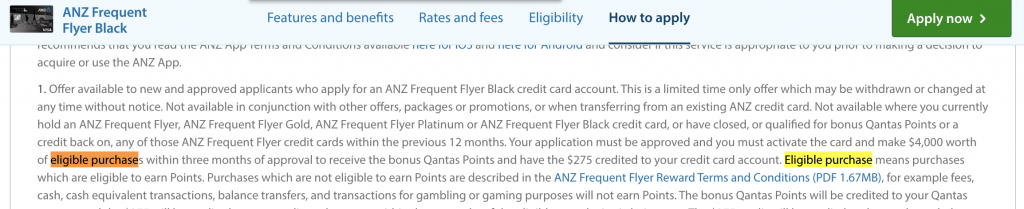

You have just been approved for a new credit card with an attractive sign-up bonus. In order to unlock those points, you need to meet a minimum spend requirement by making ‘eligible purchases’. But what purchases are deemed to be eligible?

In this guide, I look at the general definition of eligible purchases and how to check the exact requirements for your individual card.

What counts as eligible purchases?

Eligible purchases usually include everyday transactions at places like the supermarket, petrol station, doctor’s office, chemist and restaurants. Other examples include spending money on the dry cleaner, public transport, coffee and clothes. However, the definition can vary between cards, banks and financial institutions.

What doesn’t count as eligible purchases?

There are a number of transactions that are generally deemed as ineligible. These tend to include:

- balance transfers

- BPAY transactions

- cash advances

- cash equivalent transactions

- card fees

- gambling or gaming spend

- gift cards

- interest charges

- loan repayments

- refunded transactions

- travellers’ cheques

Most credit cards also do not earn points on bills or insurance or at the Australian Tax Office but there some exceptions.

How to check the definition of eligible purchases for your card

- Go to Google

- Enter the name of your credit card in the search box

- Click on the bank’s page for your credit card

- Scroll down to terms and conditions (or similar)

- Look for the words Eligible purchase (if you can’t find them, use Ctrl+F (Windows) or Command+F (Mac) to search)

- Read the bank’s definition for this card

- Note that each bank and credit card can have different definitions

Summing up

It is important to make sure that you understand which type of transactions will earn you points when using your credit card. Most everyday transactions are counted as eligible purchases. However, things like fees, charges and repayments usually aren’t.

You’ll want to check the exact definition for the credit card that you hold or are looking to apply for. That’s because the definition varies between different. cards, banks and financial institutions

Finally, here are some ideas to help you meet the minimum spend requirement on a credit card.

![Our roundup of credit card offers to know about this month [June 2024]](https://i.pointhacks.com/2017/06/23173719/credit-card-stocksnap-300x171.jpg)

I’ve recently obtained an ANZ Qantas FF Black CC, (as coincidentally shown in your example).

The Terms & Conditions Booklet doesn’t clearly state or define ‘eligible purchase’ but rather, in Clause 23 it discusses ‘Exemptions’. (ie points will not accrue exemptions).The term ‘government fees’ is listed as not accrueing points.

My question is: Are local government rates counted as ‘government fees’?

The only information regarding ‘government fees’ on the ANZ website relates to either Stamp Duties or Banking Fees.

Your advice would be appreciated.

Great website by the way.

Cheers,

Jedd.