With the new B2B payment platform pay.com.au recently launched, it’s a good time for business owners to re-evaluate the way they pay bills and invoices. Payments that are required to be completed by bank transfer typically don’t earn rewards points, and you will lose access to that cash immediately.

That’s when business credit and charge cards come in — both typically offer up to 55 cash flow days (often known as interest-free days), which means your supplier gets paid instantly by the card issuer, and your cash can sit tight until the payment is due later on.

That could potentially give you more time to make more sales of a product before the relevant supplier invoice is due. Best of all, rewards points can be earned by eligible cards.

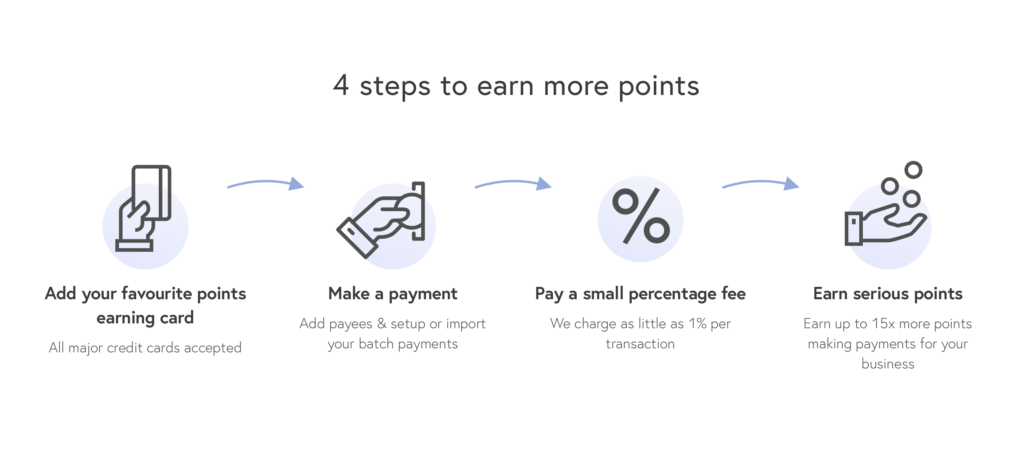

So what if your invoices can only be paid by bank transfer rather than credit cards? That’s when business payment platforms come in — read our starter guide to pay.com.au to learn more about the basics.

How can my business benefit with pay.com.au?

In a nutshell, here are ways you could come out ahead of paying invoices with pay.com.au:

- Generate incremental value from rewards cards

- Help your business’ cash flow

- Save time by efficiently paying all your invoices from one platform

- Save money with the lowest fees in the market

We’ve seen customers generate tens of thousands of dollars worth of points by simply paying a few purchases via this approach.

You can easily generate significant points balances via your business by simply paying many of your businesses purchases on a credit card — even when you wouldn’t otherwise be able to pay the invoice on your credit card

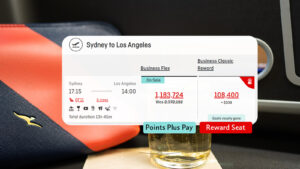

Then, use these points to fly where you want in luxury for a tiny fraction of the normal cost using reward seats — something that we cover quite in-depth here at Point Hacks.

However, this particular article will focus more on how pairing a credit card with pay.com.au could help you manage your business’ cash flow much more effectively.

How do credit and charge cards work with payments?

We’ll use the American Express Qantas Business Rewards Card as an example. This is a charge card (not a credit card), meaning there is no preset spending limit. You spend what you need for work, and pay it off in full the following month to avoid charges — it’s perfect for businesses.

American Express promotes this card as having ‘up to 51 days cash flow days’, meaning you have up to 51 days from the date of purchase to make a repayment. The actual number of days you have until repayment will depend on your billing cycle and payment due date.

While 51 days is the maximum number of cash flow days possible on the American Express Qantas Business Rewards card, it’s generally less in practice and will vary with other financial card products.

But the concept is still the same for both charge and credit cards. Imagine you ran a business that needed to pay suppliers upfront.

You could do so now, carrying the balance on your American Express card for up to 51 days (for example). This could give plenty of time for your customer to pay for your work first and for you to repay your balance, without dipping into your cash on hand.

Understanding the billing cycles and statement dates

As a very simple example, let’s say one of your monthly cycles is 1-31 January, and the payment due date is 21 February.

Any purchases you make on 1 January will have to be repaid by 21 February, giving 51 cash flow days. But any purchases made on 31 January will still be due by 21 February, giving you 21 cash flow days.

Assuming you pay the full balance off, then the same will happen next month, and so on. The video below gives an example (but using 55 cash flow days as an example).

Summing up

The idea of businesses paying off invoices via a B2B platform to earn credit card rewards points is not new — there is a handful currently operating in Australia. The main point of comparison is the fees charged for each transaction.

At the time of launch, pay.com.au has the lowest fees across the board and accepts all major credit cards. Its non-card features such as the points concierge and travel booking service will also help create a smooth end-to-end experience for users looking to maximise their rewards.

But arguably, one of the best features of using pay.com.au is gaining the ability to gain rewards points and cash flow days on invoices that would usually be paid by bank transfer. You get up to nearly two months more to pay it off and could get more in rewards back than the transaction fee.

Please note that all information in this guide is of a general nature only, and we advise readers to seek professional advice on whether business credit cards are suitable for their financial situation.

Community