Are you excited that Australia will relax its international borders by the end of 2021? It’s time to think about the more practical aspects of travel. Are there reward seats on the flights you want? And importantly, will travel insurance cover COVID-19?

Some travel insurers are opening up shop again with a new range of coronavirus-friendly policies. While these new COVID-19 insurance benefits will definitely be useful for some of us, we’ve found that not all scenarios are covered. Particularly where border restrictions are concerned.

We take a look at a few Australian insurers providing COVID-19 cover, so you know exactly what to expect.

Disclaimer: The information provided in this guide is of a general nature only, and does not take into account your personal circumstances. Be sure to read the relevant insurance policy disclosure statements (PDS) when deciding if any product is right for you.

Medibank & Cover-More

Medibank and Cover-More offer travel insurance underwritten by the Zurich Insurance Group, so the coronavirus coverage between both providers is largely the same. The Domestic and International (New Zealand) policies offer some COVID-19 travel benefits.

1. COVID-19 cancellation/amendment cover in Australia and New Zealand

If your trip is disrupted due to one of the following scenarios, then you may be able to claim on the cancellation/amendment portion of your policy.

- When you’re diagnosed with COVID-19, or are a close contact of someone diagnosed, and can no longer travel.

- A non-travelling relative or business partner is diagnosed with COVID-19 and the level of infection is life-threatening.

- Your travel partner is diagnosed with COVID-19 or is directed into quarantine and you no longer want to travel as a result.

- A pre-paid destination activity venue (e.g. a ski park or theatre) is closed because of COVID-19.

- If you’re an essential health worker and your leave is revoked as a result of COVID-19.

In addition, you may be eligible for AUD$150/night in reimbursements if you need to seek alternative accommodation because:

- Your host in Australia or New Zealand is diagnosed with COVID-19 or is directed into quarantine and you can no longer stay with them, or,

- The booked accommodation is shut down due to a COVID-19 outbreak.

2. COVID-19 medical cover in New Zealand

Medical expenses overseas can be costly. If you’re diagnosed with COVID-19 while travelling internationally in New Zealand, your medical costs will be covered. This includes hospital and ambulance fees.

Of course, within Australia, residents will usually have access to healthcare through the public system. There is also limited reciprocal healthcare arrangements with New Zealand.

3. COVID-19 cover in other overseas destinations

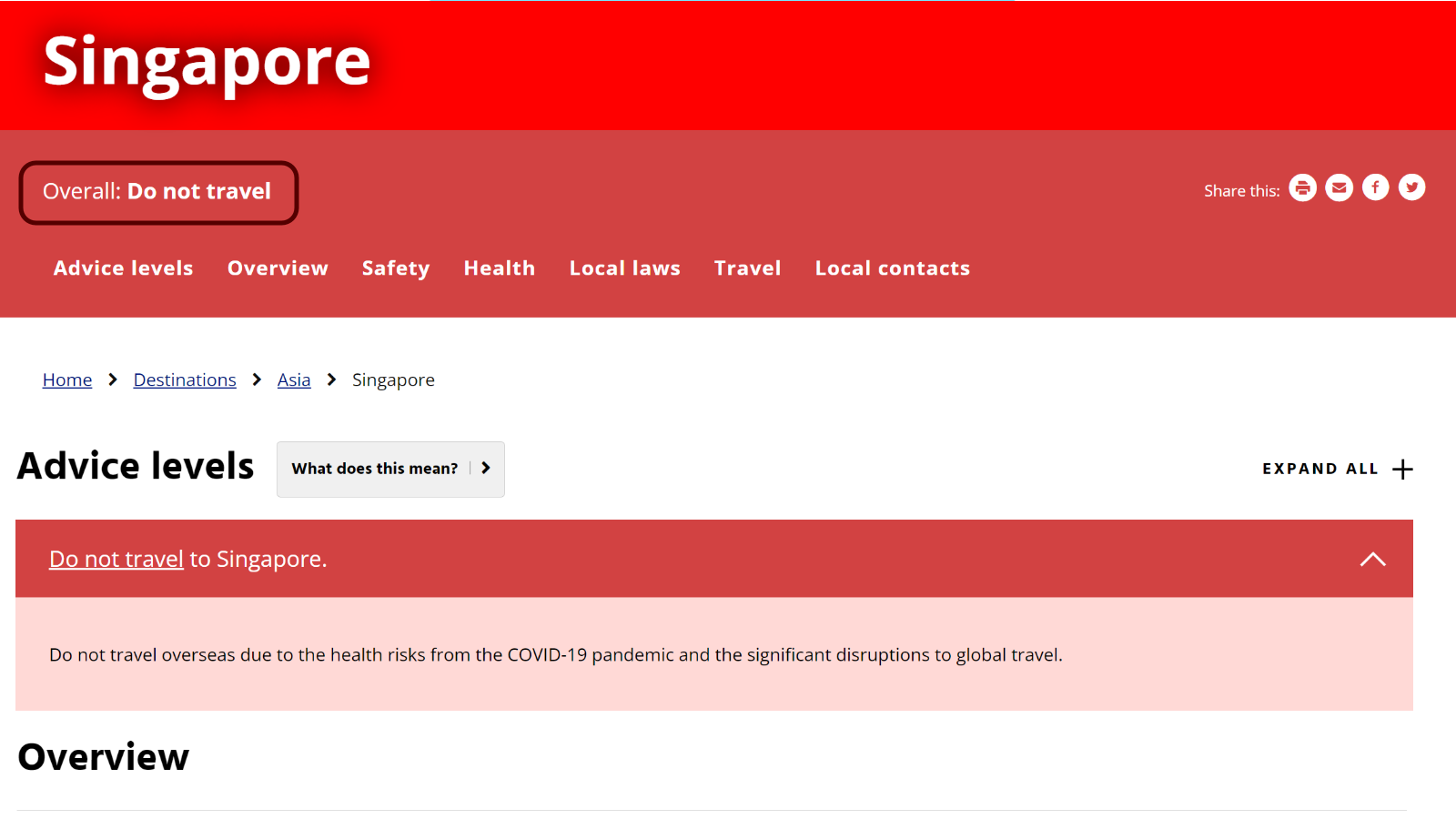

Both Medibank and Cover-More will extend some COVID-19 insurance benefits to other international destinations too. Those travel destinations must not be subject to a ‘Do Not Travel’ warning related to COVID-19 on the Smartraveller website at the time you enter the country.

At the time of writing, all international countries except New Zealand are listed as ‘Do Not Travel’ due to COVID-19 on the Smartraveller website. As a result, this benefit isn’t useful for now.

4. Exclusions to COVID-19 cover

Unfortunately, both travel insurance policies will not provide cover in the event of the following:

- Any claims caused by COVID-19 on multi-night cruises.

- Government-directed border closures, including domestic borders.

- Where the government bans travel to countries you are planning to travel to before or during the trip, such as through ‘Do Not Travel’ advisories (New Zealand may be excepted in other parts of the policy).

- Some benefits may not be covered if your trip includes a multi-night cruise.

- Costs from mandatory quarantine or self-isolation requirements related to cross-border, area, region or territory travel.

Read the Medibank COVID-19 travel insurance PDS [PDF, dated 29 Sept 2021]

Read the Cover-More COVID-19 travel insurance PDS [PDF, dated 29 Sept 2021]

Travel Insurance Direct & nib

Note: Both Travel Insurance Direct & nib have suspended selling travel insurance since this article was published.

Travel Insurance Direct (TID) and nib travel insurance is underwritten by XL Insurance Company SE and offers a different spin on COVID-19 coverage. Essentially, you’ll be given a maximum of AUD$2,500pp towards coronavirus-related travel disruptions, plus access to the overseas medical benefits.

1. Coronavirus travel costs cover

This is available on the TID Domestic plan only, or the nib Australian and International Comprehensive/Multi-Trip plans, at the time of writing. The insurer will pay up to AUD$2,500pp (or AUD$5,000 for a family) towards the following costs:

- When you or a member of your travelling party is diagnosed with COVID-19 and you have to cancel your trip.

- Your close relative or business partner in Australia is hospitalised or dies due to coronavirus and you have to cancel your trip.

- You or a member of your travelling party is permanently employed as a healthcare worker, residential care worker or law enforcement officer, and pre-approved leave is cancelled by the employer due to coronavirus.

- Your pre-booked accommodation is closed for cleaning due to a confirmed case of coronavirus.

- If you or a member of your travelling party has to quarantine during the trip due to being diagnosed with coronavirus, then reasonable additional travel, meals, accommodation and in-room entertainment.

- Reasonable additional childcare and pet care costs if you are unable to take care of them due to being diagnosed with coronavirus.

2. Exclusions to TID/nib coronavirus cover

Once again, TID and nib will not pay any benefits when travelling to a country or region that is subject to a ‘Do Not Travel’ warning issued by a government. This includes interstate travel restrictions as well.

Other exclusions to the Coronavirus Travel Costs benefits include:

- Buying a policy when you know you’ll be unable to avoid close contact with a case of coronavirus on your trip (e.g. the person you’re visiting is unwell).

- Extra costs as a result of you failing to promptly cancel or rearrange your travel plans after something impacts them.

- Change of mind with travel.

- Any quarantine that is broadly imposed by a government or other official body, which is not a result of you/your travelling party’s diagnosis or close contact to a case of coronavirus.

Read the full TID travel insurance PDS [PDF, dated 25 March 2021]

Read the full nib International Travel Insurance PDS [webpage, dated 31 March 2021]

What about included credit card travel insurance?

Many of the reward credit cards featured on Point Hacks include credit card insurance. But do those still cover COVID-19 related claims? The answer is: it varies, but probably not.

Your first point of call should be to check the PDS that applies to your credit card insurance. For your convenience, we’ve summarised a few major policies here (updated as of 4 Oct 2021):

- Qantas Premier Platinum & Titanium card: Does not cover COVID-19. See “Special Exclusions” in the PDS for the Platinum and the Titanium card.

- ANZ Frequent Flyer and Rewards Platinum & Black card: Unlikely to cover COVID-19. See “General Exclusions” in the PDS, Page 40, Section 6.

- American Express Platinum Card: Unlikely to cover COVID-19 expenses as it is a known event. However, it best to check with American Express based on your intended travel.

Earning points on COVID-19 travel insurance in Australia

Of the insurance providers discussed in this guide, Cover-More is the only one with a separate points-earning partnership with Velocity Frequent Flyer. Policy-holders can earn 3 Velocity Points per AUD$1 spent.

Silver, Gold and Platinum members will even earn 50%, 75% and 100% bonus points on top, respectively. That’s up to 6 Velocity Points per dollar!

Regardless of which cover you take out, be sure to make the payment on a rewards-earning credit card to maximise your points balance.

Summing up

It’s great to see travel insurance providers pivoting to include coronavirus-related coverage in their policies. However, at this stage, the benefits are minimal, and you need to check the policy documents to see if the cover is right for you. Credit card insurance T&Cs can be a bit ambiguous, so contact your insurer if you’re uncertain whether cover may apply to you or not.

Notably, no stand-alone policy will cover you for COVID-19 related claims in overseas countries with ‘Do Not Travel’ advisories (essentially all of them except New Zealand). It also won’t cover domestic travel costs as a result of state border closures and quarantine.

You’re mainly insuring against you and/or your travel companions getting sick with COVID-19, plus a few other scenarios that affect individuals, rather than government-mandated closures.

And don’t forget, it’s vital you read the insurance policy documents to see exactly what is and isn’t covered. This is the insurer’s rule book when it comes to claims, so it helps if you’re acquainted with it.

Ready to book your next trip? Then be sure to use your points for reward seats, as those will generally be the most flexible. Both Qantas and Virgin Australia are offering full flexibility on reward seats until 28 February 2022.

This content contains affiliate links from which Point Hacks may earn commissions from transactions generated from new customers, bookings and general enquiries. Find out more here.

https://www.anz.com.au/personal/credit-cards/using/premium-insurance/

Cheers

Chris

Windows 10; Chrome.

nib says it has stopped selling travel insurance pending review

Amex credit card insurance effectively does not cover covid – Chubb issued a statement last year saying it is considered a “known event” https://amex.chubbtravelinsurance.com/content/dam/chubbglobaltravel/Staticfiles/Doc/Notification/AU_WuhanVirus_EN_AMEXAU.pdf#0

by my reckoning ANZ credit card insurance in its current form would cover covid once Smartraveller lifts the Do Not Travel ban on a destination, BUT Westpac has a similar policy and theirs will be changing on 27/10/21 to explicitly exclude pandemics