ANZ Rewards is one of the few banks and card loyalty programs, alongside Citi Rewards and Westpac Altitude Rewards, that offer the ability to transfer points from non-American Express spending to Asia Miles and KrisFlyer.

As such, ANZ Rewards is a valuable flexible points program. Especially if you want to choose which airline program to transfer your ANZ Rewards Points.

The Card Range

If you want to earn ANZ Rewards points, you can choose from two cards. These are:

The former is the higher-end card, offering more benefits for the cardholder but with a higher annual fee. The latter is a mid-tier card offering moderate benefits and an annual fee.

Both cards offer the ability to earn rewards points, which can then be transferred to one of four airline programs. These are:

If you would like to earn Qantas Points on spend, you can also check out the ANZ Frequent Flyer Black:

Digging into the details

The range of airline partners is not as extensive as American Express Membership Rewards. However, aside from Airpoints, the other three airline partners are great quality programs. All three offer competitive redemption rates and flight rewards. Airpoints is not competitive, as it is based around an ‘any seat award’ pricing structure.

The program also offers a range of non-flight redemption options. These include products such as toys, homewares and fashion. You can also redeem your points for gift vouchers from well-known companies and brands. Or if you prefer, you can get a cashback directly to your account.

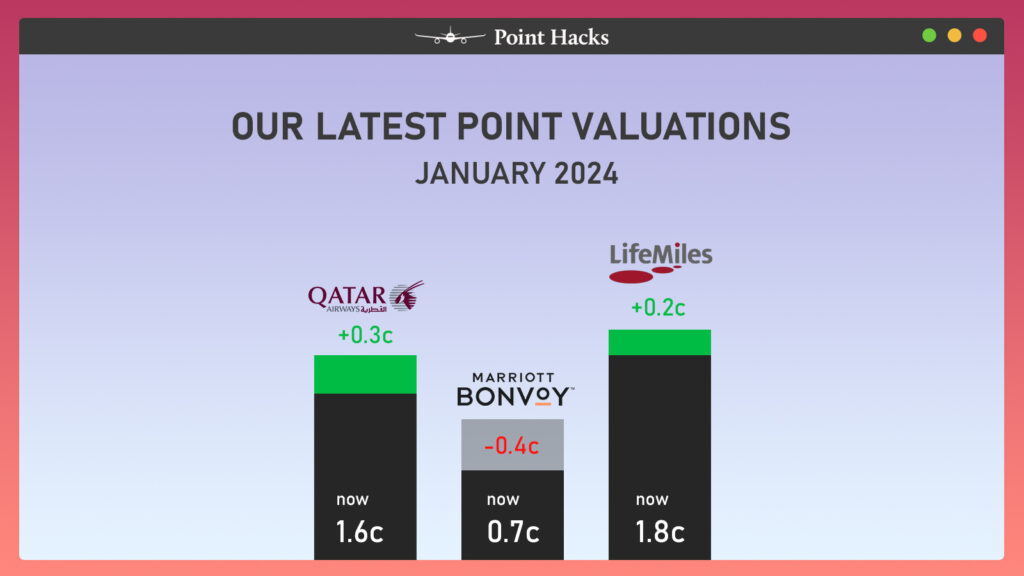

The program partners

The transfer rates and effective earn rates for each of the program’s airline partners are shown below.

| Frequent Flyer Program | Transfer Rate | ANZ Rewards Black Effective Earn Rate | ANZ Rewards Platinum Effective Earn Rate |

|---|---|---|---|

| Velocity Frequent Flyer | 2 ANZ Rewards points to 1 Velocity Point | 1 Velocity Point per $1 | 0.75 Velocity Points per $1 |

| Singapore Airlines KrisFlyer | 3 ANZ Rewards points to 1 Krisflyer mile | 0.66 KrisFlyer miles per $1 | 0.5 KrisFlyer miles per $1 |

| Cathay Asia Miles | 3 ANZ Rewards points to 1 Asia Mile | 0.66 Asia Miles per $1 | 0.5 Asia Miles per $1 |

| Air New Zealand Airports | 200 ANZ Rewards points to 1 Airpoints Dollar | 0.010 Airpoints per $1 | 0.0075 Airpoints per $1 |

If you are looking to maximise the overall points value, then Velocity offers the best option. Not only in terms of transfer rates. But also in terms of the effective earning rate.

The transfer and effective earn rates for KrisFlyer and Asia Miles are not as strong as Velocity. However, the rates are in line with the rest of the credit card market for these two airline programs.

You can also redeem your rewards points directly for flight and hotel bookings. The value you extract from such a redemption is usually around 0.5 cents per point. This is generally well short of the value you get from transferring your points to an airline partner and then redeeming for flights.

Just note that Rewards Points do expire. Points must be used to claim a reward three years after the end of the year in which the points were earned. Otherwise, they will be cancelled.

Apple Pay + Google Pay support with ANZ

ANZ cards support Apple Pay & Google Pay, meaning you can use their cards on your smartphone for easier payments. Find out more in our guides for each of the compatible services.

Summing up

The ANZ Rewards Program is a flexible program that provides cardholders with choice. Rewards Points can be transferred to a number of airline programs, or instead, redeemed for other non-flight rewards.

The transfer rate and effective earn rates are competitive against other cards in the market. Obviously, the higher-tier Black Card will earn you more points per dollar of spending, along with additional benefits. But it does come with a higher annual fee, so you’ll need to do the cost-benefit sums to see if this Card is suitable for you. Otherwise, the mid-tier Platinum Card may be better suited.

Just remember that Rewards Points do expire. So make sure that you don’t fall foul of this rule.

Disclaimers

ANZ would also like us to include the following disclaimer.

ANZ Reward Points are earned and redeemed in accordance with the ANZ Rewards – Rewards Program Terms and Conditions booklet. Certain transactions and other items are not eligible to earn Reward Points. For details, refer to the ANZ Rewards – Rewards Program Terms and Conditions booklet.