards, be aware that you will lose any protection of insurance that you would have had if you bought something directly on a credit card (although how important that is will depend on what you are buying—you are not likely to need extended warranty cover on a loaf of bread!).

Also for consideration, some gift cards, including the popular Woolworths WISH cards, may be offered at a discount through various reward portals including auto clubs, banks and having Entertainment Book membership.

Business or work expenses

If you are lucky enough to work for a company that will let you purchase work-related goods or services and reimburse you, you can use your card to make the purchase and get paid back, adding some extra dollars towards your target.

Make your travel bookings

If you have got travel coming up you need to pay for, book it slightly earlier in order to make up your spending target.

Obviously, if you choose to do this for travel a long way off, you will need to take into account the risk of your plans changing, or the extra cost of flexible bookings (if you do not routinely book them).

A few left-field, more creative options

Kiva

Another option but doing some social good and adding a little risk and time—you could do some social good and give someone in the developing world a short-term loan to start a business.

Transactions are made through PayPal fee-free, including loading up your account and withdrawing your loan repayments.

Be aware that Kiva operates in US dollars so while you should be repaid your loan, you might end up with more or less depending on currency movements.

There is also the risk of default—Kiva does not guarantee that your loans will be repaid. You also do not earn any interest on the loan but that is not the point.

Tab

If you frequent a local eatery or other establishments, you may consider running up a tab for future purchases (with the cooperation of the business, of course).

Summing up

Some creative thinking about your upcoming spending should yield plenty of ideas of ways to hit the minimum spend on your credit card, without spending money you otherwise would not.

Making minimum spend should not be a challenge or costly if you put your mind to it and if you can absorb expenses from others and have them pay you back.

Originally written by Evin Tan Khiew

Do you have any other tips to help meet a minimum spend requirement? Share in the comments below!

![Our roundup of credit card offers to know about this month [June 2024]](https://i.pointhacks.com/2017/06/23173719/credit-card-stocksnap-300x171.jpg)

Did a google search but did not see anything in forums.

Is this true?

Purchasing currency with a credit card is generally treated as a cash advance by many banks and won’t accrue points.

However in regards to purchasing gift cards, this isn’t generally treated as a cash advance, and points are accrued. When you then spend on the gift card, you of course won’t accrue any further points.

Note however that each bank treat the above differently, so there is universal answer to this.

I’m not sure if this suggestion will be helpful in your situation, but what I like to do when I am short on the minimum spend front is to prepay some bills in advance. These bills eventually need to be paid anyway and this ensures that I receive the bonus points.

Also when out to dinner with a group offer to pay with your card and get people to give you the money for their share. A couple of group dinners can make a big dent in the required spend.

/house/car insurance etc, pay upfront for the year instead of monthly debits. Obviously if within your means

I have a few investment properties managed by a real estate agent, all my bills like rates, water and maintenance issues get sent there and paid by the property management, out of my gross monthly rental income, so I’m missing on a lot of easy points or minimum spend there, But someone once gave me the idea to cut out the barcodes of those quarterly bills and laminate them with details of what property and type of bill etc it is written down on the other side, keep them in your wallet also write when they are due or time of mailing, so whenever your at the post office or available to pay those bills that are almost due to be sent by mail, you can pay in credit or advance like mentioned above in the article and stack the points in your own account. That way the real estate gets theletter that states your in credit on those payments and for paying it yourself you get the points 🙂