PayPal is a payment processor that many online websites use for transactions. Both individuals and businesses can earn and spend money in a PayPal account, and you can also send money to friends or cash it out to your bank account.

Many people find it convenient to use a PayPal account to checkout, as you can save all your cards in the account. Used correctly, PayPal can be a great tool for boosting credit card points earn in certain scenarios. This guide will walk you through how to do this and point out ways to avoid extra payment charges.

Use PayPal when the merchant doesn’t accept Amex

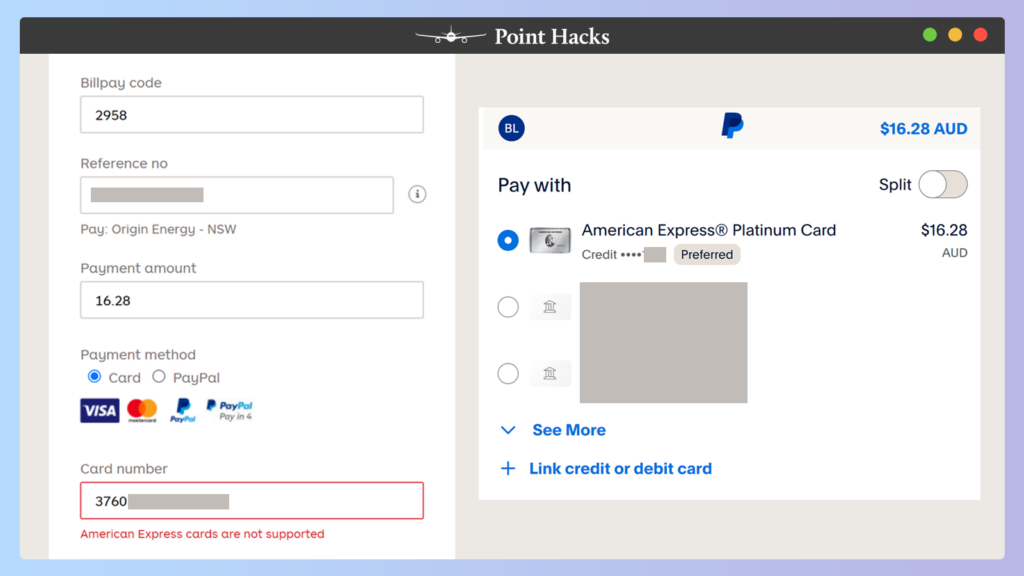

A common situation is where you want to pay with your American Express Card (which typically earns more rewards or frequent flyer points than Visa or Mastercard). One snag – the merchant doesn’t accept Amex natively, but they do accept PayPal. There’s your workaround.

An example of this is Australia Post’s ‘Post Billpay’ service, which many utility companies use. Using Origin Energy as an example, you can’t pay with an Amex with a credit card. But select PayPal, and it works like a charm.

But if you switch to PayPal, then you’ll see on the right-side screenshot that after logging in, I can pay with my linked American Express card, thus potentially earning more points.

Use PayPal when the transaction fees are lower

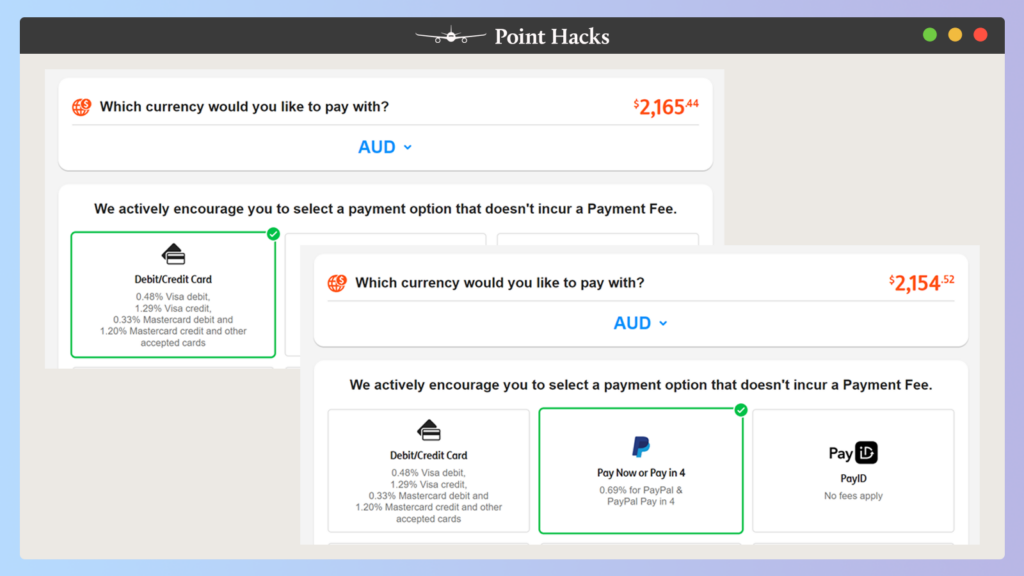

In certain cases, checking out with PayPal will save you on credit card surcharges compared to using a traditional card payment method.

For example, Jetstar currently charges 0.69% for PayPal and up to 1.29% for using a credit card. While this may just be a few dollars different on simple bookings, it can certainly add up for more expensive bookings.

Other airlines that accept PayPal for journeys starting in Australia include Qatar Airways, Emirates, and AirAsia. See the latest list here (filter for ‘Travel’).

Can you still earn points with ‘government services’?

In the past, we also used to mention that PayPal was an excellent tool for earning full points on spending that would otherwise be ineligible, such as ATO tax bills and other government services.

Unfortunately, we’re aware that this no longer appears to be the case in 2024 – at least for some banks. Card issuers such as Amex and Citi are now awarding zero points on transactions that would usually be ineligible, even through PayPal. It appears that card issuers can see the transaction category type, even via a payment processor.

Other reasons to consider PayPal at the checkout

While not strictly points-related, there are a few more benefits that you might be able to get through PayPal. The first one is buyer protection, where PayPal will allow you to file a dispute if your purchase doesn’t turn out as expected (with some terms and conditions, of course).

The second is ‘Pay in Four’, where eligible transactions can be split into four equal, fortnightly instalments at no extra cost or hit to your credit file.

Summing Up

PayPal can be a safe way to make purchases online while also maximising the number of points you earn. As a buyer, it can also offer you buyer protection for your goods, particularly on eBay.

The main reasons for using PayPal include the greater ability to use your Amex cards and potentially lower fees at some merchants. But it seems the days of using PayPal to escape zero or low earning rates on government spending are over.

Stay up to date with the latest news, reviews and guides by subscribing to Point Hacks’ email newsletter.

Looks like using Paypal doesn’t avoid a reduced points earn rate (though it’s probably still good to avoid AMEX surcharges).

Yes, as PayPal is the mechanism to get the cost of travel charged to your card, and most cards just require that the cost of travel is charged to your card. To be safe though, you may wish to contact your financial institution to confirm.

I believe it works when the payee accepts PayPal. The ATO does not accept PayPal as a payment method, therefore you wouldn’t be able to earn points through this method.