Looking for more Velocity Points? Check out our best Velocity Points-earning credits cards now!

Citi is offering up to 200,000 bonus Citi reward Points plus a discounted first year annual fee of $150 (usually $300 p.a.) for new cardholders of the Citi Premier credit card until 30 April 2024. This is currently equivalent to 100,000 Velocity Points or 80,000 KrisFlyer miles when transferred out of Citi Rewards.

The bonus is only available for new cardholders who are approved for the Citi Premier credit card and is split into two parts. The first 150,000 bonus Citi reward Points are to be received after spending a minimum of $7,000 on eligible purchases in the first 90 days from approval using your new Citi Premier credit card and an additional 50,000 bonus Citi reward Points if you keep your card over 12 months.

Cardholders can still enjoy a $150 annual fee in each subsequent year if they spend $48,000 on eligible purchases in the previous year.

The Citi Premier credit card earns up to 2 Citi reward Points per dollar on eligible spend and includes complimentary Priority PassTM membership with two airport lounge visits each year, plus the ability to earn Citi reward Points and redeem them for a statement credit or transfer them to participating partners.

Digging into the benefits of the Citi Premier credit card

The Citi Premier credit card earns Points in the Citi Rewards program.

Card Details

| Card | Citi Premier credit card |

| Loyalty program | Citi Rewards |

| Citi Rewards earn rate | 2 Citi reward Points per $1 spent on Eligible Transactions online or overseas 1 Citi reward Point per $1 spent on Eligible Transactions everywhere else |

| Points cap | 200,000 Citi reward Points over a 12-month period |

| Minimum credit limit | $10,000 |

| Earns points at ATO | No |

| Travel benefits | Priority PassTM membership and two complimentary airport lounge visits each year |

| Annual fee | $150 for the first year and each subsequent year if you spend $48,000 on eligible purchases or cash advances in the previous year, otherwise $300 p.a. ongoing |

| Overseas transaction fee | 3.40% of the converted amount |

| Included insurances* | International Travel Insurance Domestic Travel Insurance Rental Vehicle Excess Insurance in Australia Purchase Protection Insurance Extended Warranty Insurance (Policy Information Booklet) |

| Mobile wallet | Apple Pay, Google Pay and Samsung Pay |

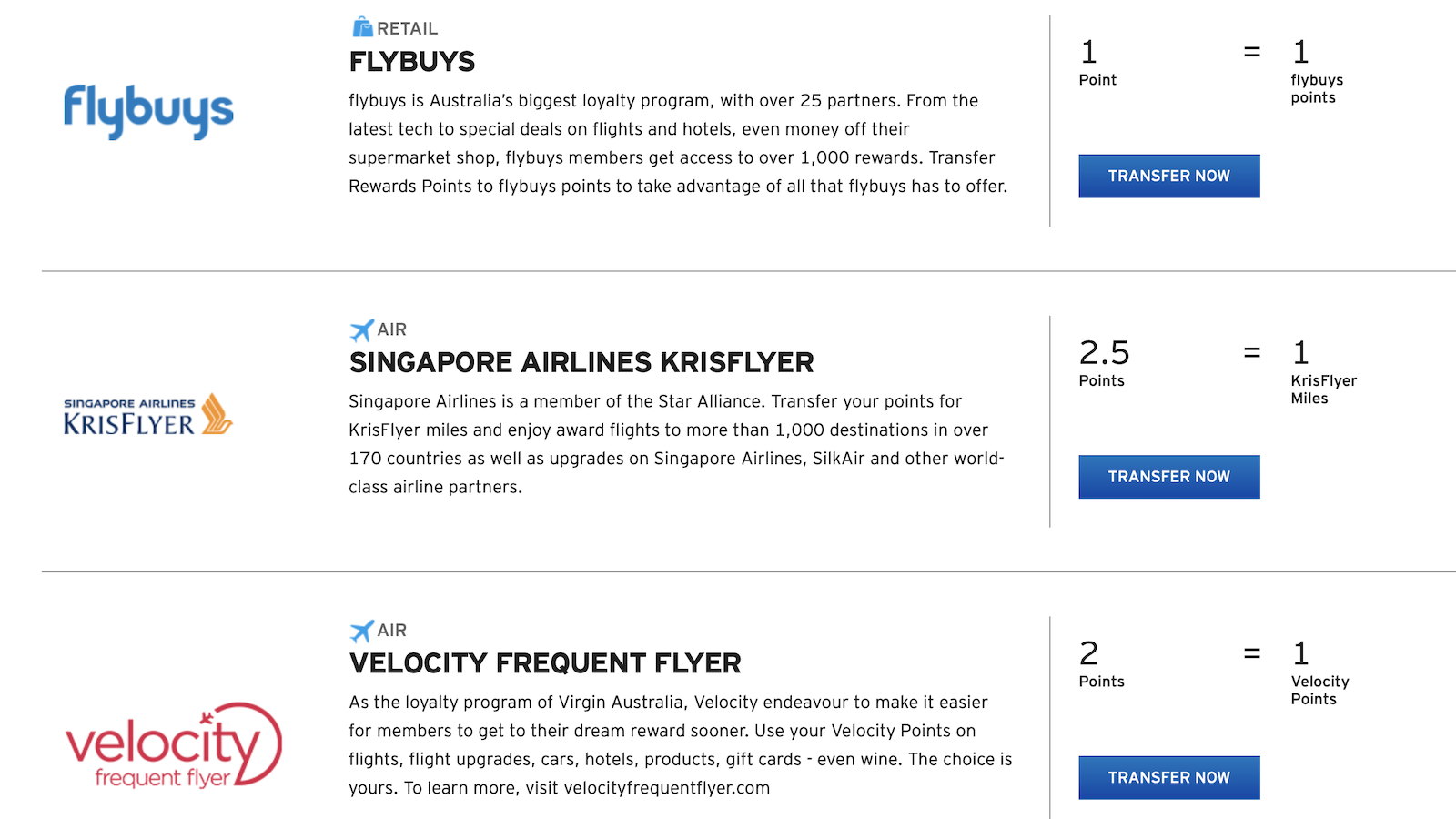

Citi Rewards transfer partners for the Premier credit card are low in number but high in quality:

Cardholders can transfer their Citi reward Points at the following rates.

Transferring to Velocity allows cardholders to redeem for flights on Virgin Australia.

Effective Frequent Flyer Program Point Earn Rates

| Frequent Flyer Program | All other eligible spend | Eligible Transactions made online and International Spend |

|---|---|---|

| Qantas Points* | 0.5 point / $ | 1 point / $ |

| Velocity Points | 0.5 point / $ | 1 point / $ |

| KrisFlyer Miles | 0.4 point / $ | 0.8 point / $ |

| * Qantas Points are only earned through the Citi Premier Qantas credit card | ||

The minimum number of Citi reward Points required to make a transfer varies depending on the partner program.

- Velocity Frequent Flyer – Minimum 2,000 points in 1-point increments

- Singapore KrisFlyer – Minimum 20,000 points in 1-point increments

- Flybuys – Minimum 2,000 points in 1-point increments

Any balance less than the minimum is ineligible to be transferred to frequent flyer programs until the minimum threshold is reached.

Priority PassTM

The card also comes with Priority PassTM airport lounge membership, currently valued at US$99 per year, and two included airport lounge visits currently valued at US$35 each.

Complimentary Insurance*

Finally, you may be eligible for a range of insurances, including the following:

- International Travel Insurance

- Domestic Travel Insurance

- Rental Vehicle Excess Insurance in Australia

- Purchase Protection Insurance

- Extended Warranty Insurance

As per usual, you’ll need to read the Policy Information Booklet to consider the eligibility requirements and assess if these insurances meet your individual needs and offer you substantial value.

This guide references some of the benefits of insurance policies provided with this card. You should read the Policy Information Booklet and obtain independent professional advice before obtaining this product.

Citi PayAll

Earn Citi reward Points on larger everyday expenses such as rent, taxes, education fees, property management fees, childcare and miscellaneous bills with Citi PayAll. Offers are subject to eligibility and are only available if your account is in good standing (for example – your account is not in default, suspended or closed).

Apple Pay, Google Pay & Samsung Pay support

Citi cards support Apple Pay, Google Pay & Samsung Pay, meaning you can use this card on your smartphone for easier payments.

Summing up: the Citi Premier credit card

The Citi Premier credit card’s airline and loyalty partners are of a high quality and are among the largest in the Australian market. The Card also comes with additional benefits, such as complimentary Priority PassTM membership and 2 airport lounge visits and complimentary insurance, making for a more comfortable journey in the future. Also, the ability to turbocharge your Points earned from Citi PayAll is another great feature.

The Card remains to be considered for high volumes of points earn outside of Qantas Frequent Flyer on a Mastercard or Visa so you’ll need to be using the card a lot on online and overseas spend to make the fee worthwhile, also note that points earn is capped at 200,000 Citi reward Points over a 12 month period.

Overall, this is a Card worth considering for those who like to diversify their Points earn and are looking for a mid-range annual fee card.

Complimentary Insurance *

AWP Australia Pty Ltd ABN 52 097 227 177 AFSL 245631 (trading as Allianz Global Assistance) under a binder from the underwriter, Allianz Australia Insurance Limited ABN 15 000 122 850 AFSL 234708 (Allianz) has issued a Complimentary insurance group policy to National Australia Bank Limited (ABN 12 004 044 937, AFSL and Australian Credit Licence 230686) (“NAB”) which allows eligible NAB account holders and cardholders to claim under it as third party beneficiaries by operation of s48 of the Insurance Contracts Act 1984 (Cth).

NAB is the credit provider and issuer of Citi branded credit cards. NAB has acquired the business relating to these products from Citigroup Pty Limited (ABN 88 004 325 080, AFSL and Australian Credit Licence 238098) (“Citi”).

Citi has agreed with NAB to provide transitional services in relation to the transferred business. Any advice on insurance is general advice only and not based on any consideration of your objectives, financial situation or needs.

The terms, conditions, exclusions, limits and applicable sub-limits of the group policy are set out in the Citi Credit Cards Complimentary Insurance Policy Information Booklet which may be amended from time to time. Neither NAB nor Citi nor any of its related corporations guarantee this insurance.

Important information

National Australia Bank Limited (ABN 12 004 044 937, AFSL and Australian Credit Licence 230686) (“NAB”) is the credit provider and issuer of Citi branded financial and credit products. NAB has acquired the business relating to these products from Citigroup Pty Ltd (ABN 88 004 325 080, AFSL and Australian Credit Licence 238098) (“Citi”) and has appointed Citi to provide transitional services.

Our/us/we means NAB unless the context otherwise requires it.

“Citi”, “Citibank”, “Citigroup”, the Arc design and all similar trade marks and derivations thereof are used temporarily under licence by NAB from Citigroup Inc. and related group entities.

I have received bonus rewards points in the past year and am still holding a Citi Prestige car. Am I eligible for the 200,000 bonus Citi Rewards points or 100,000 Qantas points on offer for a new Citi Premier card right now?

From the T&C #1, it doesn’t mention that clients who held a Citi Rewards card in the past 12 months or currently holds a Citi Rewards card will be excluded for the offers. But it’s very rare…

https://www1.citibank.com.au/credit-cards/citi-premier

https://www1.citibank.com.au/credit-cards/citi-premier-qantas

Sorry trying to make sense of this as i’m coming up to 12 months since I last had a citibank card. Given they are owned by NAB is it safe to say i need to wait 18 months in order to get the bonus again? Or Citibank don’t have a set policy as you say?

https://www1.citibank.com.au/credit-cards/citi-premier-qantas

Would love to know how this offer compares to others. Thanks.

Would someone be able to shed some light onto when I will be able to transfer Citibank rewards to velocity points again. The cost to benefit ratio of this card is at an all time low with most of its benefits at the moment unusable. Citibank wont even acknowledge a forward reduced annual fee.

This decision will differ from bank to bank. I suspect that many banks are waiting for the sale of Virgin Australia to be finalised after the second creditor’s meeting on 26 August, but I have no specific communication from Citibank on this.

annual fee is reduced to $195 p.a but you need to pay again after 12 months double that amount in order to keep earning points?

Is there anything that would stop you cancelling after 12 months?

if you did cancel early would that mean you would have only earned half of the 155,000 velocity points available (ie approx 78,000)

Priority pass membership entitling me to access to any of their lounges or is just two visits?

Thanks guys

No, the linked Diners Club Card does not include the Diners Club lounge network.

Thanks for letting us know. This has now been updated.

I’m wondering if there’s an additional card holder available. My wife and i and three sons are going around the world on the qantas 140,000 points deal. Would be great to both get into lounges on a diners club card each???

Also think the kids will have to find other things to do, most lounges only let kids under 3 in for free 🙁

Does the attached diners club offer lounge pass access?

I can confirm that if you hold a Citi Signature card, the transfer rate is still 2 Citibank Rewards points for 1 Velocity point. This is reflected in your online Rewards account when you go to transfer your points.

The transfer rate of 2.5 Citibank Rewards points for 1 Velocity point applies to the Citi Platinum card.

The T&Cs do not specifically exclude current Citibank credit card holders from being eligible for the bonus points, however, it is always best to check with Citibank prior to applying to be certain. Their terms regarding the bonus points are as follows:

To be eligible to receive up to 300,000 bonus Points you must apply for a Citi Rewards Signature Credit Card by 31 March 2019. You will receive 15,000 bonus Points when you spend a minimum of $1,000 during each monthly statement cycle. A maximum of 300,000 bonus Points can be earned over the first 20 monthly statement cycles. If you do not meet the minimum spend for one monthly statement cycle, you forfeit the bonus Points for that monthly statement cycle, however you are still eligible for subsequent months 15,000 bonus Points if you meet the minimum spend within each monthly statement cycle during the promotional period. Cash Advances, Balance Transfers, Refunds, Chargebacks and Special Promotions do not contribute to the spend threshold. The bonus Points will be credited within 6 – 8 weeks of meeting the spend criteria for any given month. All rewards are subject to the Terms and Conditions of the Citibank Rewards Program. Points do not expire while the card remains open and in good standing. Please note that if you have a balance transfer, you will be charged interest on any spend that you make. This offer is valid until 31 March 2019. Post this advertised date; Citi reserves the right to continue, withdraw or change the offer at any time without notice.

I have confirmed with Citibank that applying for a linked Diner’s Club card will not create an additional credit enquiry, however as at 11 September, I was advised that they have temporarily suspended issuing these cards due to their systems requiring upgrading. Citibank could not give a specific date when this will be up and running again.

Good article, but it looks like Citi may have devalued airlines transfer rates again; at Citi Rewards they show Velocity at 2.5:1 and Kris at 3:1 or am I missing something as at this transfer are the 120k bonus doesn’t really seem that great anymore.

Thanks.

The way the Citibank Rewards site is designed is that it shows the transfer rates that apply for the Citi Platinum card when you visit without logging in.

However, when you log into the Citi Rewards site as a Citi Signature card holder, the correct transfer rates apply. These are:

2.5 points = 1 Skywards mile

2.5 points – 1 KrisFlyer mile

2 points = 1 Velocity point

I hope that clears it up.

Thanks for a great article about citi rewards.

I just want to ask about the increased bonus of 120k. How much is it equal to Qantas points ? Also the same Q for citi infinite card ?

Cheers.

Hassan.

There has to be a catch… correct me if I’m wrong?

Is the minimum required income for this card $75k incl. super or plus super?

I think the cut in the FOREX earn rate will hurt more the cut in domestic spend.

Still, it’s hard to find a Visa card that has a better earn rate than 0.75/$1, especially when factoring in the card is free.

From the sounds of it bpay will also no longer earn points, so that’s something to be careful of. Best to set up direct debit or go to the service providers page and use their payment system.

I end up just take the fee waived.

Or maybe I just got cheated by their representatives?

TIA

AFAIK there’s no fee for additional cardholders on this account.

I am looking for a non Amex card (for when Amex isn’t accepted) that I can transfer points to Krisflyer account, from what I can tell the Citibank cards are the only ones you can do that with is this correct?

How long will it take to get the signup bonus?

I have the Virgin Money velocity flyer visa, which is issued by citibank, so would I be eligible for this introductory offer for the bonus points? As I noticed on the citibank website that it states that existing citibank credit card holders are not eligible to apply for this offer.

Also had an issue with the additional card holder having the wrong home address so wasn’t issued. Didn’t resolve that after a few calls. Just couldn’t be bothered to keep trying. Will try again if/when the rewards issue is resolved. The infamous Citibank customer service at work again…

I’d stay away from this card. I signed up online, and there was no option to credit the points to Qantas instead of Citibank rewards. I was a little suspect, so I rang them as my application was in process, and I was clearly told the 60k points would be credited to my qantas account (agreed to the extra fee and reiterated my qantas details). Two months later, over 8k spent on the card, repeat communication, and I receive an online message on the Citibank website saying I’m not eligible for the 60k qantas points, as they were credited to the Citibank rewards program. I’m still arguing with Citibank to get the points credited to my qantas FF, but it’s been a major hassle, and their representative has made no guarantee that they will credit the points to qantas.

Keith – This Citibank deal is not as advertised. As you said in another reply above, the deal clearly states that the points can be credited to Citibank rewards or qantas. I wouldn’t be recommending Citibank products if they’re not holding up their end of the deal.

You have the choice of earning 60,000 Citibank reward points or 60,000 Qantas Frequent Flyer points (if you enrol in the Citibank Qantas Rewards Program for an additional annual fee of $49 at the time of application)

Still reading your Citibank card guide 🙂 so thanks!

Just to let you know, I just received an email from Qantas, sign up to Commonwealth Bank Awards Card and get 40,000 QF points, and 50% off the annual fee for the first year.

First Citibank, then ANZ, then Bankwest and now CBA, seems like QF is selling their points like hot cakes!