For small business owners, RewardPay is one of the most useful services for American Express cardholders who want to pay their business expenses with their credit card.

In short – RewardPay allows you to make payments that would normally be done by bank transfer, on your points-earning credit card. They charge a fee (to the payer, not payee), which is tiered based on the payment amount for each individual transaction. So you need to be strategic about how you use it to justify the cost.

The cost makes sense if you have a high-points earning card, and there are a few American Express cards and business circumstances where this approach to earning points could work if you’re a business owner.

I have been using RewardPay since the middle of 2016, and have put many payments through the service successfully. However since I first started using RewardPay, other competitors have entered the market, such as B2Bpay and Payment Logic.

What is RewardPay?

RewardPay is a payment platform that allows you to pay your ordinary business expenses for suppliers and other institutions that don’t take credit card (or you’d rather pay by bank transfer due to excessive fees or to improve your cashflow), to the ATO for your tax bills, or for superannuation payments – and earn points.

There are a few non-points benefits too – primarily that you can use your credit card to improve your business cashflow.

Payment recipients do not need to be registered with RewardPay – but they will see ‘RewardPay’ and your reference number in the payment description in their bank account, so it’s not a completely hidden service to them.

One of the main restrictions of RewardPay over other payment platforms like B2Bpay is that they only accept American Express cards as a form of payment, which means you are out of luck if you do not hold one of these cards.

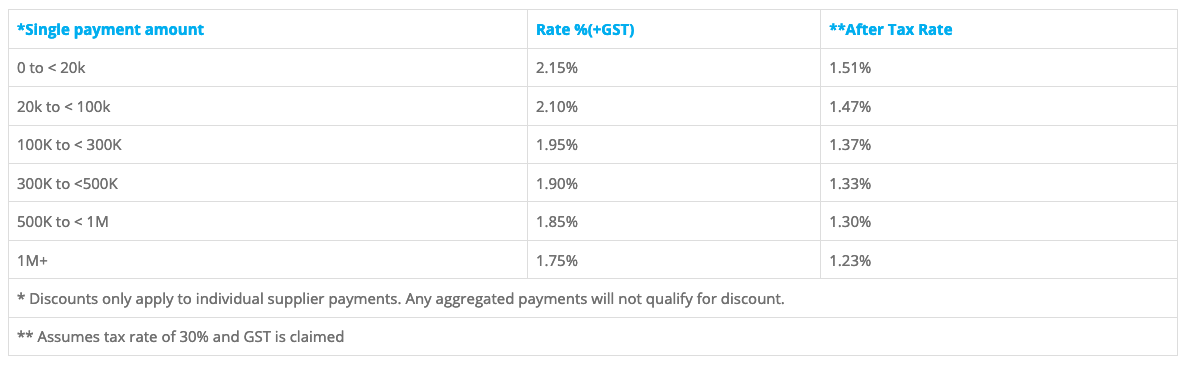

What fees does RewardPay charge?

RewardPay recently updated their fee schedule following changes made by American Express to the fees they charge vendors for accepting American Express cards, precipitated by the RBA’s changes to interchange fees in 2017.

The revised fees schedule is shown below:

The new fee schedule is based on a single payment amount and replaces the previous fixed fee model of 2.4% +GST, irrespective of the transaction amount.

While the decrease in surcharges is a welcome move by RewardPay, the devaluation in earning potential by American Express in April 2019 has lessened the appeal of using RewardPay to essentially “purchase points”.

Whether you decide to use RewardPay or pay with other means will be decided a three factors, which include:

- The transaction amount

- The points earn on your American Express card

- The value you place on your American Express points

Let’s assume…

- You are GST registered and you have incoming GST payments to offset against the GST paid to Rewardpay – in which case that “+ GST” component of the fee is moot

- Your business makes a profit, and you have justifiable reasons to use Rewardpay for your business – i.e. to improve cashflow or ease payments to suppliers – in which case the cost may be deductible from your business profit and reduce your tax burden (but check this with your accountant).

From our Point Hacks valuation guide, you can see that we value Qantas Points at 1.9c each, meaning that you wouldn’t want to spend more than this to earn a Qantas Point.

When using American Express’s highest-earning card, the American Express Qantas Business Rewards card earning 1.25 frequent flyer points per dollar spent, even on a low transaction amount of say $10,000, then using RewardPay would still be worth it. The cost to earn 12,500 Qantas points is $151, meaning that the cost per point is 1.2c, which is lower than our valuation—that’s a good thing.

However, if we were to use an American Express card earning only 1 Qantas Point per dollar spent, then the RewardPay cost to earn 10,000 Qantas Points is still $151, but the cost per point is now 1.51c, which is still worth it but of lesser value than the example above.

But, going back to my third point above, the value people place on points is subjective and our guide on points valuation is intended to be just that, a guide.

For example, some people like to split out the valuation into a maximum earn amount (the most they are willing to pay to purchase a point) and a redemption target (the minimum value they are willing to redeem a point for). Others like to go a step further and articulate a final, single-point value. This sits around the upper bound at which they like to earn points, and a lower bound at which they tend to redeem them.

We recommend the former approach, as there are other non-cost factors that should be considered, such as which airline has seats for the route you want to travel on, which offers you more readily available upgrades for your points, or which you actually prefer to travel with. However, if you do follow the latter approach, then using RewardPay to “purchase points” will definitely make sense.

Therefore, whether using RewardPay makes sense for you is determined by the three factors above, and specifically on which approach you take to value a point.

Tax consequences of using RewardPay

For this part, you should consult your accountant (I am not one) to make sure this analysis is correct for you and you don’t have different tax implications.

In order to utilise the “after tax rates’ shown in the above schedule, the business expenses must be deemed to be deductible, assuming your business is healthy and making profit, and you are willing to absorb some cost to take advantage of earning points and cashflow benefits of using Rewardpay.

You would be reducing your taxable profit by the amount of the fee (as a cost going out of the business). When tax on company profits is at 30% for larger businesses as it is currently, a $100 fee would result in $30 less tax being paid. For smaller businesses the tax rate is 27.5%.

At the 30% tax rate, deducting RewardPay as a business expense is equivalent to a 30% reduction in the cost of the points being earned.

What cards could work best with RewardPay

There are several American Express options that earn the equivalent of at least 1 frequent flyer point per dollar – we’ve explored the options available for highest points earning cards with RewardPay in a separate guide.

RewardPay eligible payments

Essentially, RewardPay steps in any time you would usually make a regular EFT / bank transfer to make a payment from your bank account. Payment recipients need:

- An ABN

- An Australian bank account with BSB/Account Number

- A phone number and address

- An email address to send an (optional) payment confirmation to

BPAY doesn’t get involved anywhere, so if a payment recipient only accepts BPAY, then you should consider using B2Bpay instead.

How a RewardPay payment works for you and the recipient

RewardPay has an easily understood concept of payees and payments. Payees can be set up and stored for reuse, while payments are made on demand to the stored payees. Payees and payments can be created by hand on the website, or by uploading batch files for larger payment runs.

Payments will take 3-4 business days to hit the recipient’s account, so this isn’t a service to use for last minute or quickly needed payments.

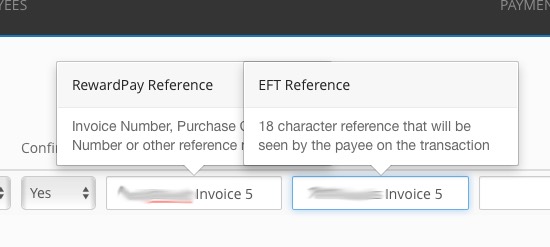

When you go to make a payment to a previously created payee, you can then add payment reference details – one for your own credit card statement, and the other for the recipient’s bank account.

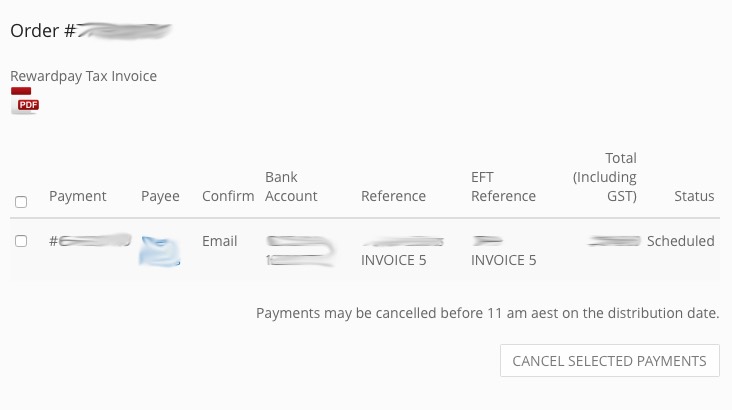

When you make a payment, RewardPay will ask you for your credit card details and SMS you with a confirmation code. Once complete, from the payment confirmation screen you can then download a PDF Invoice for the RewardPay fee and GST.

Worth noting – the PDF invoice only has the RewardPay fee included, but the fee is not charged independently to your credit card. You or your bookkeeper will need to link your supplier’s invoice with each RewardPay invoice to correctly account for the fee that shows in your credit card statement.

The details appear on both statements with RewardPay in front of the details you input. Here’s what it looks like to a recipient in their bank account:

Using RewardPay to pay the ATO

This is also possible, and cuts out the ATO’s fee as you are making a bank transfer, via RewardPay, to the ATO instead of using the usual EasyPay portal and the associated merchant fees. You’ll pay the RewardPay fees instead, of course.

We’ve dug into this more in our guide to earning points from ATO payments here, but this is most useful for American Express-issued cardholders as payments for ‘government’ transactions for their cards only pay out at 0.5 points per dollar. Despite the ATO’s lower surcharge (of 1.45%) when paying directly, the ability to earn full points on your card and paying via RewardPay may be more appealing.

Summing up

RewardPay is not an option for everyone to start paying every bill they have using the service – it is specifically designed for business to business payments. That said, it will work for businesses of any scale, as long as you have an ABN.

Having used the service for some time, it does provide a great way to earn rewards points where you otherwise couldn’t have, assuming the maths stacks up to do this. However, with the emergence of competitors that accept a broader range of cards or payments (eg B2Bpay), there is now room for improvement with RewardPay.

The key to actually benefiting from the service is to ensure you make the most of the cashflow benefits for not paying bills early, and that you are earning enough points from your American Express card – at least 1 frequent flyer points per $ but likely more, to make the cost worthwhile.

Can’t seem to find the info

I think i have posted my Q twice on this article.

I didn’t realise that the 1st one went through.

Sorry about that.

Hassan.

I want to ask few Qs to the people who are using reward pay. I have gone thru the article n if anyone can pls answer the flowing Qs, that will be much appreciated:

It says that fees rewardpay charge is 2.4%+ GST

– so if someone has to pay lets say an amount of 50k- does it mean that he will be paying 2.4%=1200+GST = 1320$ in total.

– is it rite or i have done a wrong calculation ?

On rewardpay website, it says we can pay rent as well. Any1 has experience of that ?

Lastly the article said about the cards best to use- amex explorer or business accelrator- as the earn rate is very good.

– with the explorer, we can pay to ATO @ reduced points earn rate of 0.5/$. If we pay to ATO via rewardspay, is it the double fees, we will be paying: 2.4%+GST to rewardpay and 1.45% to ATO ?

In my 1st Q, i said 1320$ we are paying on top of 50k and that can be a tax expense, so can claim in tax return. But my understanding is that it will still be a 3rd of that amount we can claim in tax return so that is 440- still 880 to pay on top.

(i am not asking any help with tax here- its better to leave for the accountant, thats just a rough idea).

With this rough calculation at the top earning rate, we will be getting 100k points for 50k spend. So 880$ for 100,000 points give a value of 0.88c/p (have i done the correct calculation

here ?).

-So my only Q to the people who are using it if they are spending 880 $ in fees, would it not be better off getting 2 credit cards with this money and possibly get more than 100k points.

-nothing negative about rewardpay or any1.

– also i am not sure if i have done all the calculations rite- so would appreciate the users to correct me if i am wrong.

Let me know if i have done any calculations wrong…

Keith, and few other people who are using it- ur replies will be greatly appreciated.

Cheers.

Hassan.

if using rewardpay you only pay the 2.4%+GST fees, ATO will get that amount via EFT so no need to pay the 1.45%.

Yes you could get 2 cards but you can only churn through cards so often before it hurts your credit rating.

For me personally it stretches out my cash flow and allows me to fly business for the price (via fees) of an economy flexi ticket.

I guess if u r making 3-4 trips in business class in a yr., then definitely it outweighs the fees.

Square charges us a 1.9% flat fee for all credit cards.

AMEX recently changed their fee to 1.5% on our bank merchant terminal.

So, I’m thinking that we could use our merchant terminal to essentially do the same thing with only a 1.5% fee?

Does anyone perceive any issues with this, other than the accounting overhead?

You probably have more chance of getting it through if you aren’t going direct merchant with amex, and with a third party service… but rewardpay seems like a simpler solution.

I am not seeing the advantage of moving payments that we currently do not get a surcharge (super/ato/suppliers we pay direct debit currently) over for the sake of paying double what an actual point is worth – is there a formula that you work off?

Also the earn rate from that card.

only you can make that call.

to me personally, its worth it as the same flight would cost me nearly double

Does anyone have any experience with it, and could recommend which option is better

the accessline site says you get 1ppd, would that be in addition to your 2ppd that you would get with your business explorer?

what are the fees? I didn’t see anything mentioned

“All transactions on Business Explorer Card is 2 points including Accessline except for Government transactions which is .5 per dollar spent like for example ATO.”

Not sure if one is owned by Amex and the other a separate entity. I’ve emailed them so will wait and see

Thank you

I was wondering if I had a ABN as a sole trader whether it would be worth it if i use my personal charge card/ platinum credit card to pay for govt bills on Rewardpay eg land tax so i can get the points. I do not trade on it at the moment.

I usually pay cleaners/gardeners etc by bank acccount and would love this as a way to get some extra points.. i occasionally use paypal to pay them. I get points but its costly..

All payment process within 3 working days ( payment arrived at receiver bank account ). So far I have used 4 times with rewardpay. Looking to use it more.

had some teething issues at the very beginning, called them up (think they have an answering service) and within 30min I had a return phone call sorting out my issues/questions.

while doing my 6th or 7th payment i stuffed up a detail and they duly called me up to double check things, which was great!

I’m earning 2KF/$1 as mentioned above. I am also using this to pay my suppliers overseas and taking advantage of the currency spikes (thus pretty much negating the surcharge by booking a good rate).

Having compulsory overseas trips every year for my business means this way I am stretching the cost of the tickets (IE earning & redeeming points) over a few months, thus also helping cash flow.

Instead of buying a P.E ticket to Europe for ~$4.5k in one hit, I am earning the equivalent in points over a ~4 month period, all for 0.84% and therefore also “paying” less than half for the same ticket.

I have a dilemma and am struggling a little with the calculations.

I have both the explorer card and the Westpac Altitude Platinum business card Amex/Visa

Trying to work out which one would be best to Pay an ATO tax bill to earn Kris flyer and assuming tax deduction on the Fee.

Explorer with reward pay I calculate 1.12 cents per Kris flyer point

Westpac Plat VIsa direct Pay to ATO – 1.89 cents per Kris flyer

Not sure if I have calculated this correctly. If I have then The explorer with reward pay is the better option?

Also would love a clarification of my question pretty please 🙂

In the last paragraph of your review you say “The key to actually benefiting from the service is to ensure you make the most of the cashflow benefits for not paying bills early”

My question is -Would this still be a good way to point earn even if you aren’t deriving any cash flow benefits?

Yes, IMO. But only if you are using a 1.5 frequent flyer point equivalent or above points earning credit card, and especially yes if the RewardPay fee is a legitimate business expense that you can use to offset taxable profit. That brings the cost per point down far enough that it makes it usable for me. Without the fee being a deduction, the costs are still OK at that level of points earn too, but 1.6c per point is probably a little high for me (1.5ppd card with no deductible fee).

Would this still be a good way to point earn even if you aren’t deriving any cash flow benefits?

Also does the Westpac Altitude Business Platinum still work positively with this as they are reducing their points earn. I only got this card this week!! It has no points earn cap which will come in Handy.

The key to actually benefiting from the service is to ensure you make the most of the cashflow benefits for not paying bills early.

Would it then be not worth it if not getting any benefit from the cash flow??

I also had Amex companion and Amex-issued cards not work (declined in Rewardpay) but I emailed them about it, they fixed something, and I’ve had two payments go through with a third on the way. And I’ve had support queries have been answered in 24-48 hours.

I won’t say I’m totally impressed by the service, but for me it’s been acceptable to the point where I’m willing to use it (and write about it).