Citi is offering a $750 Luxury Escapes Gift Card when you apply, are approved and spend $7,000 on eligible purchases with your Citi Premier Credit Card within 90 days from approval plus a reduced first year annual fee of $150 (usually $300).

Cardholders can still enjoy $150 annual fee in each subsequent year if they spend $48,000 on eligible purchases in the previous year.

The Citi Premier Credit Card earns up to 2 Citi reward Points per dollar on eligible spend and includes complimentary Priority Pass(TM) membership with two airport lounge visits each year, plus the ability to earn Citi reward Points and redeem them for a statement credit or transfer them to a number of partners

Digging into the benefits of the Citi Premier Credit Card

The Citi Premier Credit Card earns Points in the Citi Rewards program.

Card Details

| Card | Citi Premier credit card |

| Loyalty program | Citi Rewards |

| Citi Rewards earn rate | 2 Citi reward Points per $1 spent on Eligible Transactions online or overseas 1 Citi reward Point per $1 spent on Eligible Transactions everywhere else |

| Points cap | 200,000 Citi reward Points over a 12-month period |

| Minimum credit limit | $10,000 |

| Earns points at ATO | No |

| Travel benefits | Priority PassTM membership and two complimentary airport lounge visits each year |

| Annual fee | $150 for the first year and each subsequent year if you spend $48,000 on eligible purchases or cash advances in the previous year, otherwise $300 p.a. ongoing |

| Overseas transaction fee | 3.40% of the converted amount |

| Included insurances* | International Travel Insurance Domestic Travel Insurance Rental Vehicle Excess Insurance in Australia Purchase Protection Insurance Extended Warranty Insurance (Policy Information Booklet) |

| Mobile wallet | Apple Pay, Google Pay and Samsung Pay |

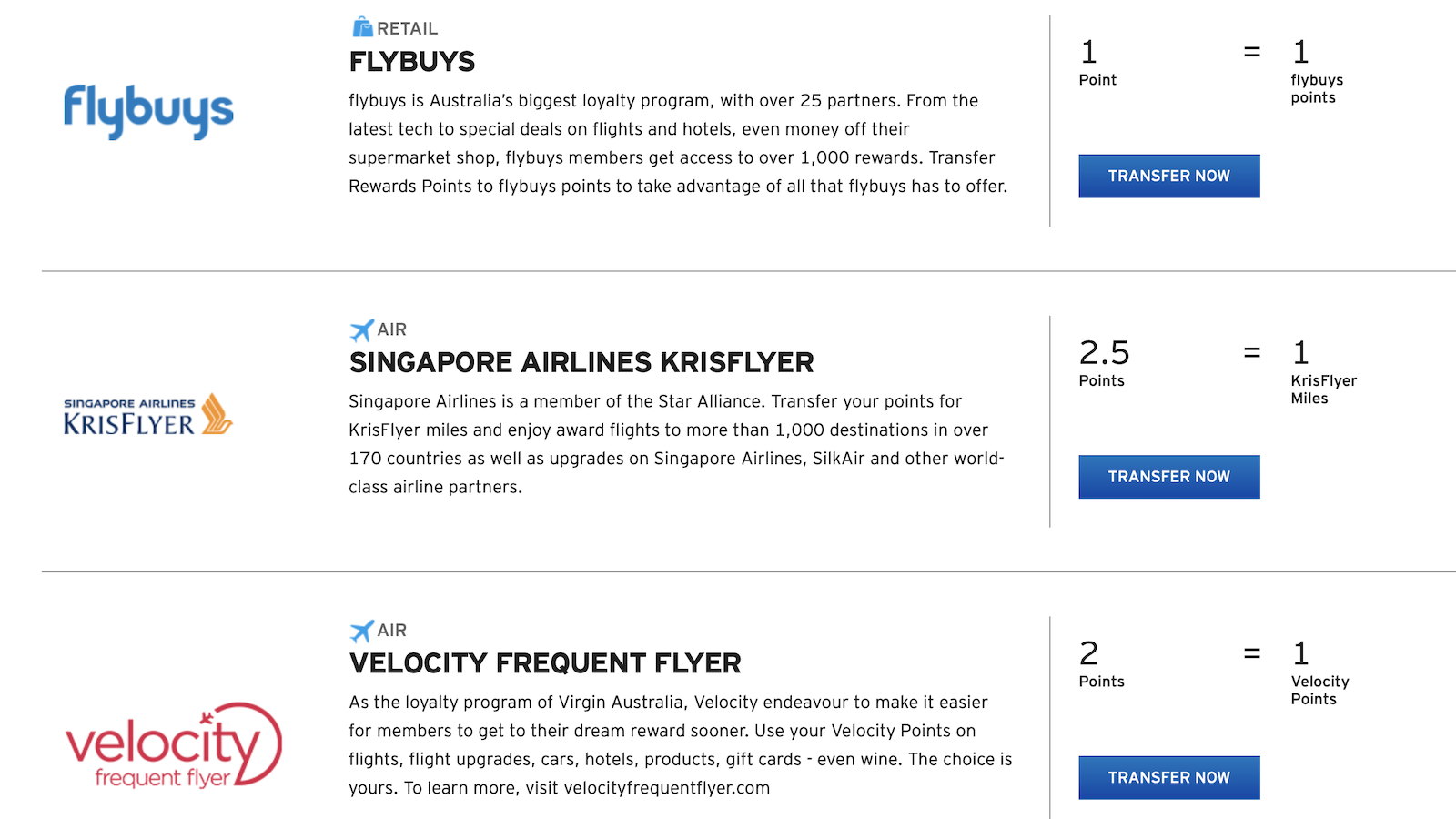

Citi Rewards transfer partners for the Premier Credit Card are low in number but high in quality:

Cardholders can transfer their Citi reward Points at the following rates.

Transferring to Velocity allows cardholders to redeem for flights on Virgin Australia.

Effective Frequent Flyer Program Point Earn Rates

| Frequent Flyer Program | All other eligible spend | Eligible Transactions made online and International Spend |

|---|---|---|

| Qantas Points* | 0.5 point / $ | 1 point / $ |

| Velocity Points | 0.5 point / $ | 1 point / $ |

| KrisFlyer Miles | 0.4 point / $ | 0.8 point / $ |

| * Qantas Points are only earned through the Citi Premier Qantas credit card | ||

The minimum number of Citi reward Points required to make a transfer varies depending on the partner program.

- Velocity Frequent Flyer – Minimum 2,000 points in 1-point increments

- Singapore KrisFlyer – Minimum 20,000 points in 1-point increments

- Flybuys – Minimum 2,000 points in 1-point increments

Any balance less than the minimum is ineligible to be transferred to frequent flyer programs until the minimum threshold is reached.

Priority Pass(TM)

The card also comes with Priority Pass(TM) lounge membership, valued at US$99 per year, and two included airport lounge visits valued at US$35 each.

If you are a cardholder, you will receive a welcome pack from Citi with a Priority Pass(TM) access code soon after receiving your card in the mail. The code then lets you sign up for the relevant membership from Priority Pass(TM).

Insurance

Finally, you’ll also get a range of insurance, including the following:

- Guaranteed Pricing Scheme

- Purchase Cover Insurance

- International Travel Insurance

- Extended Warranty Insurance

- Transit Accident Insurance

- Interstate Flight Inconvenience

As usual, you’ll need to read the PDS and assess if these insurances meet your needs and offer you substantial value.

This guide references some of the benefits of insurance policies provided with this card. Before obtaining this product, you should read the PDS and obtain independent professional advice.

Citi PayAll

Earn Citi reward Points on larger everyday expenses such as rent, taxes, education fees, property management fees, childcare and miscellaneous bills with Citi PayAll. Offers are subject to eligibility and are only available if your account is in good standing.

Apple Pay, Google Pay & Samsung Pay support

Citi cards support Apple Pay, Google Pay & Samsung Pay, meaning you can use this card on your smartphone for easier payments.

Summing up: The Citi Premier Credit Card

The Citi Premier Credit Card is a great option for those looking to earn points into Velocity, KrisFlyer or Flybuys whilst taking advantage of the flexible nature of the Citi Rewards Program.

The Card’s airline and loyalty partners are of a high quality and are among the largest in the Australian market. The Card also comes with additional benefits, such as complimentary Priority Pass(TM) membership and 2 airport lounge visits, making for a more comfortable journey in the future. Also, the ability to turbocharge your Points earned from Citi PayAll is another great feature.

It is also good to see that the Card also comes with many complimentary insurances, which is expected for this level of card.

Overall, this is a Card worth considering for those who like to diversify their Points earn and are looking for a mid-range annual fee card.

Important information

National Australia Bank Limited (ABN 12 004 044 937, AFSL and Australian Credit Licence 230686) (“NAB”) is the credit provider and issuer of Citi branded financial and credit products. NAB has acquired the business relating to these products from Citigroup Pty Ltd (ABN 88 004 325 080, AFSL and Australian Credit Licence 238098) (“Citi”) and has appointed Citi to provide transitional services.

Our/us/we means NAB unless the context otherwise requires it. “Citi”, “Citibank”, “Citigroup”, the Arc design and all similar trade marks and derivations thereof are used temporarily under licence by NAB from Citigroup Inc. and related group entities.

Community