CBA guts credit card Awards program transfer partners

In a drastic move, Commonwealth Bank is saying goodbye to 14 points transfer partners.

What we'll be covering

The Commonwealth Bank is decimating its CommBank Awards program with almost every points transfer partner to face the axe. From 1 October 2025, CBA Awards members will lose the ability to convert credit card points into rewards with every current hotel partner, and almost every current airline partner.

The abrupt changes, first reported on Australian Frequent Flyer, significantly reduce the appeal and value of points held in the CommBank Awards program. With CBA being Australia’s largest credit card issuer, the number of cardholders set to be impacted will be very high.

Here’s a rundown of the coming changes, and alternative paths you might consider to continue earning flexible points.

CBA’s current Awards transfer partners

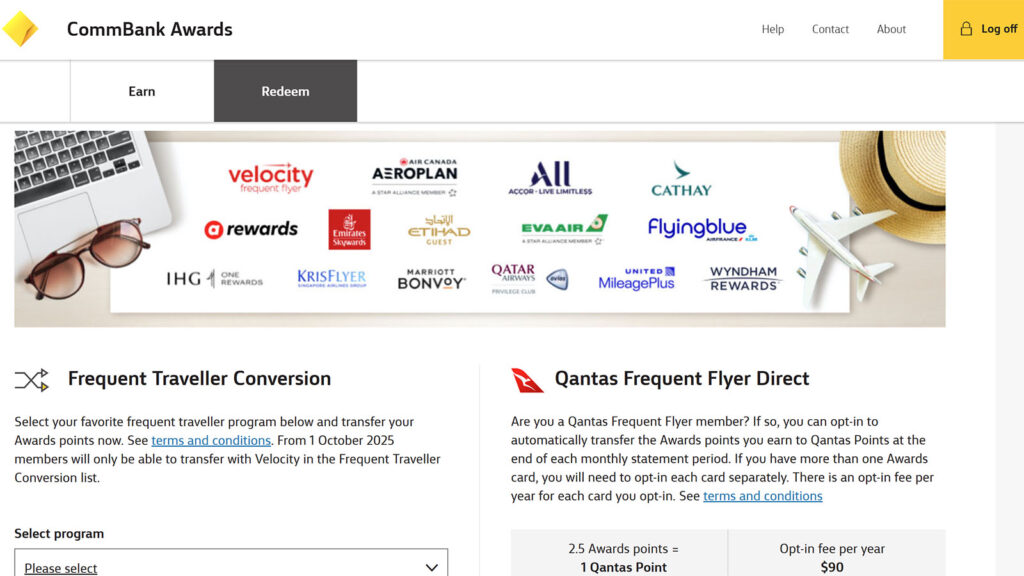

Currently, CBA Awards offers an enviable number of global points conversion partners. Not only are the usual suspects available – Velocity, KrisFlyer and Cathay (Asia Miles) – but there’s an eclectic mix of hotel chains and international airlines.

For instance, CommBank Awards is the only credit card program in Australia to offer direct transfers to Air France/KLM Flying Blue. That’s currently one of the best frequent flyer programs for securing seats on SkyTeam Alliance flights. CBA Awards is also the only Aussie card program to provide points transfers to AirAsia Rewards.

Added to that, CommBank Awards is one of the only Australian credit card programs with direct conversions to Air Canada Aeroplan, Emirates Skywards, Etihad Guest, EVA Air Infinity MileageLands, Qatar Airways Privilege Club and United MileagePlus.

On the hotel front, CommBank is the only credit card program Down Under with transfers to IHG One Rewards and Wyndham Rewards. It’s also one of just a few programs with Accor Live Limitless and Marriott Bonvoy as transfer partners, too.

But from 1 October 2025, that all changes.

The new-look CommBank Awards program

Come October, CommBank Awards’ list of transfer partners will include Velocity Frequent Flyer… and that’s all. KrisFlyer is gone. Cathay is gone. Those other great airline programs are gone – and you can guess what we’ll say of those hotel partners, too. Gone.

It’ll still be possible to opt-in for the earning of Qantas Points on CBA cards. This continues to attract a $90 p.a. fee, in addition to the usual credit card monthly or annual charges. However, for those chasing flexible points, CommBank Awards is about to get a whole lot less flexible.

Sure, you can hold onto your points and choose when to switch them for Velocity Points. But if that’s where they’re going to end up anyway, that really isn’t the meaning of flexibility.

CBA is also removing a number of other features of the Awards program from the same date. For instance, points redemptions at Flight Centre and the Awards eShop will also disappear.

Members have until 30 September to use their CommBank Awards points with the program’s current web of partners. The biggest challenge for cardholders will be deciding what to do with any current points balances. For instance, weighing up whether it’s better to convert these to one of the disappearing partners – knowing it’ll be harder to top-up that same account in the future. Or whether it’s better to keep them and just stick to Velocity.

Where to next?

CommBank Awards’ key users will likely fall into three customer sets. That is, those who use the program to earn with Velocity, those who prefer flexible points, and those hoping to avoid foreign transaction fees – a key feature of the bank’s latest card products.

For those chasing Velocity Points, nothing changes. Velocity remains an option, and there’s no mention of an amended conversion rate. These users needn’t panic – unless that changes in the future.

But spenders seeking flexible points might be seeking alternatives. Perhaps, earning Velocity Points isn’t their cup of tea. Or, the value of flexible points is more appealing – particularly when travelling internationally. After all, different frequent flyer programs can be valuable for securing different types of reward seats. When one airline has no reward seats available, others might have plenty. And flexibility allows hunting for those seats – and securing them before somebody else does.

After CommBank’s current program, American Express Membership Rewards offers the highest number of transfer partners. Products like the American Express Explorer Card and American Express Platinum Card can deliver uncapped, flexible points.

American Express Explorer Credit Card

American Express Platinum Card

But for the greater acceptance of Mastercard or Visa, cards attached to programs like ANZ Rewards, NAB Rewards and Westpac Altitude Rewards could also be worth a look. For instance, the ANZ Rewards Platinum and Rewards Black cards.

ANZ Rewards Platinum

ANZ Rewards Black credit card

There’s also NAB Rewards Platinum Card, among other NAB products like NAB Rewards Signature, which has no international transaction fees.

NAB Rewards Platinum Card

Plus, there’s the Westpac Altitude Rewards Platinum and Altitude Black credit cards.

Westpac Altitude Rewards Platinum

Westpac Altitude Rewards Black

Those making business spends might also consider the Pay.com.au platform and its loyalty program, PayRewards. (Pay.com.au is affiliated with Point Hacks). PayRewards offers a growing mix of points transfer partners, including many of the key programs being cut from CommBank Awards. For instance, PayRewards Points can be converted to Air Canada Aeroplan, Singapore Airlines KrisFlyer, Qatar Privilege Club, United MileagePlus, and more.

Also read: Frequent flyer points in the crosshairs of the RBA’s credit card crackdown

Point Hacks may receive a commission where a customer applies for a credit card linked from this article.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.