This guide has been produced in partnership with Virgin Money, a Point Hacks commercial partner.

Virgin Money has significantly expanded its presence into the Australian banking market with the launch of a new digital bank, a new everyday transaction account, 2 new savings products and a new loyalty program, Virgin Money Rewards.

The new product offerings push the starter gun on Virgin Money’s new brand platform, dubbed ‘Bank to your own Beat’, which provides Australians with a more rewarding way to bank along with another option for their banking needs in a market that is generally concentrated among 4 major players.

This article takes a closer look at these new products, as well as Virgin Money Rewards.

Virgin Money Rewards

One of the major changes to Virgin Money’s product offering is the launch of Virgin Money Rewards, which looks to reward Virgin Money transaction and savings customers with offers, experiences and Virgin Money Points.

Virgin Money is mostly known for its relationship with Velocity Frequent Flyer and the ability to earn Velocity Points through the Virgin Money Flyer or Virgin Money High Flyer credit cards, and while this relationship won’t change, Virgin Money Rewards provides an additional avenue for Virgin Money transaction and savings customers to be rewarded.

And this avenue can be very rewarding. We’ll show you how you can easily earn 30,000 Virgin Money points within the first few months of taking out a Virgin Money product, which is worth at least $130 in value.

Virgin Money Rewards is designed to be more than just a points program. Whether Virgin Money customers are spending big, saving hard or creating better money habits, the program seeks to seriously recognise and reward their customers each and every day.

Earning Virgin Money Rewards Points

There are a number of ways to earn Virgin Money Rewards Points, which include:

Welcome Bonus – A welcome bonus of when you signup for an account.

Use your Virgin Money Go Transaction Account – You can earn 8 points with every purchase, direct debit or BPAY payment. Just make sure to meet the Monthly Criteria.

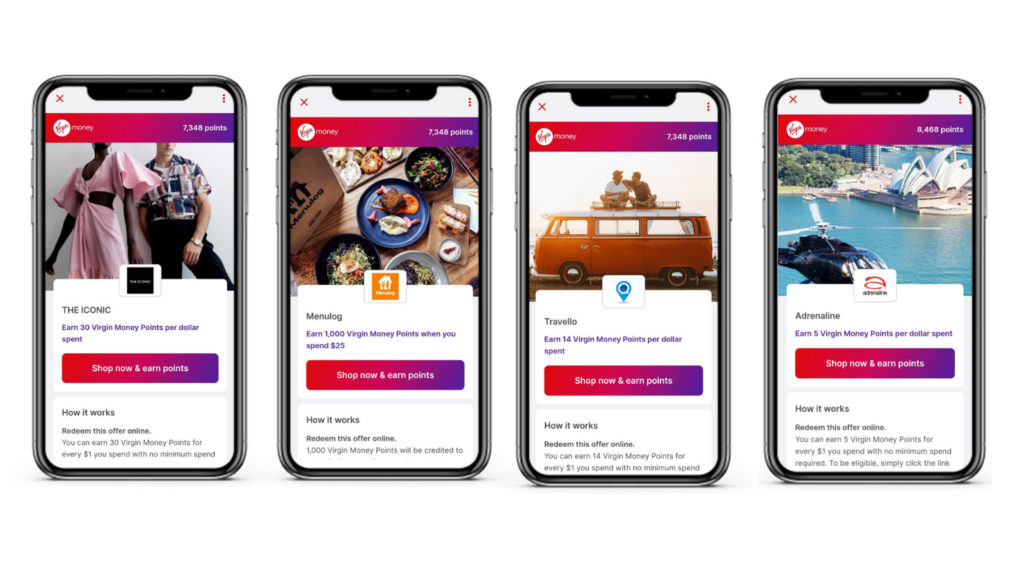

Take advantage of partner offers – Access loads of partner offers to earn thousands of bonus points and other epic benefits from Virgin Money Rewards bonus partners. Bonus partners include:

- Travello – earn 14 Virgin Money Points per dollar spent

- Menulog – earn 1,000 Virgin Money Points every time you spend $25 or more, as many times as you like

- Adrenaline – earn 5 Virgin Money Points per dollar spent

- THE ICONIC – earn 30 Virgin Money Points per dollar spent

Note, each partner offer will have their own terms and conditions and expiry date which can be viewed in the app at the time of purchase.

Booking a hotel – Book a hotel stay through the Virgin Money app and earn 5 Virgin Money Points per $1 spent upon check-out.

Refer a friend – Referring a friend to the Virgin Money Go Account could earn you and your friend with 5,000 bonus points. You can successfully refer up to 5 friends per month. T&Cs apply.

Rewards just for you – These could be rewards for your birthday, reaching a milestone or just to say thanks for being a loyal customer.

See how easy it is to earn 30,000 Virgin Money Points!

Let’s see how easy it is to earn 30,000 Virgin Money Points in just one month!

- Bonus Virgin Money Points for taking out a new Virgin Money Go Account and making a settled purchase within the first 30 days

- Take a break from the kitchen and spend $25 through Menulog to earn 1,000 Virgin Money Points. Do this twice a week for a month and that’s 8,000 point boost to your account

- Looking for some adventure? Then look no further than Travello. Book your next tour or activity through Travello and earn 14 Virgin Money Points per dollar spent. Say you spend $600 for an adventure for 2. That will earn you 8,400 Virgin Money Points.

- Looking for some extreme adventure? Then make sure to book an experience such as jumping out of a plane or taking in some laps around Sandown in a V8 race car, where you can also clock up 5 Virgin Money Points per dollar spent. Spend $760 on one of these experiences and 3,800 Virgin Money Points are yours.

- If you’re wanting to give your wardrobe a bit of a spruce up, then make sure to head to THE ICONIC, where you earn 30 Virgin Money Points per dollar spent. Spend $160 on your new outfit, and that will earn you 4,800 Virgin Money Points.

Do all the above in the first month of signing up to the Virgin Money Go Account and you will earn yourself at least 30,000 Virgin Money Points. It’s that easy

Using Virgin Money Points

There are a number of ways to redeem your Virgin Money Points, which include:

Points for cash – Swap your points for a cash amount in AUD, which can be credited to your Virgin Money Go Account or your Virgin Money Boost Saver.

Gift cards – Redeem your points for a gift for you, or a gift for someone else. There are a range of gift card providers, including but not limited to Coles, Bunnings and JB Hi Fi, which can be instantly used both in store or online.

Purchase eraser – Use your points to erase any purchase you make on you’ve made in the last 90 days on your Virgin Money Go Account – and voila, they’ll credit the purchase back into your account instantly, just like it never happened!

Share points – You have the option of gifting your points to anyone you hold a Joint Account with.

What 30,000 Virgin Money Points can get you?

Once you’ve earned 30,000 Virgin Money Points, you may be wondering what you can do with them. Here are some suggestions for you:

- A $150 gift voucher from THE ICONIC

- Erase up to $130 worth of purchases you’ve made on your Go Account or,

- A similar amount in cashback straight into your spending or savings account.

Virgin Money Go Transaction Account

The Virgin Money Go Account is a transaction account with a difference. An everyday transaction account that allows you to earn points for how you spend and budget. And earning points from a transaction account is a pretty unique proposition with very few other similar products being offered in the market.

Aside from the bonus Virgin Money Points and the ability to earn 8 points with every purchase, direct debit or BPAY payment when you meet the Monthly Criteria, the account comes with many other benefits, including but not limited to:

- Zero monthly fees

- Bundled with a high-interest Virgin Money Boost Saver (Monthly Criteria applies)

- Easily track and categorise your spending

- See upcoming bills

- Set yourself spending budgets

- Links to Apple Pay, Google Pay, and Samsung Pay

- Pay your mates and transfer money instantly with Pay ID and Osko

Click on the link below to read more about the Virgin Money Go Account or apply.

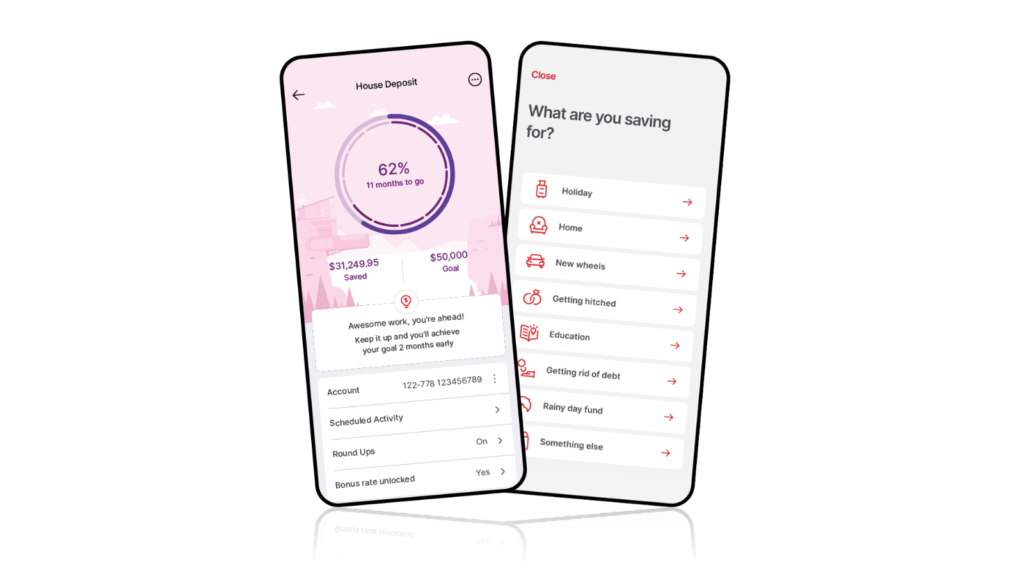

Virgin Money Boost Saver

The Virgin Money Booster Saver is a high-interest savings account bundled with the Virgin Money Go Account.

Here are some of the benefits:

- Get the highest variable interest rate on all your Virgin Money Boost Savers, up to a combined total balance of $250,000 when you meet the Monthly Criteria each month (outlined below)

- Set up to 9 personalised savings goals

- Joint Accounts available

- Get clever insights and real-time alerts

- Save like a pro with Round Ups. Choose to Round Up your Go Account purchases to the nearest dollar, so the change goes straight into your linked Virgin Money Boost Saver

- Ability to earn points on your linked Go Account purchases and transfer them back to cash into your savings account for that extra boost. That is, use your points to further boost your savings! How good is that?

For further information on this Account, click on the link below for the Virgin Money Booster Saver.

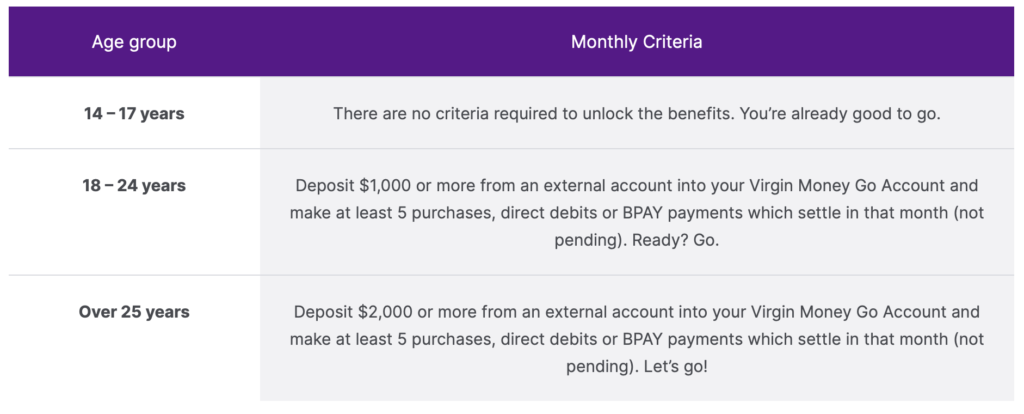

Monthly Criteria

Note, that in order to unlock 8 points per purchase, direct debit, and BPAY payment on your Virgin Money Go transaction account, plus the highest variable interest rate on your Virgin Money Boost Saver, you need to meet the Monthly Criteria in the previous month. Here’s what you need to do each month

Summing Up

It is great to see another entrant into the transaction account loyalty space, providing consumers with another avenue to do their everyday banking, save or do both and get rewarded in the process.

The opportunities to earn and redeem points with Virgin Money Rewards is plentiful, with many options that will cater to the individual preferences of their customers.

These new products will complement the existing Virgin Money credit card range well and allow Virgin Money customers to hold a range of Virgin Money banking products to suit their needs.

Disclaimer: Point Hacks Australia Pty Ltd. provides general information only. You should assess whether the information is appropriate for you having regard to your objectives, financial situation and needs and consider obtaining independent professional advice before making an investment decision. If information relates to a specific financial product you should obtain a copy of the PDS for that product and consider that statement before making a decision on whether to acquire the product.

Frequently Asked Questions

Virgin Money Rewards is the new program from Virgin Money that promises to be more than just ‘loyalty’. Say goodbye to points you’d never spend and ‘rewards’ you’d never use, and say hello to a program that’s all about you. Recognising and rewarding you for who you are, and to helping you create better money habits. It’s about giving you a rewarding banking experience every day, not just someday.

There are a number of ways to earn Virgin Money Points including through partner offers, everyday purchases, direct debits and BPAY payments when you meet the Monthly Criteria (see below) on your Virgin Money Go Account. Also, Virgin Money may decide to say thanks or well done, as well, for doing a bunch of good things for you. And when it comes to using your points, Virgin Money provides plenty of ways to do this as we’ve outlined above.

Yes, if you’re currently earning Velocity Frequent Flyer Points on a Virgin Money credit card, home loan*, super or insurance, you’ll continue to do so, just as you do today. Want Virgin Money Rewards on top of that? Simply take out one of our new Virgin Money transaction or savings accounts to get earning.

*If you make a material change to your home loan including a restructure and/or opening a new loan account on or after 25 May 2020, you may no longer be eligible to earn Velocity Points.

There’s no ‘use-by’ date on these points as long as you have an active eligible product with Virgin Money and have earned or redeemed a point within the last 2 years. That said, if you close all your accounts, you’ll have 3 months to redeem any outstanding points.

In short, no. You can apply for a new Virgin Money Go Account and Boost Saver directly through Virgin Money’s website.

It’s just strange that they wouldn’t put it on their website.

8 points per transaction is not much. 8 points per. Dollar seems good.