Knowing the rough value of a point is an important step in your thinking. Why? Because it’ll help you plan how to earn and use your points systematically and rationally.

In this guide, we run through our methodology and our current estimates of the value of different points currencies. We suggest you read this in conjunction with our disclaimer – and keep in mind that our method is one of many ways to value points.

Ultimately, everyone will value points differently, so just think of ours as a guide rather than a gospel.

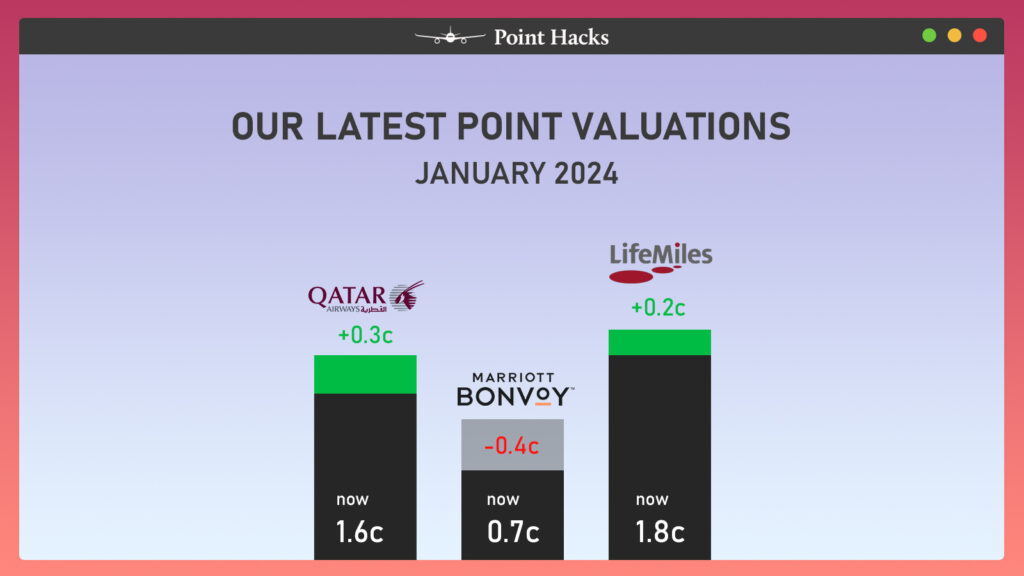

UPDATE 16 January 2024:

We’ve adjusted the underlying base redemption target rate by 8% to reflect inflation affecting taxes, fees and charges. We’ve also adjusted the weightings of some of our criteria behind the scenes to better reflect what the average frequent flyer is looking for in a loyalty program.

In terms of individual program movements, we have down-weighted Singapore Airlines KrisFlyer slightly due to the increase in transfer rates from 2:1 to 3:1 across American Express Membership Rewards and similar programs (although it did not result in a change of its valuation).

Conversely, we have up-weighted Qatar Airways Privilege Club since it’s a new 2:1 partner of American Express Membership Rewards and reward availability is decent. This has pushed its value from 1.3 to 1.6 cents per Avios.

Programs with increase in valuation ↑

As of 16 January 2024 (compared to June 2023)

All values are cents per point. Many programs saw a minor uplift due to the increase of the baseline redemption rate and inflation, rather than due to specific-program changes.

The main exception is Qatar Airways Privilege Club, which enjoyed a significant boost since becoming an American Express MR transfer partner.

- Qantas: from 1.8c to 1.9c

- Velocity: from 1.8c to 1.9c

- Asia Miles: from 1.7c to 1.8c

- Skywards: from 1.1c to 1.2c

- Privilege Club: from 1.3c to 1.6c

- AAdvantage: from 1.6c to 1.7c

- Alaska: from 1.8c to 1.9c

- Avianca: from 1.6c to 1.8c

- IHG: from 0.7c to 0.9c

- Hyatt: from 1.5c to 1.8c

- Radisson: from 0.2c to 0.3c

- Accor: from 2.9c to 3.0c

Programs with a decrease in valuation ↓

As of 16 January 2024 (compared to June 2023)

One hotel program saw a drop in value due to reward nights requiring more points relative to the cash rate.

- Marriott Bonvoy: from 1.1c to 0.7c

Watch our video or continue reading below to learn more:

Our current points valuations

Remember, these valuations are based on our bespoke set of criteria and should be taken as a guide only. There can sometimes be differences in the value between two programs that allow transfers.

A 2:1 ratio doesn’t mean we’ll automatically value one program as worth double the other – we evaluate each program on its merits based on a variety of factors. Here’s what we take into consideration.

Airline programs

- The ease of acquiring enough points in the program to achieve your targeted redemption.

- The range of destinations you can travel to with those points, and the availability of award seats.

- How strict the expiry conditions on points in the program are.

- What level of out-of-pocket costs are required when redeeming points for flights.

- How many points are required to redeem an award seat compared to other similar programs.

Hotel programs

- The number of points required to redeem a standard room in a major Australian city.

- The general availability of rooms that can be booked with points.

- The range of hotels within the program where you can earn or redeem your points (including price point and locations).

- How strict the expiry conditions on points in the program are.

Other programs

- The quality of Australian airline transfer partners.

- The quality of international airline transfer partners.

- The rate at which points can be transferred from the program to airline and hotel partners.

- The quality of hotel transfer partners.

- How strict the expiry conditions on points in the program are.

Airline points valuation

| Program Name | Valuations (in Cents) | Pros | Cons |

|---|---|---|---|

| Qantas Frequent Flyer | 1.9 | Easy to earn with huge range of domestic and international redemption destinations in theory (Oneworld and Emirates). | Difficult to find premium cabin availability, both on QF and some major partners such as EK. |

| Velocity Frequent Flyer | 1.9 | Easy to earn with decent range of domestic and international redemption destinations (Qatar Airways, Singapore Airlines and more). | Network coverage patchy within Europe and to/from South America. |

| Singapore Airlines KrisFlyer | 1.9 | Good seat availability and range of international destinations with low/no carrier charges on redemption bookings. | 3 year hard expiry on points is uncompetitive. Partner awards are often very expensive. |

| Cathay Asia Miles | 1.8 | Can redeem for oneworld flights including Qantas Domestic. Expiration policy changed from hard to soft expiry. | Number of points has increased, removing the competitive edge against other oneworld airlines. |

| Emirates Skywards | 1.2 | Has a large international network with ability to redeem or upgrade to one of the best First Class in the market | Points requirements can be quite high, and the ability to directly earn Skywards miles in Australia is limited. New carrier charges make premium redemptions harder to justify. |

| Etihad Guest | 1.3 | Access to Etihad premium cabins and ability to book Virgin Australia flights with lower carrier charges than Velocity. | Points requirements can be quite high, and the ability to directly earn Etihad Guest miles in Australia is limited. |

| British Airways Avios | 1.3 | Great value redemptions for short-haul Economy and Business destinations worldwide on oneworld carriers. Easier to access Avios via Qatar Airways. | The ability to earn Avios directly in Australia is almost non-existent with no card partners (apart from going via Qatar Airways and Amex/Citi/Commbank). |

| Qatar Airways Privileges Club | 1.6 | Great value long-haul redemptions on Qatar Airways. | Some partner airlines can't be booked online easily (requires a manual form). |

| American Airlines AAdvantage | 1.7 | Low carrier surcharges make this a useful program to use your Qantas points on for travel in North America. | Ability to earn AA miles in Australia is almost non-existent with no card partners. |

| United MileagePlus | 1.6 | Good range of destinations via the Star Alliance and low carrier charges. Miles never expire. | Ability to earn MileagePlus miles in Australia is almost non-existent with no card partners. |

| Delta Skymiles | 1.4 | Miles never expire. | Dynamic Pricing makes it hard to determine redemption cost. |

| Alaska Airlines Mileage Plan | 1.9 | Frequent offers in market to buy discounted points that can be used on oneworld partner airlines including Qantas. | Change to reward tables makes the program less competitive in some cases. |

| Avianca LifeMiles | 1.8 | Get cheap Business and First redemptions on Star Alliance carriers. | The ability to earn LifeMiles in Australia is almost non-existent with no card partners. Semi-strict expiry policy for non-elite members. Difficult to manage flight change/cancellations. |

Hotel points valuation

| Program | Valuation (in cents) | Pros | Cons |

|---|---|---|---|

| Hilton Honors | 0.5 | Can be used across a wide range and standard of hotels in the Hilton Group with good availability for redemption. | Dynamic pricing. |

| IHG Rewards | 0.9 | Can be used across a wide range and standard of hotels in the IHG Group with good availability for redemption | Dynamic pricing. 12 month points expiry for non-elite members. |

| Marriott Bonvoy | 0.7 | Can be used across a wide range and standard of hotels in the Marriott Group with good availability for redemption | Devaluation has made the program less appealing in terms of number of points required for a redemption |

| World of Hyatt | 1.8 | Fewer points required for a redemption than most programs | Much smaller range of hotels available than other similar programs and redemption availability can be limited. |

| Radisson Rewards | 0.3 | Good transfer rate from Citibank Prestige card. | Smaller range of hotels available than other similar programs and redemption availability can be limited. Points requirement extremely uncompetitive. |

| Accor Live Limitless | 3.0 | Easily redeemed via a discount off your hotel charges at a rate of 2,000 points for every 40 Euros (~AUD$66) | Points expire in 12 months if no account activity. |

Other points valuation

| Program | Valuation (in cents) | Pros | Cons |

|---|---|---|---|

| American Express Membership Rewards (Ascent) | 1.0 | Highly flexible with no expiry on points and the ability to transfer to a large range of airline and hotel programs. | Can't transfer points to Qantas Frequent Flyer program. Ability to earn points limited to places where Amex is accepted. |

| American Express Membership Rewards (Ascent Premium) | 1.2 | Highly flexible with no expiry on points and the ability to transfer to a large range of airline and hotel programs. | Ability to earn points limited to places where Amex is accepted. |

| Amplify Rewards | 0.8 | Ability to transfer points to the Velocity and KrisFlyer programs. | Transfer rates to airline partner programs is low. |

| ANZ Rewards | 0.8 | Flexibility to transfer to Velocity, KrisFlyer and Asia Miles. | Transfer rates to airline partner programs are low, especially on international carriers. |

| NAB Rewards | 0.8 | Flexibility to transfer to Velocity, KrisFlyer, Asia Miles and NZ Airpoints. | Transfer rates to airline partner programs are low, especially on international carriers. |

| Westpac Altitude Rewards | 0.5 | Flexibility to transfer to Velocity, KrisFlyer, Asia Miles, NZ Airpoints and Enrich. | Transfer rates to airline partner programs are very low across all partners. |

| Flybuys | 0.8 | Easy to earn on everyday spend and can be transferred to Velocity points. | |

| Everyday Rewards | 0.8 | Easy to earn on everyday spend and can be transferred to Qantas points. | |

| Citi Rewards (Prestige) | 1.0 | Huge range of airline and hotel programs to convert points to including both major domestic carriers. | Transfer rates to airline partner programs are low, especially on international carriers. |

| Citi Rewards (Premier) | 0.8 | Huge range of airline and hotel programs to convert points to. | Transfer rates to airline partner programs are low, especially on international carriers. |

| CommBank Awards | 0.8 | Strong list of airline partners (plus 1 hotel partner) to transfer points to including both major domestic carriers. | Transfer rates to airline partner programs are very low. |

Why consider the value of points?

All points are not created equal!

Many people believe that each loyalty program delivers the same level of value to its members. But this is far from true! Each program sets up its points differently. The number of points members earn when transacting with the program or its partners (e.g., purchasing a product or service) varies.

And not only that – the number of points required to redeem for a particular reward (e.g. a Business Class flight) differs as well. Simply put, the way each program is structured from an ‘earning’ and ‘redeeming’ perspective makes the value of a point in each program unique. Plus, these values can change over time.

Our valuation methodology

At Point Hacks, we base our valuations on the rate we feel consumers could afford to ‘buy’ points – knowing that they could safely redeem those points for something of higher value.

As we mentioned, we determine our valuations from the perspective of an Australian-based customer. We don’t delve into the complexities of our calculations in this guide. However, we do explore the factors that contribute to the overall points value for each type of program.

How to use points valuations

Ultimately, when you have an idea of the value of a point, it allows you to better assess whether you’re getting good value from earning or redeeming those points.

As a simple guide, you’re getting good value if:

- You can earn points at a cost that is less than the value of the point you are acquiring; and

- If you can redeem your points for a product or service that has a value higher than the value of the points you are using.

Advanced examples

Below, we dive into a number of examples. These will help you determine the cost of acquiring points or the value you’re getting from a points redemption.

Purchasing points directly from programs

Overall, we wouldn’t advise you to purchase points at the standard rate – unless perhaps you’re just shy of the points required for an award redemption.

However, a number of airlines offer promotional rates throughout the year. During these promotions, you can purchase a bunch of points at a much better value.

If the cost to buy the points is less than the value of the points, then it may make sense to buy those miles.

However, if the cost is more than other methods of purchasing the ticket, then it may be financially smarter to use cash or redeem your pre-existing points.

Note we say may make sense. That’s because at Point Hacks, we don’t recommend purchasing points speculatively if you don’t have a concrete plan to use them.

Even during great buy promotions, you run the risk of the points being devalued in future.

Using a credit card with a payment surcharge

Is your main reason for using a credit card to earn points on the transaction? Then take note of any additional surcharges incurred for using that card.

Most merchants don’t implement charges for using a credit card, but some do. In those instances, check that the surcharge you’re paying is below the valuation you place on the point you’re about to earn.

As an example, say your card earns you one point for every dollar spent. If you’re asked to pay a fee of 1.5% (i.e. 1.5 cents for every dollar), and you value a point in that program at 1.8 cents, then you’re acquiring the point at a rate (1.5 cents) less than our valuation (1.8 cents). So this represents good value.

On the other hand, say your credit card only earns you 0.5 point for every dollar spent. Then the cost of acquiring the point (3 cents per point) – calculated as 1.5 cents for every 0.5 point earned – is more than our valuation (1.8 cents). This, of course, represents poor value.

You should also be careful of points caps on your credit card. If your credit card has a points cap and you’ve exceeded that cap, then you won’t be earning any points on purchases. This is regardless of any fees you pay to the merchant to use your card.

Earning points from purchasing products or services

There are many instances where you can earn points for purchasing products or services from a provider that partners with a points program (e.g. energy plans, insurance products, etc).

Sometimes, the cost of these products are higher than their non-points earning equivalents. In these instances, you should assess the value you’re getting for the higher cost before you make a decision to purchase.

As an example, a standard product may cost $100 to purchase. But the exact same product may be $110 to purchase from the same provider if it includes points. In this instance, you may earn 500 points by selecting the points-earning option, but you have paid $10 extra to get those points.

This means you’ve acquired those points at a value of 2 cents each. If you value those points at 1.8 cents, then this would potentially represent poor value. You paid more for the points than you believe they are worth.

Say, however, the product provider was running a ‘double points promotion’ where you could earn 1,000 points for the same price. In this case, you would have acquired the points at a cost of 1 cent each, which would represent good value. This is well below the value you believe these points are worth.

Redeeming points for an airline seat

Most points redeemed by the Point Hacks audience are for airline seats – and in particular, premium cabin seats.

Given the cost of airline seats varies greatly depending on the route you’re travelling, seasonality, time of day, airline quality etc, it can be hard to determine the value of a point redemption. It gets even more complicated when you take into account the out-of-pocket costs that airlines can charge.

As an example, you may be looking to use 8,000 points + $36 in taxes to get a one-way Economy seat from Sydney to Brisbane.

If you were to purchase that seat with cash on a discounted fare, you may be able to get it for $150. Given you have to pay $36 to redeem your points for the seat, you are actually getting $114 in value ($150 less $36) for your 8,000 points, which equates to 1.425 cents per point.

If you value these points at 1.8 cents, then this redemption would represent poor value.

If, however, you were to redeem 68,400 points + $400 in out-of-pocket costs for a Business class one-way flight from Sydney to Hong Kong, your value would be very different.

You may be able to get that seat by paying $2,500 in cash. This means you’re getting $2,100 in value ($2,500 less $400) for your 68,400 points, at a value of 3.1 cents per point. This is well above the 1.8 cent valuation. In this example, you’re scoring good value.

Redeeming points for a product or service

Many points programs have an ‘online store’ which allows you to redeem your points for products such as appliances or vouchers.

The value of these redemptions is quite straightforward, as there is a clear cost for the item you are looking to acquire.

As an example, you may want to redeem 10,000 points for a $50 gift card. This equates to 0.5 cents per point in value. If you value those points at 1.8 cents each, then this redemption would be a poor use of your points.

Alternatively, you may want to obtain a toaster for 30,000 points. The toaster can be purchased for $200 using cash. This equates to 0.66 cents per dollar. Again, this represents poor value given the 1.8 cent valuation on those points.

In general, most redemptions from ‘online stores’ represent poor value. Using your points for a premium cabin flight redemption is almost always your best bet.

Summing up

Knowing the value of a point helps you make more informed decisions and extract greater value from them.

So if you’re looking for a place to start (or to point someone else to) to start earning more points from your day-to-day spending, check out our ‘earning points email course’ here →

This email course lays the groundwork for you to assess the different offers out there on a far more accurate basis. Your points may come from credit card bonuses, or be earned from ongoing spend. Ultimately, the points path you choose is up to you.

Disclaimer

Please be aware that the valuations on this Website have been prepared by Point Hacks using its own proprietary valuation system for the purpose of comparison between the value of rewards issued by different rewards programs. While we invest a great deal of time and energy into ensuring that our valuation processes are based on the most up to date and accurate information published by the rewards program, we do not warrant that there will not be a lag between the date that a rewards program issuer updates their rewards program and our valuation.

The information published on this Website does not constitute a recommendation from Point Hacks to acquire any particular product or service. The valuation of a loyalty scheme is only one of many factors (including fees, costs, features etc) to be taken into account in acquiring a product or service and it is your own responsibility to ensure that any products, services or information available through this Website meet your specific requirements. Point Hacks expressly excludes any liability arising from any person acting on these valuations to the fullest extent permitted by law. Where conditions or warranties are implied by law and cannot be excluded, our liability will be limited to the re-supply of information.

Point Hacks’s valuation system and the information published on this Website have not been reviewed or endorsed by any third party, including the issuer of any product or service described on this Website. While Point Hacks aims to attribute a value to each loyalty scheme and reward for the purposes of comparison, we do not warrant that rewards earned through products or services available on this Website can be redeemed for cash, goods or services to the value ascribed to them by this valuation process.

Recent guide updates by Brandon Loo.

Qatar and BA Avios can be freely transferred between the programs. How could they possibly have a different value?

You’ve said that Amex adding Qatar Avios as a transfer partner increases the value of an Avios point. What it is instead doing is increasing the supply of Avios points held by Australians, and increasing competition for Avios redemptions from Australia, so it has devalued the use of an Avios point to an Australian redeemer.

It is a shame this article is so poorly put together as it would be nice to see some accurate rankings of the various systems.

Believe me, whilst we’d love to keep a valuation of Aeroplan up, there are external factors out of our control that prevent us from doing so, unfortunately.

We actively talk up Aeroplan’s value in our various guides and reviews that relate to Aeroplan.

According to their calculator my Platinum Amex scores a big fat zero on low monthly spend.

Unsurprisingly, another loser promoted by Points Hacks (if the pay.com.au website is truthfully listing Point Hacks as a partner….)

..is your post dinkum, dude?

This website is descending into the promotional gutter.

1) points earned from everyday spend

2) points effectively purchased

3) both

The article satisfies none of these as currently written.

You just haven’t thought this through.

Hilton point, if your claim of factoring in ease of acquisition is correct.

Maybe the “redemption value” can be, but not the “overall value”.

You are so very confused in your approach.

Does “ease” of earn reflect accessible earn rates or

breadth of earn opportunity (or both)?

Did factoring in “ease” of earning points:

1. Push your valuations up; or

2. Push your valuations down?

In other words, does harder to earn makes them more or less “valuable”?!

Nonsense. There is another much more important variable you need to know. But you won’t learn about that one on Point Hacks.

“In this guide, we run through our methodology”

Barely.

“ We’ve refined our approach and now assess many key factors in the various loyalty programs.”

But despite this new approach only a few valuations changed.

“Here, we deep-dive into various examples, helping you maximise the value of your points in a range of contexts.”

There is no deep dive in this article. It’s all very basic and highly misleading stuff.

“Many people believe that each loyalty program delivers the same level of value to its members. But this is far from true!”

And yet there is remarkable consistency in your valuations. Hint – seeking to homogenise and define some magic average point values is the worst approach you can offer your readers.

“the way each program is structured from an ‘earning’ and ‘redeeming’ perspective makes the value of a point in each program unique”

And suggests that you are looking at entirely the wrong metric when you focus on subjective point valuations. It is beyond dumb.

“Points valuations are fluid and vary between programs”

That doesn’t actually matter at all.

“At Point Hacks, we live and breathe points”

Despite the basic errors in fact in the article and fundamentally derelict approach.

“So it makes sense that we’ve come up with a methodology to determine their value for a variety of programs”

No, it doesn’t make sense. You’re fixated on the wrong metrics.

“Determining the value of a point isn’t an exact science”

But it can be. You’re just not smart enough to work it out.

“At Point Hacks, we base our valuations on the rate we feel consumers could afford to ‘buy’ points – knowing that they could safely redeem those points for something of higher value”

Fundamentally misleading. I can readily buy wine at 2.5 cents per point and get the wine, but that is above your valuation for QF points. You just haven’t thought this through.

“We don’t delve into the complexities of our calculations in this guide”

Perhaps you should. Their failings would then be obvious to the reader.

The list of factors is meaningless without the detail. No doubt you have failed to compile any relevant underlying datasets in making your valuations.

Basing your valuations on premium award seats is especially dumb – many routes don’t feature that cabin class. The redemption values / availability for PE can be misleading since PE seats per aircraft can be less similar or less than business class.

You continue to homogenise by choosing PE and standard hotel rooms.

There is no such defined concept as “quality” of transfer partners from credit card schemes.

“ our valuations should be used as a guide only”

No – they should be completely side-tracked.

“Our valuations are assessed as of today”

If they are based on the errors in the table (e.g. claim cannot earn Avios in Australia) they are utterly fake.

“Ultimately, when you have an idea of the value of a point, it allows you to better assess whether you’re getting good value from earning or redeeming those points.”

You’ll mess up if you use these valuations. The valuations confuse buying points and earning points. Many earn opportunities are less that your valuations, but still worthwhile if you’d get no points for money you’d be spending anyway. Your “logic” is utterly flawed. As a redeem benchmark the valuations are way too low.

“Valuing points is a subjective exercise”

No. it’s not. You just decided to make it so.

“Of course, how you value points may differ. But whatever your method, the main thing to consider is that you have a value in mind when earning and redeeming points. Without it, you won’t be able to extract the best possible value from your points – the goal of any point hacker.”

No, that statement is simply not true. You DO NOT need to know the valuation of a point to make informed choices.

“Overall, we wouldn’t advise you to purchase points”

So, this should be your final example.

“If the cost to buy the points is less than the value of the points, then it may make sense to buy those miles”

Nonsense, because you have made a covert and homogenised estimate of award availability.

“say your card earns you one point for every dollar spent. If you’re asked to pay a fee of 1.5% (i.e. 1.5 cents for every dollar), and you value a point in that program at 1.8 cents, then you’re acquiring the point at a rate (1.5 cents) less than our valuation (1.8 cents). So this represents good value.”

Nonsense. You’re suggesting an advantage of 0.3% is good value.

“ If you value those points at 1.8 cents, then this would potentially represent poor value. You paid more for the points than you believe they are worth.”

Once again, in your examples you are dithering around in the fractions of a percent. Putting focus on such trivial examples implies that consumers are facing decisions offering fractions of a percent of either upside or downside. Don’t even bother playing the game in that sandpit.

“If you were to purchase that seat with cash on a discounted fare, you may be able to get 1.425 cents per point. If you value these points at 1.8 cents, then this redemption would represent poor value.”

But you are confusing two different metrics – redemption value and your point valuations factoring whatever nonsense you’ve mysteriously factored into your bogus valuations.

You are also confusing fares with different restrictions, notably ability / cost to cancel / amend booking.

“at a value of 3.5 cents per point. This is well above the 1.8 cent valuation. In this example, you’re scoring good value.”

And yet you have provided no data on where that redemption value sits in the pack. That’s a major failing of seeking to homogenise.

That critique is just the tip of there iceberg. There is so much wrong with your approach.

It is riddled with basic errors.

Give the game up if this is the quality of Point Hacks.

Glaring examples of your lazy and inaccurate efforts:

– VA is NOT still missing international redemptions on SQ

– the ability to earn Avios in Australia NOT non existent wrt BA (earn on Qatar and transfer to BA from either QF or VA flights)

– ability to earn Avios in Australia NOT non existent wrt Qatar (earn on either QF or VA flights)

– AA using QF points?! Confused mess

– ability to earn UA miles in Australia is NOT non existent (earn on VA)

– Accor: how can your redemption value be less than the fixed redemption value within the program?

Lots of other pathetically basic errors.

How about you STOP publishing these utterly misleading point valuations?

They are meaningless garbage.

You are so busy writing the articles promoting the airlines and credit cards that pay for your content you have completely forgotten to update your material.

Your credibility is in tatters.

Delete this post if you like, but you know I’m right.

Anyone want to trade their Avios for my Qantas points 1 for 1?

With 90000 Avios you can fly business to Europe. In Qsuites for that matter.

For 90000 Qantas points you can fly business to nowhere because there are no seats. But you could fly to US east coast is theoretically. But according to this article Qantas points are worth nearly 50% more than Avios.

Also, something being scarce doesn’t make it less valuable.

Qantas has poor availability in premium cabins vs SQ Krisflyer has reasonable availability

Qantas has significant surcharges on redemptions vs minimal taxes for SQ Krisflyer redemptions

I can’t see how you only prescribe a 0.1c premium for SQ on these key attributes for any FF looking to redeem points.

QF is way overvalued. Yes, I can redeem for higher than that amount, but when I want it? No. 1 cent would be a far more realistic valuation.

Avios/AAdavantage can be earnt by crediting QF flights to them. I am very disappointed that an expert doesn’t point this out. Maybe you should do an article on https://www.wheretocredit.com/

You can use Avios/AAdvantage on QF for generally less points and less fees and similar QF availability but greater other carriers avail. and far better websites.

SQ – “3 year hard expiry on points is uncompetitive and uncertainty surrounding award availability”. Are you serious??? If you can’t use your SQ points in 3 years you are doing something wrong. They have amazing availaility and cheaper overall cost.

There are plenty of other examples on there but these should cover it. Redeeming above your points value is only good value if the timing of the flight suits you. Less flexibility = less cost.

Maybe if you did a points + taxes comparison between all the different plans for a SYD-LHR and SYD-JFK you would show a more accurate value of those points

1 cent valuation for Qantas is much more realistic.

I have not been able to find a single premium flight to any destination I want to travel which renders them largely worthless.

It’s probably easier with status but I prefer to fly other airlines when I am actually paying.

Krisflyer is still much better value despite them raising their prices. Lower ‘additional fees’ as well.

Just booked one for later in the year.

“ Ability to earn AA miles in Australia is almost non-existent with no card partners. Uncertainty surrounding award availability”

SQ Saver Redemption: 106,000 SQ miles +AUD279.

QF Classic Saver Redemption: 132,400 QF points + AUD373.62

With most cards converting 1SGD purchase to 1 SQ mile, and 1AUD purchase to 1 QF point, and SGD roughly equivalent to AUD: right off the bat,

– Qantas is 25% more expensive in terms of points

– Qantas is 34% more expensive in terms of fees.

So I’m not too sure how Qantas points would have a higher valuation than SQ miles. Not to mention 2 more important factors:

1. Under Star Alliance, SQ has 34% more destinations than Qantas under Oneworld.

2. SQ generally has a larger seat pitch and width than QF. E.g. On an A330-300 (333), QF has 31inch and 17inch, while SQ has 32inch and 19inch – pitch and width respectively. There is value to this sky-high real estate.

On the 3 years expiry, one can request an extension. And with a few cards that can hold the points indefinitely before converting to miles, I don’t think this factor alone would devaluate SQ miles below QF.

That’s why I’m curious as to the detailed calculations because it seems misleading especially when making an informed decision.

However SQ have been extending the 3 years because of Covid-19

In general, the points valuations could be used as a guide to the minimum value you should get out of a reward. If you can earn those points for less than that value and redeem rewards for more than that value, then that’s probably a good use of them.

is it still possible to transfer points between Virgin and Kris Flyer?

Regardless of what you think a business class airfare should cost /prepared to pay, the fact is that it’s worth exactly what the airline charges for it. I don’t see any point valuing them at some arbitrary gut feel of what you think a business class seat is worth. And you only do it to business fares not economy. If you value them at the cost would be in cold hard cash thats the real worth. Its higher and you’ll feel like you are getting much better benefit!

I also think in terms of earn value and redemption values, but also throw in a different methodoloy when I’m redeeming. I consider my cost per point is 1.2c though they usually cost me less because I look for bonus sign ups at nil or minimal cost for 1st year. So I value them at 1 or 1.2 depending on what the last few chunks of points cost me usually it’s 1c I use. Then when I consider a redemption of say 78k 1 way business Perth to Tokyo I consider whether I’m happy to pay $780 ish plus tax for that ticket. SAme goes for Perth melb business, Ie am I happy to pay $360 one way business. If so I redeem

Your Marriott Reward point value seems high at 1.2c given they are only worth 1/3 of an old SPG point.

As an aside they are now very difficult to get hold of in bulk with demise of sayisfactory Amex transfers-maybe they will start selling them

Ta

Andy

I was wondering what your view is on the latest Velocity points offer with Westpac Loans. They are offering 200000 Velocity points for new loans or transfers, which I’m contemplating. But it would cost me about $970 to refinance. I’m not sure if this is good value. I’d appreciate your thoughts.

Kind regards

I recently redeemed 16,000 Qantas Frequent Flyer points (and paid just under US$12 in taxes) for a one way flight on American Airlines for my wife & me when we will be in the USA in November. The fare worked out to AU$576 for the two of us, so they points were worth 3.6 cents.

Better yet, with my Platinum status with QFF, we got to select preferred seats, and get three complimentary checked bags for the flight.

What’s the best way to get from Melbourne to Japan return Business class?

Cheers,

Leigh

That makes it a cool 5 cent per Qantas point.

I scored 225k Q points using 3 credit cards, ANZ Q FF Black – 75k points, NAB Q Signature – 90k points and Qantas Premier – 60k points. I spent $550 in card fees, but it still works out to 5 cents per point!!

Your devaluation of Westpac Altitude cites changes to redemption values to Asia Miles and Velocity. I think this should be Asia Miles and Krisflyer?

You mention about quickly having to decide if a credit card surcharge is worth it. I have always used credit cards that have foreign conversion fee when overseas (ie 28 degrees mastercard). The trade off is they provide no points earning ability.

I know it is a personal decision, but do you think there is value using cards that usually get slugged 3% on transactions overseas? I note that one of the AMEX in my wallet collects 2 QF points per dollar spent overseas.

Thanks for your insights.

2 Qantas Points per $AUD on an overseas transaction at 3% surcharge equates 1.5% surcharge per point earned, or 1.5c per point. So it’s purely about whether you are prepared to pay 1.5c per Qantas Point or not. I wouldn’t, but only just. But with a different points currency worth more earning at the same rate and surcharge, then I would.

ING no longer has the 2% cashback on paywave purchases so you might want to remove that.

Personally I think your valuation on David Jones Membership Rewards is too low, compare to MR Ascent and MR Gateway.

1 MRA point = 1 FFP or 0.5 SPG

1 MRG point = 0.75 FFP or 0.5 SPG

1 DJMR point = 0.625 FFP* or 0.5 SPG //*through SPG

I think you might have a typo in here. 2,000 FlyBuys points are redeemable for 870 Velocity points, not 800.

The 2000:800 (5:2) rate is only applicable for Etihad Guest miles.

A suggestion for consideration in your excellent guide:

https://www.americanexpress.com/australia/pdfs/customerservice/amex_mrpoints_gift_requestform_v5.pdf

For the cost of $250, one can potentially convert Gateway points to Ascent or Ascent Premium (and also Ascent to Ascent Premium). Depending on the valuation of a particular redemption that one has in mind, it may have some value.

Any plans to update this article?

Particularly interested in your thoughts on difference in value between the Amex Ascent and Gateway programs.

Why is Gateway not included in the list? Is it because Ascent and Gateway are the same now?

It was actually an Amex rep who came up with the idea of her getting a Platinum card because the points could be transferred. On my request, the rep added a note to her file (we were on speaker hone) that he had confirmed that the points could and would be converted.

Thanks – I love your site.

MLH

In answer to your question though – yes, Explorer is quite different to the Platinum Charge when it comes to points earn and transfer rates. Your cents per point calculations seem right – Amex are offering some big bonuses at the minute.

They have two different rewards programs – Membership Rewards Ascent Premium (Platinum Charge) and Membership Rewards Gateway (Explorer). The balances (on paper) can’t be combined, so your first plan to get the existing 120,000 into Ascent Premium points isn’t guaranteed to work.

However… some cardholders of these cards are reporting success with Amex, on request, combining their rewards accounts and having the points from MR Gateway moved into Ascent Premium and then earning into one program from both cards in future. There is no guarantee they will do this for you though, and you may have to call and ask a few times until you get someone to do it for you, and ensure that the existing balance is transferred. I’d also consider it a bonus if you get it working, not something to factor in / rely on in your purchase decision.

This is at least a consistent measure of a guarantee value per point and comparison of various cards

M

If the business is held in a company , the after tax cost of a 2% credit card surcharge is 1.4% being 1- .30 company tax rate X 2% surcharge. Consideration should be given to timing as company tax is not often not levied straight away and some business expenses such as large assets purchases are only deductible over a number of years.

If you compare it to Gary or Lucky’s valuations of AA miles, which are ~1.5-2 c (USD) per mile, QFF provide much less value.

You are definitely entitled to your own opinion and valuation of points, and if you value them lower, then that’s totally fair enough.

The earn value is where i’m different, you’d willing to pay much more for the points than I am.. but that comes down to

a) Your balance, the higher your balance the less you’re willing to pay

b) How easy you can earn/buy them for a cheaper cost…

My target is usually to only ‘buy’ them for < 0.5cent per airline point…. may vary a little depending on which airline (ie AA > QF)… but in general that’s my target 🙂

That’s completely fair. 1.5c is totally my upper limit, I would rarely acquire them at that rate but if it were super easy to buy with no or minimal effort, then I’d at least consider it.

It might be worth doing a write-up of complimentary insurances as it’s something that’s relatively unknown and buried in the fine print. As far as I know ANZ’s Complimentary Insurances come without excesses which might make them better for riskier purchases (or those you’re taking travelling?).

Not dismissing it, just explaining why it’s not there, for now. Getting into the major insurances and outlining the headline benefits and restrictions of each would be pretty valuable – so it’s on my list!

I have been following your website for a while now. I have learnt so much over the past year and I think I have a decent strategy in place. All thanks to you. 🙂

Regarding the surcharge on business expenses (not personal), I always felt that I could justify up to 2% as long as it’s on an amex $1 to 1 or a WBC Amex $1 to 3 points. Anything around the low to mid 1% for a visa/mastercard business expense.

If it’s a personal expenses, I am more hesitant if there’s a surcharge of much to 1.5% regardless of the card. However, sometimes I think that the more points I have the better as I aiming to do a few oneworld award 35k mile trips. Do you think this is the right approach?