CommBank Awards: last chance to transfer points to international partners

If you've been eyeing rewards with Aeroplan, Cathay, KrisFlyer and others, act fast.

What we'll be covering

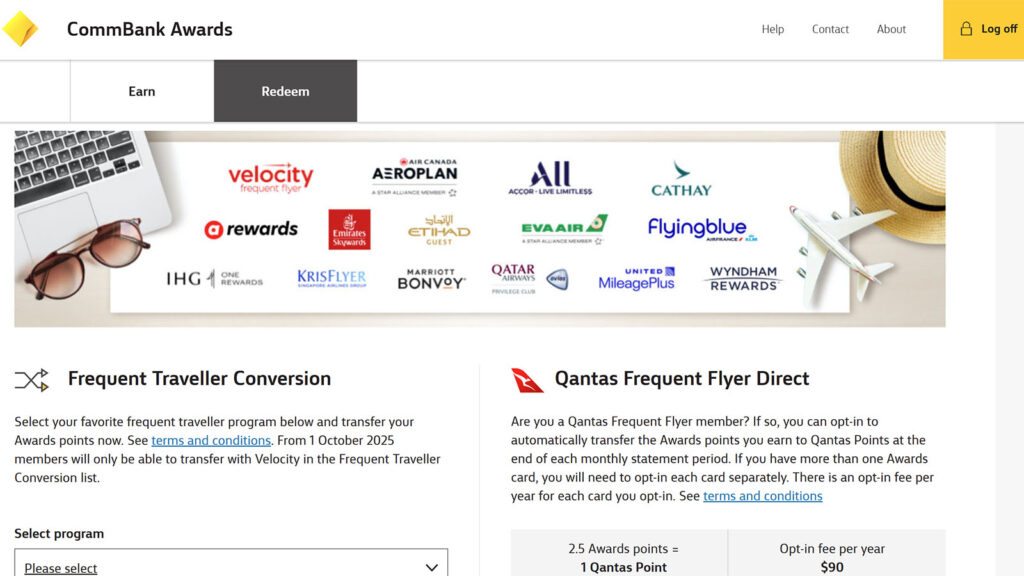

If you’re sitting on a pile of CommBank Awards points, there’s a looming deadline to be aware of. That’s 1 October 2025 – which is when CBA is scrapping credit card points transfers to all of its international airline and hotel partners. But there’s still time to act, and get any spare CommBank Awards points converted to your preferred program.

If you haven’t heard the news, it’s quite drastic. CBA is removing 14 transfer partners from CommBank Awards – the loyalty program attached to the bank’s points-earning credit cards. This means that it’ll no longer be possible to convert CommBank Awards points across to programs like Air France/KLM Flying Blue, Cathay Asia Miles, Emirates Skywards, Etihad Guest, Singapore Airlines KrisFlyer, Qatar Airways Privilege Club and more.

So, what can you do? These partners all remain available for transfers prior to 1 October 2025. So, if you convert CBA points to these partners during the month of September, you can still get them into the program you’d hoped to use. But from October, manual transfers will only be available with one program – Virgin Australia’s Velocity Frequent Flyer.

The only alternative on the airline front is to opt-in to ‘Qantas Frequent Flyer Direct’, at a $90 annual charge. That’s over and above any monthly or annual fees you’re already paying for the CBA credit card.

Now is the time to decide your next move. Do you keep your points in CommBank Awards and just convert them to Velocity later? Do you shift everything into a specific overseas frequent flyer account, given that option won’t be there from October? Or do you scatter your points between several programs, to help with your next trip?

Ultimately, it’s your call – and there’s no right or wrong answer. But if your eyes are set on points-based bookings with international partner programs, it’s time to decide and take action. If you don’t, you’ll miss the opportunity to get any CommBank Awards points over to CBA’s current array of airline and hotel partners.

American Express Velocity Platinum

Which CommBank Awards points transfer options are disappearing?

CBA customers with credit cards attached to CommBank Awards will bid farewell to the points transfer partners below from 1 October 2025. We’ve also indicated the transfer rates at which conversions can currently be made until the end of September.

| Partner program | Transfer rate from CommBank Awards |

| Accor Live Limitless | 5:1 |

| AirAsia Rewards | 2.5:1 |

| Air Canada Aeroplan | 4:1 |

| Air France/KLM Flying Blue | 2.5:1 |

| Cathay (Asia Miles) | 3.5:1 |

| Emirates Skywards | 5:1 |

| Etihad Guest | 3:1 |

| EVA Air Infinity MileageLands | 3:1 |

| IHG One Rewards | 2.5:1 |

| Marriott Bonvoy | 3:1 |

| Qatar Airways Privilege Club | 3.5:1 |

| Singapore Airlines KrisFlyer | 3:1 |

| United MileagePlus | 3.5:1 |

| Wyndham Rewards | 3:1 |

From 1 October, it’ll only be possible to convert CommBank Awards points into Velocity Points. For most cardholders, this uses a 2:1 conversion rate. Alternatively, for those opted in for Qantas Frequent Flyer Direct ($90 p.a.), CBA points are converted to Qantas automatically at a 2.5:1 rate after each credit card statement is generated.

CBA is also axing the ability to spend CommBank Awards points directly with Flight Centre, effective from the same date. Points redemptions at CBA’s Awards eShop will also cease, and you won’t be able to convert CommBank Awards points to charity from October, either.

ANZ Rewards Black credit card

How you could redeem CommBank Awards points

Before racing into action, consider whether there’s a need to race at all. If you’ve already opted in for Qantas Points, or plan to do this in the future, nothing on that front is changing. Similarly, transfers of CommBank Awards points to Velocity Frequent Flyer remain available going forward. Based on the bank’s current announcements, the conversion rate applicable to Velocity also isn’t one of the known changes in October.

In other words, if your usual approach with CommBank Awards has your points ending up with Qantas or Velocity, you can relax. (Take a deep breath, and go about your day!) But if you’re a savvy frequent flyer and prefer to earn points or miles directly with airlines based overseas, this is your warning.

With so many transfer partners departing from CommBank Awards, we can’t go through the merits of every program. If you’re already using some of CBA’s more obscure international partners, it’s fair to say, you probably know what you’re doing already. But if you’d like some inspiration, here are five international frequent flyer programs that you might consider transferring your CommBank Awards points to before it’s too late – and why.

1. Air France/KLM Flying Blue

- Conversion rate: 2.5 CommBank Awards points = 1 Flying Blue mile

- Best for: SkyTeam travel, and Qantas domestic flights

It’s a shame to see Flying Blue disappearing from Australia’s credit card landscape. CommBank Awards is the program’s only credit card points transfer partner Down Under. On the one hand, it’s always made Flying Blue a powerful and compelling choice for CommBank Awards transfers, because there’s less competition for those same seats.

For instance, Flying Blue members can book reward flights on carriers like China Airlines, Garuda Indonesia and Vietnam Airlines. These SkyTeam airlines release a fair amount of reward seats to SkyTeam frequent flyers – such as those with Flying Blue miles to spend. You can also travel on China Eastern, Delta, Korean Air and XiamenAir on direct routes from Australia.

Further abroad, secure reward flights on airlines like SAS, Saudia, Virgin Atlantic, and of course, Air France and KLM. Sure, you might also be able to book Air France and KLM reward flights using Qantas Points. But quite often, the reward rates can be lower for Flying Blue members – and with less to pay in carrier charges. Wink. Using Flying Blue miles for Qantas domestic flights can also present great value, with one-way flights starting at just 5,000 Flying Blue miles.

Flying Blue’s mileage expiry rules can be a little complex. But in short, as long as you take a qualifying flight at least once every 24 months, your balance of miles won’t expire. Qualifying flights don’t include Qantas, but do include all SkyTeam partners and many others. To keep things simple, plan to use your Flying Blue miles within two years of earning, and you won’t have any problems.

2. Cathay Pacific (Asia Miles)

- Conversion rate: 3.5 CommBank Awards points = 1 Asia Mile

- Best for: Cathay Pacific premium cabins to Hong Kong and beyond

A more mainstream international choice for your CommBank Awards points is to convert into Asia Miles with Cathay Pacific. Members of Asia Miles have a much better chance at securing reward flights on Cathay Pacific’s own flights. Especially so in Premium Economy and Business Class.

It’s quite common to see reward flights open for booking to Cathay members that aren’t otherwise visible to members of Cathay Pacific’s partner frequent flyer programs. This means that Qantas Frequent Flyer might show no reward seats available on a particular Cathay Pacific flight, which members of Cathay may nonetheless be able to secure using Asia Miles.

But wait, there’s more! Cathay Pacific is offering 10% bonus Asia Miles on eligible transfers until 30 September. For this offer, you’ll need to register before you transfer your points to qualify for the bonus. As with Flying Blue, you can browse reward seat availability online before converting CommBank Awards points. But note that the 10% bonus may appear a few months down the track, so plan accordingly.

Asia Miles have an 18-month activity-based expiry period. That means, as long as you earn or spend Asia Miles at least once every 18 months, your full balance of Asia Miles will never expire. (It’s the same approach as used by Qantas Frequent Flyer).

American Express Explorer Credit Card

3. Qatar Airways Privilege Club

- Conversion rate: 3.5 CommBank Awards points = 1 Avios

- Best for: Business Class to Europe, and British Airways transfers

While the conversion rate from CommBank Awards isn’t as strong as some other partners, Qatar Airways Privilege Club is still worth a look. That’s because the program offers Business Class reward seats on Qatar Airways from just 90,000 Avios from Australia to Europe, one-way. Sure, these seats can be a little hard to find, but if you plan ahead and search regularly, you might just find one.

Another benefit of Privilege Club is that its points currency is Avios – the same as British Airways. Thanks to a partnership between Qatar and BA, this allows you to transfer your Qatar Avios onwards to British Airways at a 1:1 rate. (And, any BA Avios you might have, into Qatar – also at a 1:1 rate). This means that you could ultimately get your CommBank Awards points into Avios with The British Airways Club.

Why do that? BA has some great-value redemptions on its own flights. Particularly, its ‘fifth freedom’ service between Sydney and Singapore, which you can book without continuing to London. The BA Club also has competitive redemption rates on Qantas domestic flights – particularly in Business Class. While it’s fair to acknowledge that Qatar Airways Privilege Club can book reward seats on Virgin Australia, if that’s your ultimate goal, it may make more sense to convert from CBA to Velocity at the sharper 2:1 rate.

When contained in a Qatar Airways Privilege Club account, Avios have a rolling 36-month expiry. Provided that Avios are earned or redeemed at least once every 36 months, the account’s full Avios balance is preserved.

American Express Platinum Card

4. Singapore Airlines KrisFlyer

- Conversion rate: 3 CommBank Awards points = 1 KrisFlyer mile

- Best for: Singapore Airlines Premium Economy, First Class and Suites

In what’s generally the most popular program in Australia for Star Alliance flights, Singapore Airlines KrisFlyer has quite a following. CBA’s 3:1 conversion rate mirrors that used by most others in the credit card space, so this option is worth a look.

KrisFlyer wins for those hoping to book First Class or Suites on Singapore Airlines. That’s because these reward seats aren’t otherwise made available to most partner airline programs. KrisFlyer miles are also a great way to book Singapore Airlines Premium Economy, as this cabin also usually isn’t bookable by partner programs. (Velocity Frequent Flyer is the exception, although carrier charges apply, which aren’t payable through KrisFlyer).

Singapore Airlines also releases a good quantity of Business Class reward seats for KrisFlyer members. But check whether you could book the same flights through Velocity instead, to avail of Velocity’s stronger points conversion rate from CommBank Awards.

Be aware that KrisFlyer is tweaking its redemption rates for new bookings made from 1 November 2025. This applies even where you convert your CommBank Awards points to KrisFlyer in September – so act fast to get the best value. For instance, Sydney-Singapore increases from 68,500 KrisFlyer miles for a one-way Business Class ticket to 72,000 KrisFlyer miles. KrisFlyer miles also have a hard 36-month expiry date, calculated from the month in which they’re earned.

If you’re on the fence, remember that you can still convert points directly from Velocity to KrisFlyer. And you’ll still be able to convert to Velocity from CommBank Awards. Hint hint. It’s just slightly less rewarding than the current, direct conversion option. At the 3:1 rate from CBA to KrisFlyer, 12,000 CommBank Awards points is worth 4,000 KrisFlyer miles. Converted to Velocity, those same 12,000 CBA points fetch 6,000 Velocity Points. And from there, converting to KrisFlyer at a 1.55:1 rate nets approximately 3,870 KrisFlyer miles. That’s quite similar to the current direct transfer option from CBA to KrisFlyer.

Westpac Altitude Rewards Black

5. Air Canada Aeroplan

- Conversion rate: 4 CommBank Awards points = 1 Aeroplan point

- Best for: Business Class to Asia and within Europe

Look, the transfer rate from CommBank Awards points isn’t great. But it can still make sense. You know that Sydney-Singapore Business Class flight we were discussing? To book that with KrisFlyer, you’d currently need 205,500 CBA points to fetch the 68,500 KrisFlyer miles you’d need, via a 3:1 conversion to KrisFlyer. But with Aeroplan, that same seat could cost you only 180,000 CommBank Awards points instead.

That’s because Aeroplan only charges 45,000 points for a one-way Business Class flight from Australia to Southeast Asia. And Aeroplan has access to Business Class reward flights on Singapore Airlines’ premium aircraft, which are often restricted from other partners. Translation: convert 180,000 CommBank Awards points to Aeroplan, and you have the 45,000 Aeroplan points needed to get to Singapore. The conversion rate is worse, but the redemption cost is lower, so you come out ahead.

Keep in mind that you can’t book Singapore Airlines Premium Economy, First Class or Suites through Aeroplan. Also, as a general tip, consider whether it’s also possible to book the same Singapore Airlines flight through Velocity. Depending on the redemption rate for the route you want, the numbers could be even better than via Aeroplan. But now, you have another trick up your sleeve.

Aeroplan is also great value for short Business Class flights within Europe. Just 15,000 Aeroplan points can be all it takes on some airlines and routes – on which KrisFlyer would require more than twice as many miles. It pays to shop around: including when it comes to points programs!

Honourable mention: Accor Live Limitless (ALL)

- Conversion rate: 5 CommBank Awards points = 1 ALL Reward point

- Best for: Hotel accommodation with booking flexibility

If you’re all set for flights, consider shipping your CommBank Awards points over to Accor Live Limitless. That’s the loyalty program of Accor, encompassing hotel brands such as Sofitel, Fairmont, Raffles, Swissotel, Pullman, Novotel, Mercure, Mantra and more.

Here’s the drill. Accor doesn’t have ‘reward rooms’ in the way that airlines have ‘reward seats’. Instead, its points offer a set value towards paid room bookings across its portfolio of hotels. For every 2,000 ALL Reward points, you can save €40 off your accommodation bill. Based on current exchange rates, that’s around AU$71. And, with a 5:1 conversion rate from CommBank Awards to ALL, 10,000 CBA points gets you 2,000 ALL Reward points. In other words, 10,000 CommBank points is worth a ~$71 discount on your hotel bill.

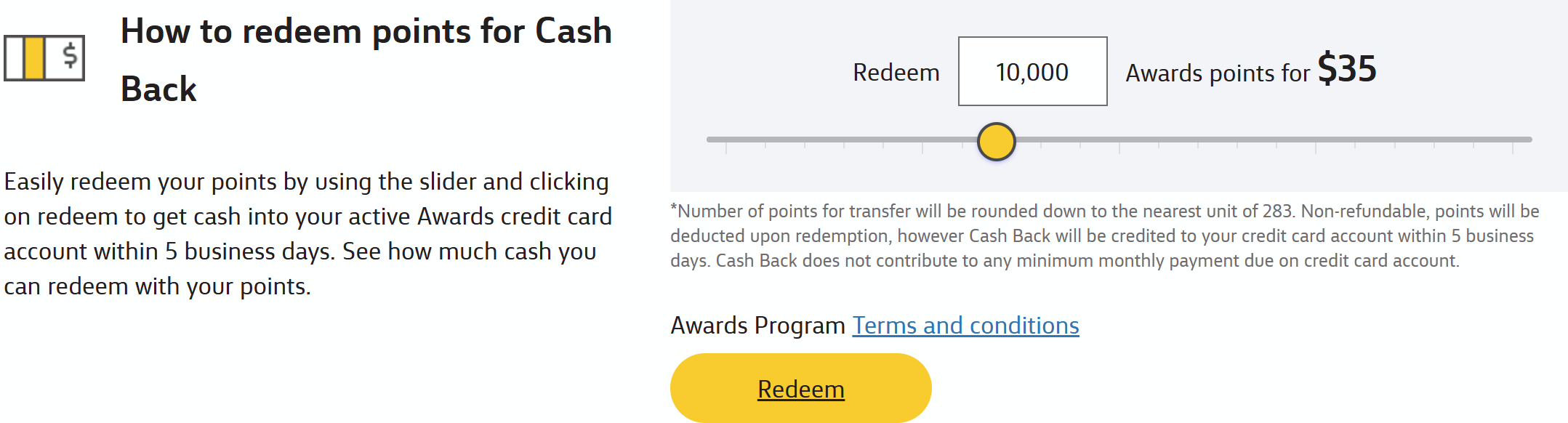

Now, if you were to redeem your CommBank Awards points directly to help pay for charges on your credit card, 10,000 points would only get you $35 through the bank’s own program.

So if you’re going to stay in a hotel anyway, you might as well book via Accor Live Limitless and get twice as much value from the same starting balance of CommBank Awards points.

Also read: CBA guts credit card Awards program transfer partners

Point Hacks may receive a commission where a customer applies for a credit card linked from this article.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

Community