If you are an American Express Card Member, one of the biggest perks are the regular offers for bonus points or cashback when you make purchases at participating retailers. Sometimes, there can be discounts or offers for purchases you might be making anyway.

Best of all, because these rewards are fulfilled by American Express, you may still be able to use other discounts or promotions by each retailer — you just have to meet the minimum spend requirements for the Amex reward to kick in.

In this guide, we’ll show you how to check your personalised Amex Offers and the generalised promos at Amex Connect to take advantage of these rotating promotions.

Want to see the deals themselves? We’ve curated the best American Express Offers here.

What are Amex Offers and Amex Connect?

Amex Offers and Amex Connect are two similar programs that entitle Card Members to discounts and savings by offering bonus points or a statement credit when eligible purchases are made. Think of it as an instant cashback offer without having to deal with any paperwork.

In short: American Express will reward you for shopping at specific eligible businesses. These can range from smaller boutique stores to big brands such as Amazon, Sony and Harvey Norman.

So what are the differences between the two programs?

- Amex Offers are for holders of Amex-issued cards and may feature personalised offers. You’ll find them listed in your online account.

- Amex Connect is open to holders of both Amex-issued and Westpac-issued cards, excluding David Jones American Express cards. Offers here are general and usually more limited. You’ll find them through the Amex Connect link.

Not sure whether your American Express card is Amex-issued or bank-issued? Our guide on telling the two apart will help.

Although the sign-up process may be different, the two programs are essentially the same when it comes to issuing rewards. As soon as you meet the spending criteria, you will receive an email from Amex confirming this, and then you’ll usually get your reward in a few days.

Here are some key points to keep in mind:

- Not every offer is put in front of all Card Members — some are personalised, so you may see something in your account that another person doesn’t

- You must use the card enrolled in the offer to access the benefit

- Make sure you read the terms and conditions for each offer

- Some business, travel, government and prepaid cards are not eligible

How do I use Amex offers?

If you’re an existing American Express Card Member with a card directly issued by Amex, then it’s easy to register for offers:

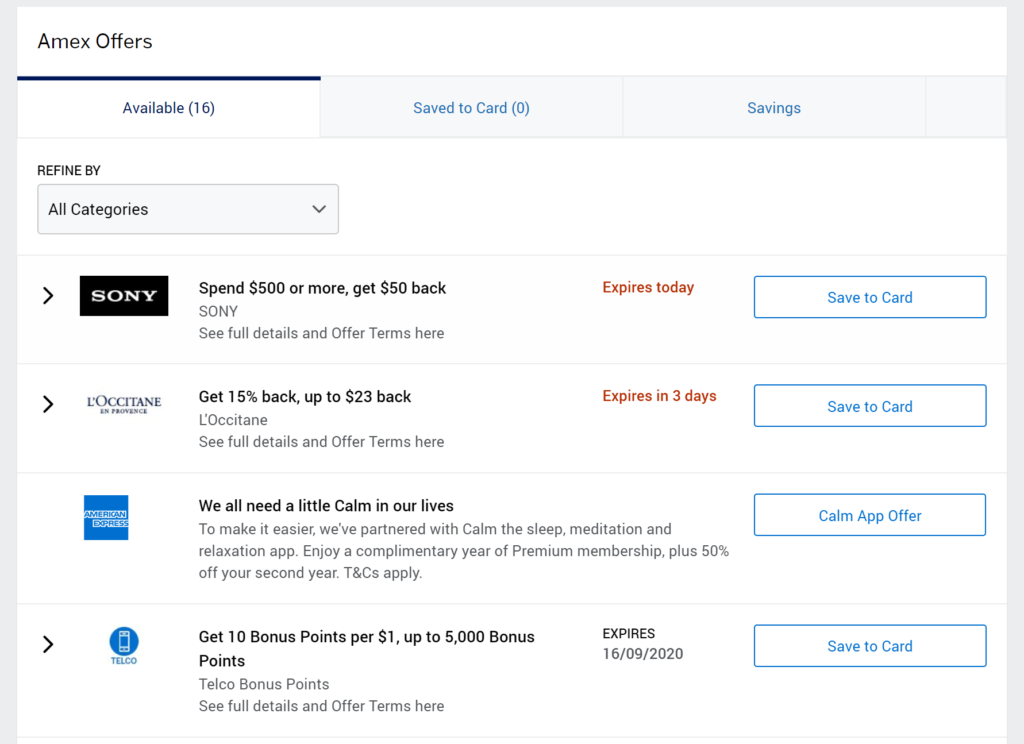

- Log in to your American Express account or go through the Amex app

- On the web, scroll down until you see ‘Offers’. On the app, look for the ‘Offers’ tab.

- You’ll see the offers your card is eligible for. Click ‘Save to Card’ to activate it.

- Complete your qualifying spend by the expiry date. If you met all the T&Cs, you’ll get your reward shortly.

According to the terms and conditions, statement credits are processed within three working days but can take up to 90 days in rare circumstances. In our experience, statement credits usually appear within 48 hours or less of the purchase being made.

How do I use Amex Connect?

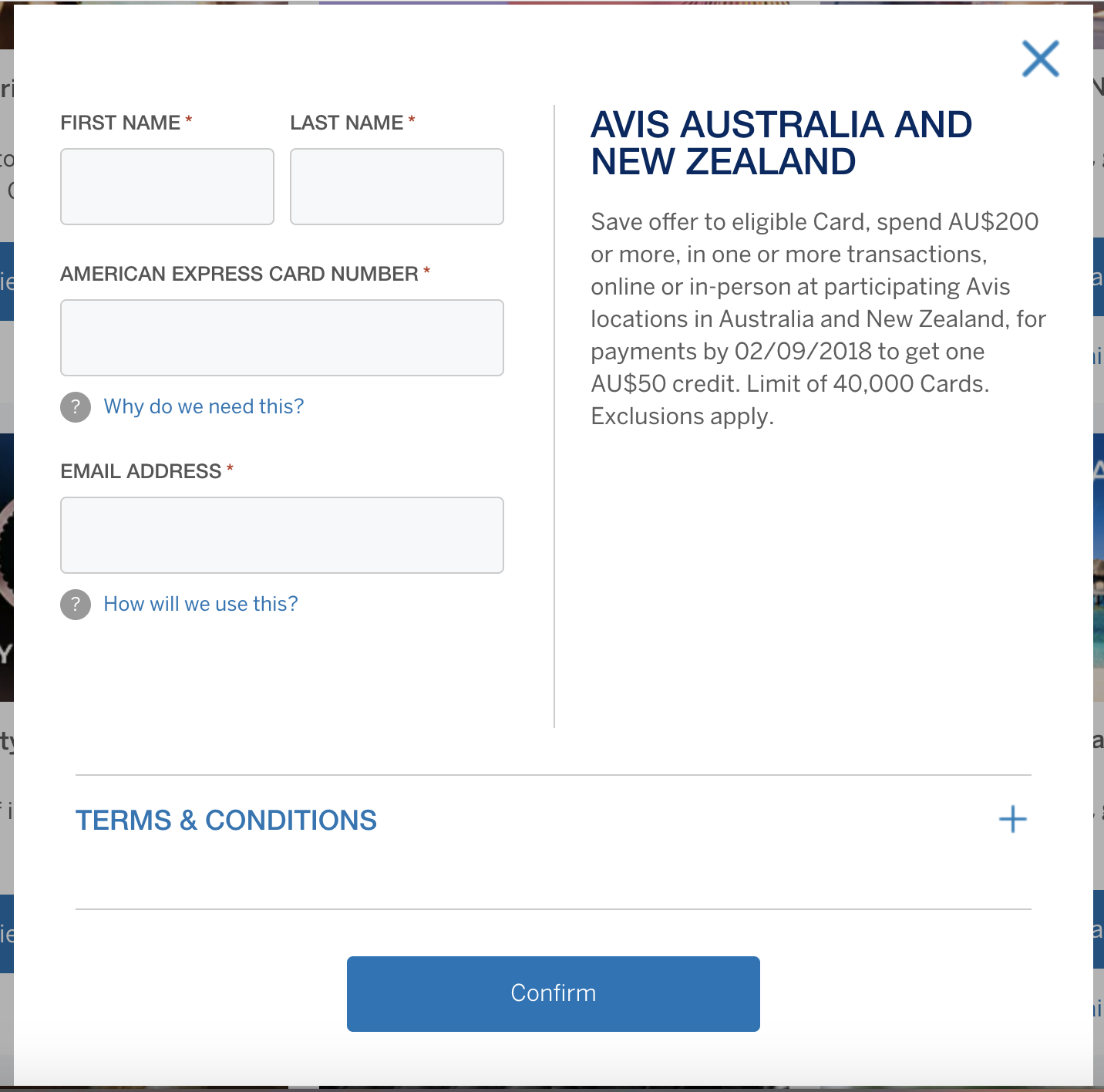

You can also manually register your card for any eligible offer found in Amex Connect. Here’s how to do it:

- Visit the Amex Connect website

- Click ‘Save to Card’ on an offer you want to enrol in

- Enter your first and last name, Amex card number and email address

- You are now registered for that particular offer. Complete your qualifying spend by the expiry date. If you met all the T&Cs, you’ll get your reward shortly.

In either case, offers are redeemable instantly. It pays to check what new offers are available before heading out to the shops or when purchasing anything online, as the selection is refreshed regularly.

What is Amex Shop Small?

American Express also runs its popular Shop Small campaign once or twice per year. It’s essentially a mega-sized version of Amex Offers, where any American Express Card Member can register for statement credits at small businesses that accept American Express.

The latest Shop Small promotion offered a $5 credit on your account each time you spend $10 or more at up to ten different participating small businesses per card.

Summing up

American Express continues to try and innovate for the consumer, and with Amex Offers and Amex Connect they are providing an increasing number of deals to their customers.

Keeping an eye on the Offers section of the mobile app is an easy way to see where you can score some discounts in the form of statement credits. But the usual rules of discount hunting apply — don’t go overboard and spend more than you would have done anyway just because there’s a deal!

Frequently asked questions

If you have an Amex-issued card, you will find the offers in your account or on the mobile app.

American Express does not typically waive annual fees. You should contact Amex for more information or to put in a request.

Apart from these promotions such as ‘Shop Small’, many American Express cards come with other benefits such as bonus points signups and lounge access passes.

Supplementary images courtesy American Express and frequent flyer partners.

Worse, I had travel credits that was refunded to me due to cancelled flights so I have double the amount of credits to spend.

Information regarding Amex Travel credits can be found at https://www.americanexpress.com/au/customer-service/coronavirus/

You may already know but Amex changed its T&Cs since October 2017 (May 2019?) so that you only get complimentary Qantas lounge invitations if you buy directly from Qantas.com.au. This means that if you buy thru Amex Travel (e.g. to claim your $450 flight credit) you will NOT be eligible for a lounge invitation. Perhaps Amex Travel should put a big warning on their site that you may be better off booking with qantas.com.au than with them.

Just a little point hack tip for the shop small and offers and why they are awesome! Offers actually apply per card you register not per account so it is applicable to supplementary cards too that have the offer in the offer section. So in our case my wife and I have an AMEX each and are supplementary holders on each others card which meant in the shop small promo, we had 4 cards with 10 places each. So we actually got $400 worth of credits! Must admit we ate out more than we normally do that month but oh it was worth it!

Also for a Harvey Norman offer they had spend $300 get $100 credit, we purchased 2 x $600 ish items, paid $300 deposit on one card and then balance on delivery on the other card = $400 off $1200 worth of stuff that was already discounted and further reduced because we paid cash (not interest free)

WINNING!!!!

Is this because the number of offers available have already been activated by others and the allocation is exhausted? Or, do different card members receive different offers?

“We’re sorry, the Connect Login/Sign up functionality is currently unavailable. We are working to get this fixed as soon as we can. Thank you for your patience, we apologise for any inconvenience. If you have any other Connect enquiries please contact us using the contact us link.”

Seems to be some teething issues…

Seems to be an issue with bank issued cards?