HSBC Rewards Plus is your ticket to earning Velocity Points on eligible HSBC credit card spends. But the options get even greater for top-tier Premier cardholders, with Cathay and KrisFlyer added to the mix.

Being a flexible credit card points program, members earn points in HSBC’s own loyalty program first. From HSBC, those points can then be converted into frequent flyer points or exchanged for cash back or gift cards. Here’s the drill.

How does HSBC Rewards Plus work?

HSBC Rewards Plus allows cardholders to earn flexible points on their purchases. These points accrue in the HSBC Rewards Plus program, and can later be redeemed via HSBC, or converted into airline frequent flyer points.

This is distinctly different to how customers earn points via the bank’s better-known Platinum Qantas Card. Rather than earning points with HSBC Rewards Plus, the Qantas-branded card earns points directly with Qantas Frequent Flyer.

HSBC Rewards Plus is instead linked to the bank’s traditional ‘non-Qantas’ rewards cards. This means customers need to choose between earning Qantas Points directly or earning points with HSBC Rewards Plus.

By choosing HSBC Rewards Plus, cardholders can transfer their points across to Virgin Australia Velocity. Eligible Premier cardholders also get the option of converting points to Cathay or to KrisFlyer.

There’s one other option recently added to the mix, and that’s the HSBC Star Alliance Credit Card. It instead accrues points in the brand-new Star Alliance Rewards program.

Read: HSBC unveils Star Alliance credit card in Australia

Which credit cards are linked to HSBC Rewards Plus?

There are two key credit cards attached to the HSBC Rewards Plus program. These are:

- HSBC Platinum Credit Card

- HSBC Premier World Mastercard

Of the two, the HSBC Platinum Credit Card is the easiest to qualify for, with a $6,000 minimum credit limit. Cardholders get two HSBC Rewards Plus points per AU$1 spent overseas, where a 3% foreign transaction fee applies. All other eligible purchases earn one Rewards Plus point per dollar spent. Rewards are capped at 10,000 points per statement period in total.

The HSBC Premier World Mastercard is instead less ‘mass market’. To apply, you’ll first need to be an HSBC Premier member. In Australia, that requires monthly account deposits of at least $9,000, or maintaining a savings balance of at least $150,000.

For those who qualify, there’s no ongoing fee for HSBC Premier membership. There’s also then no annual fee on the HSBC Premier World Mastercard when earning points via HSBC Rewards Plus.

Premier cardholders receive one HSBC Rewards Plus point per dollar spent in Australia and 1.5 Rewards Plus points per AU$1 spent overseas, where a reduced 2% international transaction fee applies.

On paper, the Premier card appears less rewarding than the Platinum card. And yes, that’s actually true if chasing Velocity Points. But Premier members get the option of converting points to KrisFlyer and Cathay (formerly Asia Miles) at attractive rates, as below.

What are the HSBC Rewards Plus transfer partners?

Once a cardholder has a balance of points with HSBC Rewards Plus, these can be converted into airline frequent flyer points. Here are those options and applicable conversion rates.

| Transfer partner / HSBC credit card | Platinum Credit Card | Premier World Mastercard |

| Cathay (formerly Asia Miles) | – | 2:1 |

| Singapore Airlines KrisFlyer | – | 2:1 |

| Virgin Australia Velocity | 2:1 | 2:1 |

Points can be converted from HSBC Rewards Plus in increments of 5,000 HSBC points. As all partners have a 2:1 conversion rate, that’s a minimum transfer of 2,500 Velocity Points, Cathay miles or KrisFlyer miles.

Given the earning rates on both cards and the conversion rates above, we can also calculate the effective earn rate in frequent flyer points. Here’s how the figures look for HSBC customers across both credit cards above, until the monthly cap is reached.

- On eligible domestic transactions, earn the equivalent of 0.5 Velocity Points per $1 spent via the Platinum Credit Card. With the Premier World Mastercard, it’s 0.5 Velocity Points, 0.5 Cathay miles or 0.5 KrisFlyer miles per dollar spent.

- On international transactions using the Platinum Credit Card, it’s equal to one Velocity Point per AU$1 spent.

- Using the Premier World Mastercard abroad, the rewards are worth 0.75 Velocity Points, 0.75 Cathay miles or 0.75 KrisFlyer miles per AU$1 spent.

Because transfers to HSBC’s airline partners adopt a 2:1 rate, calculating the numbers above is easy. You just take the card’s earning rate in HSBC Rewards Plus points and divide it by the first digit of the conversion rate.

For instance, many transactions earn one HSBC point per dollar spent. You need two of those for every airline frequent flyer point, so you divide that earning rate by two. This gives you our figure – 0.5 actual airline frequent flyer points per dollar spent.

What else can I do with my HSBC Rewards Plus points?

Transferring HSBC Rewards Plus points into airline frequent flyer points usually provides the best value. But if you do want to redeem those points on the ground, HSBC does provide a couple of options.

- Cashback is an easy one, and provides the flexibility to reduce your statement balance regardless of where you’ve transacted. For every 6,000 HSBC Rewards Plus points, you can get $25 cashback on your statement. That makes each HSBC point worth 0.416 cents.

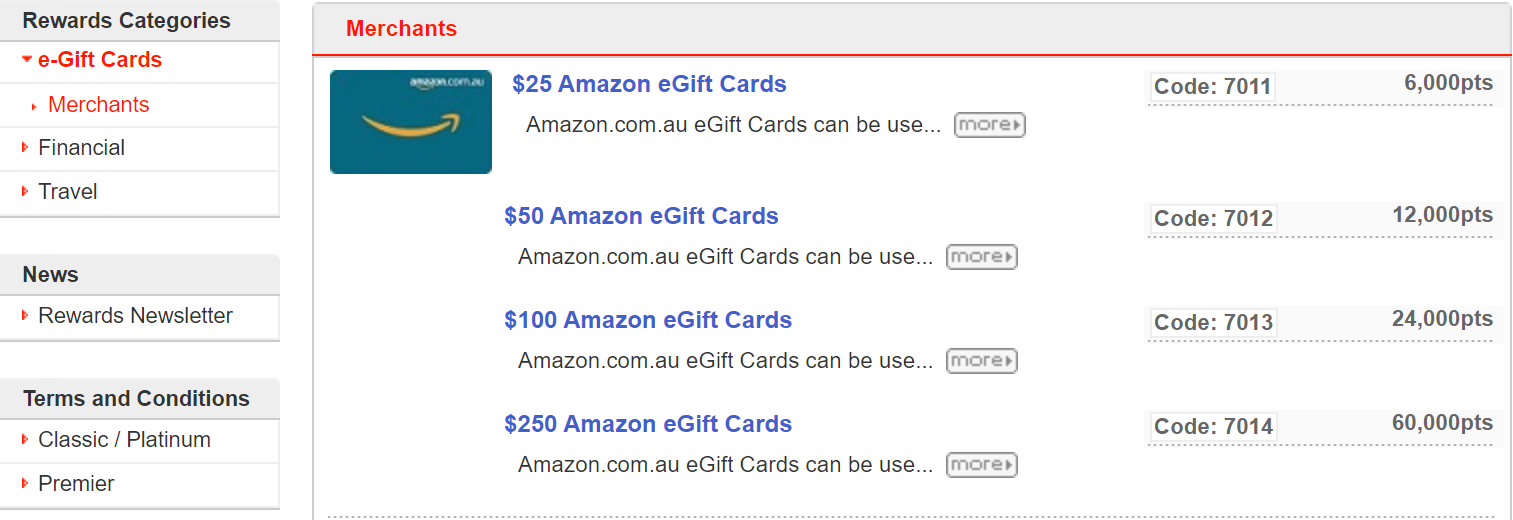

- Gift cards are the other main alternative, and the redemption rate is the same as cashback. For every 6,000 HSBC points, you can get a $25 gift card. Single gift cards are also available in higher-value increments if you have more points to burn. Choose from a range of popular options including Amazon, Apple, David Jones, eBay, Uber, Woolworths and more.

How can I contact HSBC Rewards Plus?

You can call HSBC on 132 152 from Australia for credit card-related queries, including rewards programs. From overseas, that number is +61 2 9005 8511.

As an alternative, visit this page on the HSBC website to communicate with the bank via online chat.

Summing up

HSBC Rewards Plus won’t appeal to everybody – especially those who mainly spend within Australia. Many other cards in the market offer more generous frequent flyer earning rates. On Mastercard or Visa spend, this can often provide up to one airline frequent flyer point per dollar spent.

But HSBC can still provide good value. At the time of writing, the standard HSBC Platinum Credit Card comes with a first-year annual fee of just $29. That’s not to be sniffed at, although that does shift to $129 in the years thereafter.

Things get more interesting for those able to qualify for the HSBC Premier World Mastercard. With no ongoing fee for HSBC Premier membership and no annual fee on the credit card itself, earning points effectively becomes ‘free’ in Australia.

While a 2% foreign transaction fee applies for HSBC Premier cardholders, the ability to convert points into Cathay miles or KrisFlyer miles may be a big enough drawcard to keep customers spending.

Frequently Asked Questions

Redeem your HSBC Rewards Plus points by visiting this landing page and logging in to your account.

The value of an HSBC Rewards Plus point varies greatly depending on how you redeem them. For cashback or gift cards, expect 0.416 cents of value per point. But by transferring to Velocity Points or KrisFlyer miles, each HSBC point takes on a value of at least 0.9 cents, per our in-house points valuations. Each HSBC point becomes worth at least 0.85 cents when transferred to Cathay, in line with those same valuations.

Head to the HSBC credit card comparison page and see if the HSBC Platinum Credit Card or HSBC Premier World Mastercard suit your needs, compared to other cards on the market.

Editorial Note: Opinions expressed in this guide have not been reviewed, approved or otherwise endorsed by HSBC.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

Community