When travelling overseas, foreign currency is one of the most important things to keep track of. Qantas Travel Money makes this easier, being a pre-paid debit card that you can reload. Happily, it also doubles as your Qantas Frequent Flyer membership card!

If you typically use your points-earning credit card for domestic and overseas spending, the Qantas Travel Money card won’t be too useful. But it could be great for those who can’t or don’t want to get a credit card – the minimum age is just 16. It might also appeal to travellers who’d rather lock in an exchange rate before travelling.

As a product with no signup or recurring fees, the card’s exchange rates aren’t the most competitive in the market. In fact, having a mark-up on exchange rates is one of the ways you indirectly pay for the service.

How does the Qantas Travel Money card work?

Qantas Travel Money is a reloadable pre-paid debit card. You load money onto it before travel, which can remain as Australian dollars or be converted into some of the 10 supported foreign currencies. It’s also your Qantas Frequent Flyer membership card, so you can use it to fast-track check-in at the airport, for example.

Your stored foreign currencies can be converted on the go. This means you can load your AUD wallet now and exchange it to other currencies whenever it suits you, via the app or website. Otherwise, you can add to your foreign currency wallet straight from AUD at the time of loading to lock in the exchange rate.

Qantas Travel Money card funds remain separate from your bank account. If you lose your card, nobody would be able to access any of your other bank funds.

Card Details

| Card | Qantas Travel Money |

| Card type | Prepaid debit card |

| Loyalty Program | Qantas Frequent Flyer |

| Points earned on eligible transactions | 0.25 point per $ on domestic spend 1.5 point per $ on overseas spend |

| Load fee | No load fee via bank transfer or BPAY; 0.5% load fee from bank debit card |

| International ATM withdrawal fee | Varies by currency |

| Currency conversion fee | No fee |

| Annual fee | $0 p.a. |

The following transactions won’t earn any Qantas Points:

- ATM withdrawals and quasi-cash transactions.

- Fees and charges.

- Account adjustments and reversed transactions.

- Gambling transactions and adult entertainment.

- Government-related transactions, including to the ATO.

There are also limits on how you use the Qantas Travel Money card, such as a minimum load of AU$50 per transaction and a maximum of AU$3,000 ATM withdrawals every 24 hours. See the Qantas Travel Money card website for more details on limits.

How do I use the Qantas Travel Money card?

Spending is easy – just use the card at the checkout or ATM as you normally would in Australia. It works wherever Mastercard is accepted, which is practically everywhere.

If you have funds loaded in that same currency, your purchase or withdrawal will automatically be deducted from that balance. Otherwise, the funds will be converted out of other currency balances in an order of your choice. In the screenshot below, the order is AUD first, then Yen.

The same occurs when you spend in a currency for which you can’t load a specific pre-paid balance. In other words, an ‘unsupported currency’. That’s not to say you can’t make transactions in an ‘unsupported currency’. It’s just that you can’t pre-load a balance in that currency to secure your exchange rate.

Example of unsupported currencies

For example, let’s say you have AU$20 and ¥900 Japanese Yen on your card at the end of a holiday. While stopping over in Malaysia on the way home, you buy some duty-free for 84 MYR (about AU$28). Since Malaysian Ringgit isn’t a supported currency, here is what could happen (numbers have been rounded for clarity):

- 20 AUD is converted to ~59 MYR.

- ¥809 JPY is converted to ~25 MYR.

After the transaction, you would be left with AU$0 and ¥91 JPY remaining, as in the screenshot above. While the exchange rates used aren’t the most competitive, Qantas Travel Money doesn’t charge additional currency conversion fees.

When you arrive back home, you can just leave the funds on the card with no inactivity fees, or cash out to AUD at the daily exchange rate.

How to load cash onto the Qantas Travel Money card

- Simply log in to your Qantas Travel Money card through the website or app.

- Navigate to the menu to load funds.

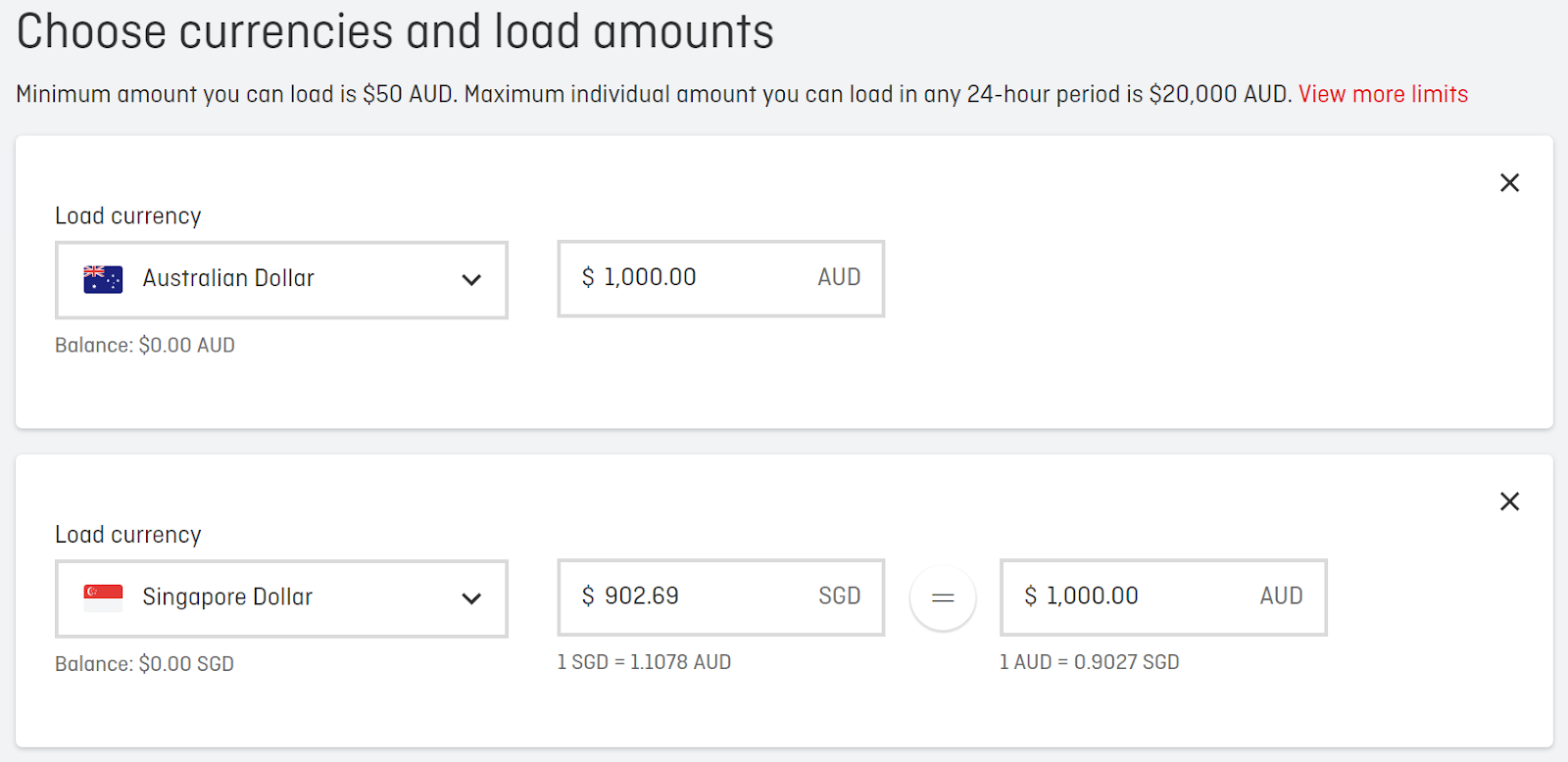

- Select which currencies you‘d like to load. Don’t forget the limits of $50 AUD minimum and $20,000 AUD maximum within any 24-hour period. Conveniently, you can mix and match currencies.

For example, let’s say you’re going on a trip to Singapore and Malaysia. SGD is supported on the Qantas Travel Money card, so you can load into that currency directly. Malaysia Ringgit is not supported, so it’s best to load some funds into AUD as well, which will be used for those purchases.

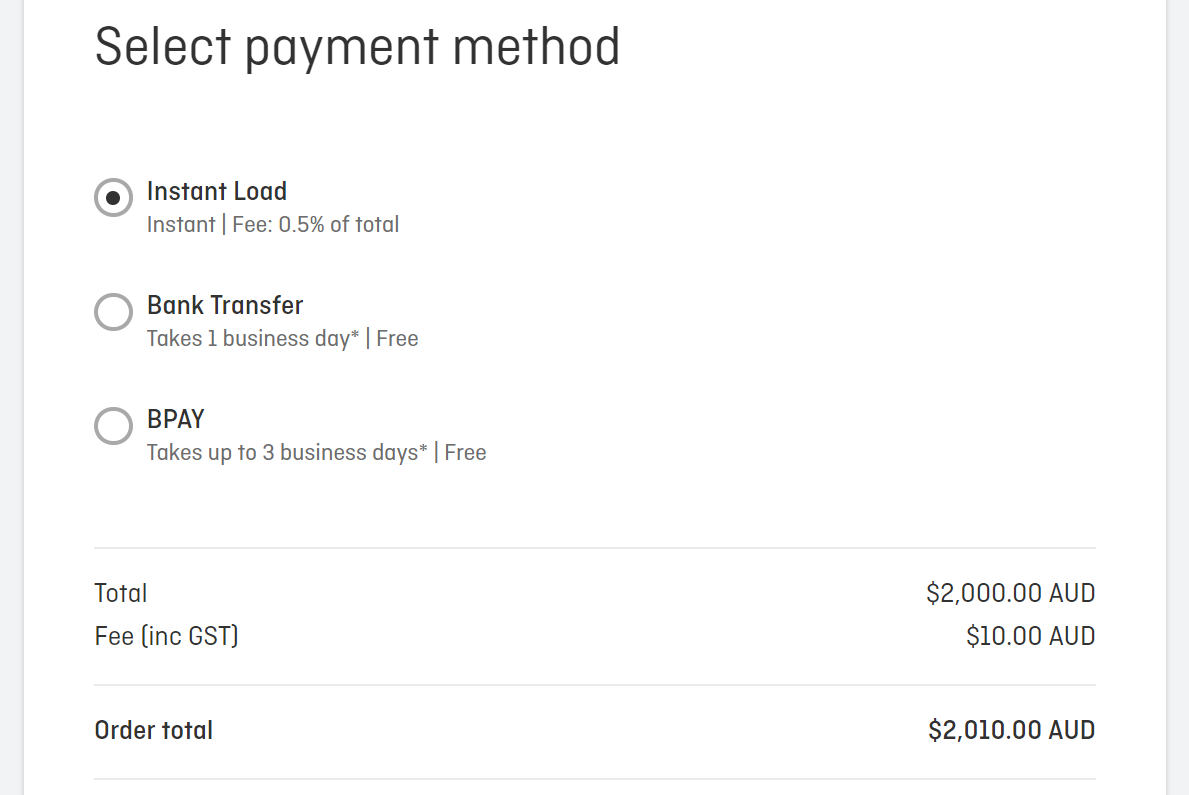

If you need the funds straight away through the debit card, there is a 0.5% fee. Otherwise, bank transfers and BPAY are fee-free.

How to get a Qantas Travel Money card

It’s very easy to get a Qantas Travel Money card for free. You just need to be older than 16 and have a residential address in Australia.

But if you’re already a Qantas Frequent Flyer member, check the back of your membership card. It might already have Qantas Travel Money there, which means you just need to activate it online. Otherwise, log in to Qantas, go to ‘Profile’ and ‘Request a membership card’.

If you‘re not a Qantas Frequent Flyer, head to this link to sign-up. You’ll get the $99.50 joining fee waived.

Read our full comparison of pre-paid travel cards here.

How do I earn points in Australia?

Qantas Travel Money earns 1 Qantas Frequent Flyer point for every $4 spent on eligible transactions. That’s equivalent to 0.25 Qantas Points per dollar spent.

Ineligible transactions cover all types of government transactions including – but not limited to – the ATO. This is in addition to cash-equivalent transactions, gambling and adult entertainment, which don’t earn points. Refer to the Qantas Money website for the full details.

How do I earn points overseas?

On the flip side, Qantas Travel Money earns you 1.5 Qantas Points per AU$1 spent on eligible foreign currency transactions.

Qantas Travel Money also often suggests you lock in your exchange rate now by converting everything over to the foreign currency you need. Be aware though that this approach may or may not work in your favour depending on subsequent exchange rate movements.

If our dollar falls, great – you’ve saved some money. But if the dollar goes up, you’ve just lost out. It depends on how much certainty you prefer.

Summing up

Over the years, Qantas Travel Money has provoked some pretty extreme responses. Some people love it, and others not so much. It is very convenient though, with every Qantas Frequent Flyer cardholder having access to the product through their membership card.

As with any financial product, it’s well worth comparing against other foreign exchange providers before you decide to jump aboard. You also won’t earn many Qantas Points when using the card in Australia, but for some, it could be a handy little points earner.

At least you can’t argue with free. The fact the card is available to use with no upfront fee means there is little risk in trying it out and seeing if it has some use to you. And when there’s a decent bonus points offer, it can certainly sweeten the deal.

Have you used Qantas Travel Money before? What was your experience with it?

Frequently Asked Questions

Qantas Travel Money (formerly Qantas Cash) is a prepaid, reloadable debit Mastercard that supports 10 foreign currencies and can be used around the world. It’s free, and part of your Qantas Frequent Flyer membership card.

Absolutely nothing! Qantas Cash was rebranded as Qantas Travel Money.

The Qantas Travel Money card has features designed to be useful to people travelling internationally or spending online in international currencies. However, you should take note of any fees involved and compare exchange rates with other providers to ensure you are getting a good deal.

Qantas Travel Money is a prepaid reloadable card protected by Mastercard. If you lose the card, funds can be locked and it won’t affect your other bank accounts. It faces the same risks as any other debit or credit card, so be sure to keep your card safe when travelling and never reveal your PIN.

Yes, you are able to withdraw cash from the Qantas Travel Money card. If the target currency is one you already have loaded on the card, only the ATM fee will apply. If not, funds will be converted from your existing currency wallets and fees may apply.

Qantas Travel Money is issued by EML Payment Solutions Limited (‘EML’) ABN 30 131 436 532, AFSL 404131 in arrangement with Mastercard Prepaid Management Services Australia.

All imagery courtesy of Qantas Money.

Its now August 23 and I’m still chasing the bonus points which I haven’t received despite many emails and calls and getting told it will be sorted as they pass you between Qantas FF, Qantas Money Cards, and the Promoter.

It seems they don’t honor the bonus points and i’m not the only one who has complained.

eg Qantas gave me $us 658 which was $us27 less per $au1000, and $cad844.52 per $au1000 which was $62 less per $au 1000 ( when comparing with ING todays rates)

. Also ATM s all charged $4-5 when with drawing cash. limited countries to use it too..

But on balance would probably use it again as there so many conditions on other options Suggestions for cards in Turkey please

Ended up using our American Express and Visa cards, which worked absolutely fine at 100% of places.

Luckily we always carry substantial funds across mutiple cards, this Qantas money card is a dud….

however upon returning to Australia I opened the app and the website but could not find my JPY balances anywhere and hence I could not convert it back to Australian dollars , What has happened to the remaining JPY I had in the purse whilst I was in Japan ?

You will need to contact Qantas Money directly, as they have a record of all your transactions and will be able to help you out.

Never again

That’s right, locking in an exchange rate isn’t always positive. It all depends on the FX movement. Using the Qantas TM card for AUD however is never a good idea, as the earn rate is extremely poor at 0.5 points per dollar spent.

At the beginning of a 3 wk USA holiday, our first hotel put an authorization against the card without our permission. They apologized and reversed it straight away but Qantas TM we’re unable to reverse it, leaving $600usd locked in limbo.

To make matters worse, the Qantas TM security system then put a lock on us adding cash via instant load because we tried to use two different cards. Making the card redundant for our travel needs as we were at the end of the trip. No point loading usd if we are back in Aus before it’s on the card.

Called QTM OS help line and they were less then helpful and loved to talk around in circles.

Will be exploring an alternative.

Let me know if you ever receive a reply!

Savannah

With the bonus points when loading foreign currency, is it possible to:

1) load e.g. $20K AUD->USD and get the 20K bonus points (using the Apr17 promo as an example)

2) at a later date transfer USD->AUD (and even make some more on the exchange rate if the timing is right) then back out into an Aust account?