The CommBank Yello program is one of the newest additions to Australia’s rewards landscape, offering ‘lifestyle value’ to eligible everyday customers. Think cashback on shopping, dining and travel, tailored offers from partner brands, and access to pre-sales and money can’t buy experiences.

Here’s your complete guide to how CommBank Yello works, who qualifies, and how to make the most of it.

What is CommBank Yello?

Launched in 2023, CommBank Yello is a tiered recognition program designed to reward customers for their banking, whether that’s through home loans, savings, credit cards, or everyday banking. It’s not a points program, first and foremost. Instead, you can enjoy an increasing range of benefits as you rise through the CommBank Yello tiers.

There are four customer tiers. To be eligible for any tier, you must first have an eligible CommBank transaction account. You then need to meet the following eligibility criteria to earn benefits:

CommBank Yello tiers are reviewed monthly, based on the previous month’s activity. If you meet the eligibility criteria, then it’s yours for 3 months unless you qualify for a higher tier sooner. If you don’t requalify after that period, you’ll move down one tier (or lose CommBank Yello access completely if you’re already on the base tier).

How do I access CommBank Yello?

CommBank Yello is an app-only program. You’ll find it after you login on the CommBank app.

- Tap the CBA Yello icon on the app’s home screen.

- Browse the latest offers and benefits, sorted by category.

- Activate an offer before making a purchase, or tap through to shop online.

- Cashback or savings will be applied within 14 days once your transaction is verified.

The ‘Overview’ tab shows your current tier and how you’re tracking for your next eligibility review. Over on the ‘Offers’ tab, you’ll find the current deals and specials which are refreshed regularly, including cashback offers and travel benefits (if eligible).

What kind of rewards can you get?

CommBank Yello offers are updated regularly, covering everything from fashion and food to travel and entertainment. Examples of current and previous CommBank Yello Gold offers have included:

- A free 6-month Uber One membership + $15 of Uber Cash credit

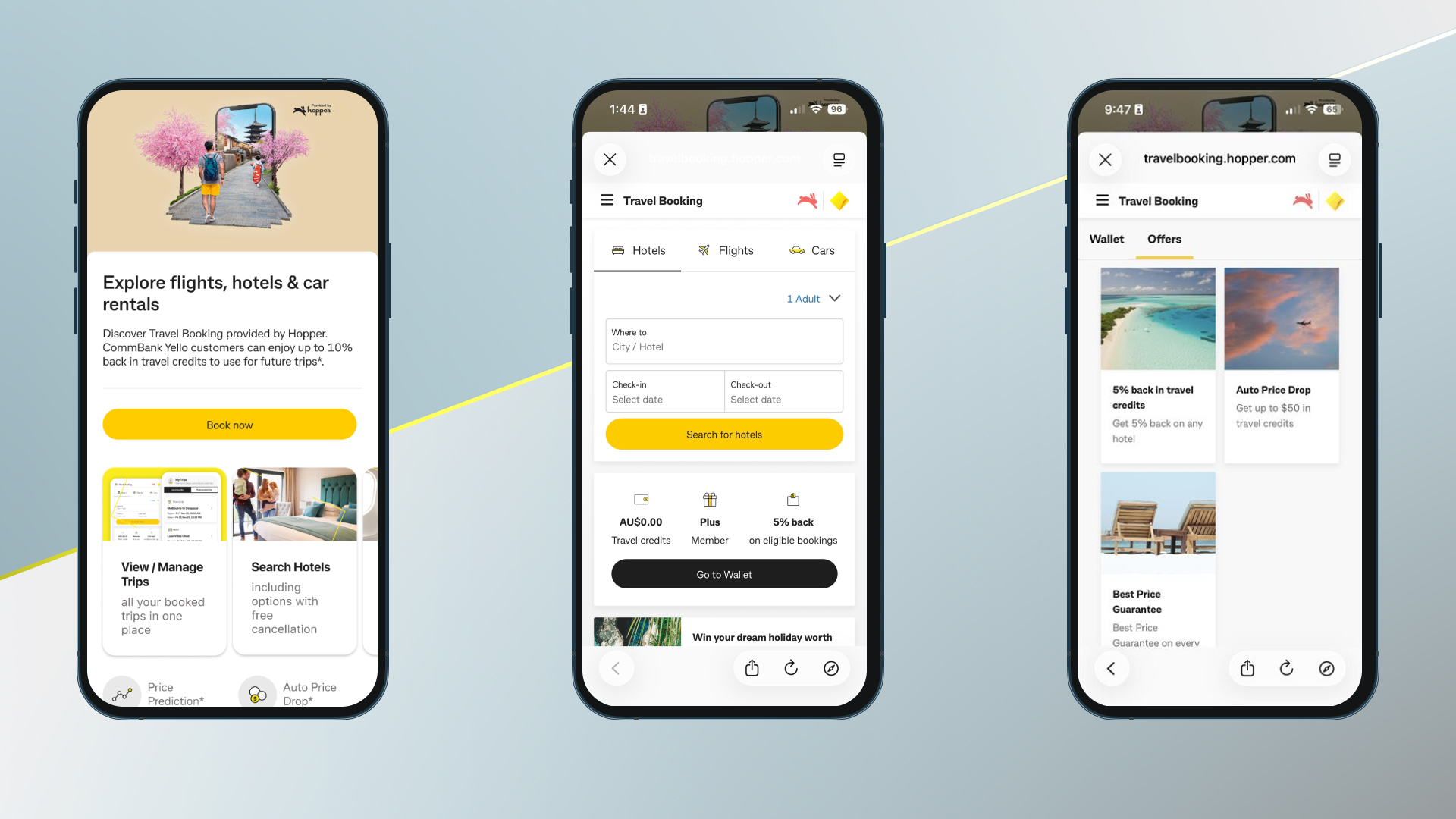

- 5% back in travel credits when you book flights and hotels through Travel Booking via the CommBank app.

- One year of free Dymocks Booklover Gold membership

- $12/month off new mobile plans for 36 months with More Telecom

Some benefits are tier-specific, with higher levels unlocking greater value or early access to exclusive campaigns. For example, CommBank Yello Diamond customers could enjoy 10% back in travel credits when they book flights or hotels on Travel Booking via the CommBank app – plus a one-off $100 travel credit for first time users.

To get the most out of CommBank Yello:

- Check the app often. New offers drop often, and the best ones are time-limited.

- Stack rewards. You might be able to use CommBank Yello cashback independently of other retailer promotions.

- Activate before spending. Only activated deals track cashback.

Is CommBank Yello worth it?

Absolutely, especially if you already bank with CommBank. There’s no cost to join, the rewards are personalised, and the cashback adds up surprisingly quickly for regular spenders.

Homeowners, in particular, could benefit the most as having an eligible mortgage may satisfy the ‘balance’ criteria for CommBank Yello Gold or Diamond. You just need to make the 15 transactions on top.

So while there aren’t any ‘point hacks’ here, CommBank Yello still makes it easy to turn everyday spending into instant value. Whether you’re paying bills, booking travel or shopping online, it’s worth checking CommBank Yello before you spend.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

This guide is brought to you in partnership with CommBank.

Community