What’s better than nabbing a sharp deal? Being able to stack offers and earn bonus points on top! For a limited time, Jetstar Holidays is offering bonus Qantas Points on all packages. It also stacks with the return for free sale for extra savings. Here’s what you need to know.

This offer is promoted in partnership with Jetstar Holidays.

Offer: 5,000 points on Jetstar Holidays

| Expiry: Book from 29 November to 11:59pm AEDT 3 December 2024 |

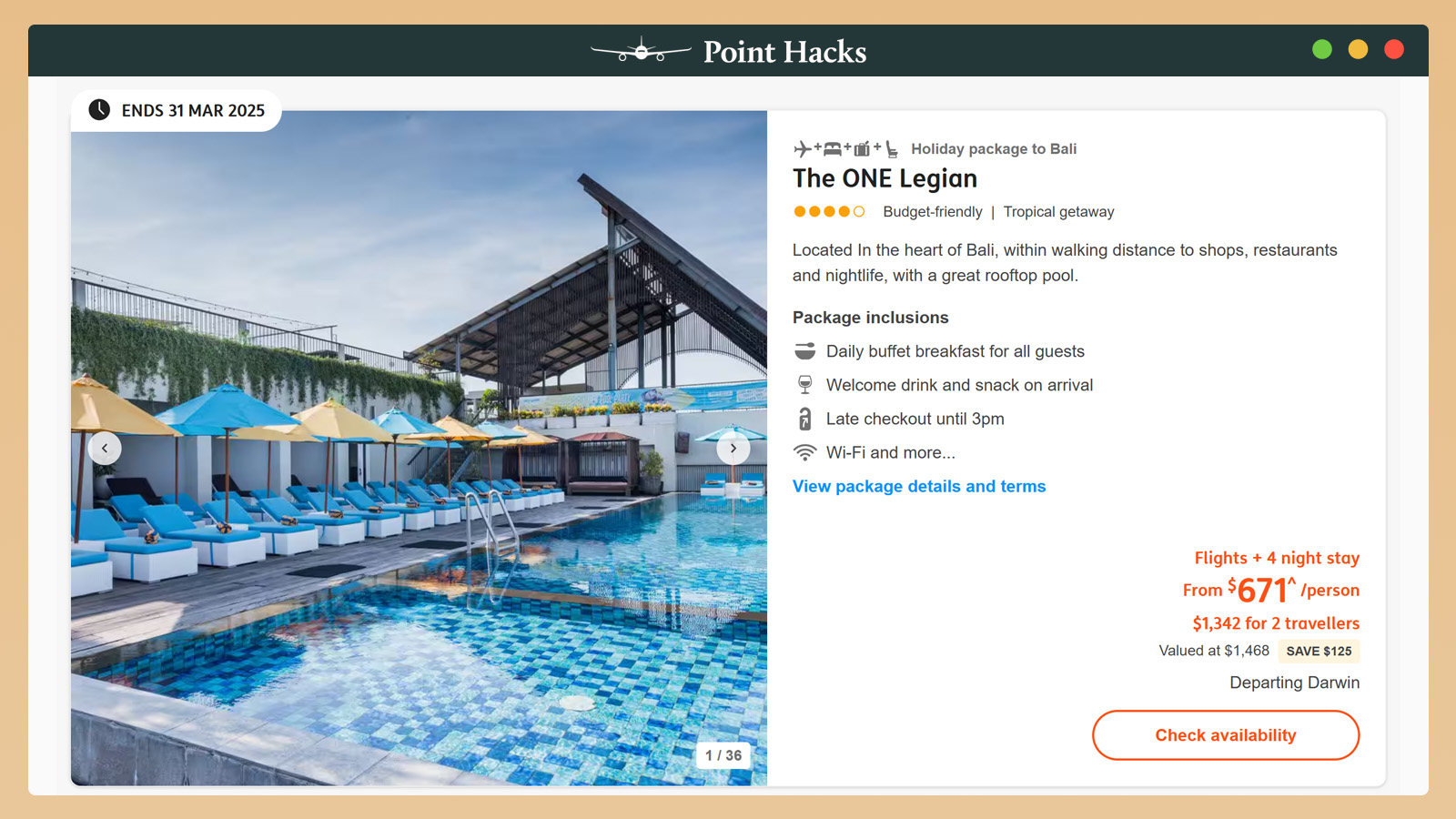

Qantas Frequent Flyer is offering 5,000 bonus Qantas Points on all Jetstar Holidays packages booked from Friday 29 November to Tuesday 3 December 2024. Whether it’s a budget Bali trip or a luxe escape elsewhere, all bookings qualify with no minimum spend. You can also line up a package with Jetstar’s return for free sale.

Note: The return for free sale ends earlier on 1 December 2024.

All Jetstar Holidays packages include return Starter fares, a 20 kg luggage allowance and seat selection. Not a Qantas Frequent Flyer member? You can sign up here for free.

Offer T&Cs:

You must be a Qantas Frequent Flyer member to earn and redeem points. Membership and points are subject to the Qantas Frequent Flyer program terms and conditions. Qantas Frequent Flyer members will earn 5,000 Qantas Points on any Jetstar Holidays packages booked through jetstar.com/holidays between 0.01am AEDT Friday 29 November 2024 and 11.59pm AEDT Tuesday 3 December 2024. No minimum spend applies on bookings, but there is a maximum of 3 bookings per member. 5,000 Qantas Points will be credited to the Lead Traveller’s Qantas Frequent Flyer account provided at time of booking, within 6 weeks of hotel check-out. Bookings made with Qantas Points Plus Pay will also be eligible to earn 5,000 Qantas Points. Points will not be earned on no-show bookings, cancelled bookings or bookings amended after 3 December 2024. Terms and conditions apply.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

Community